Private equity firms in Nigeria face worst year for investment exit

Private equity firms in Nigeria have not been spared from the global lull in the sale of portfolio companies this year.

The firms are facing the worst year since 2012 for investment exits due to a combination of high interest rates and geopolitical tensions which has marred private capital inflows and upended valuations.

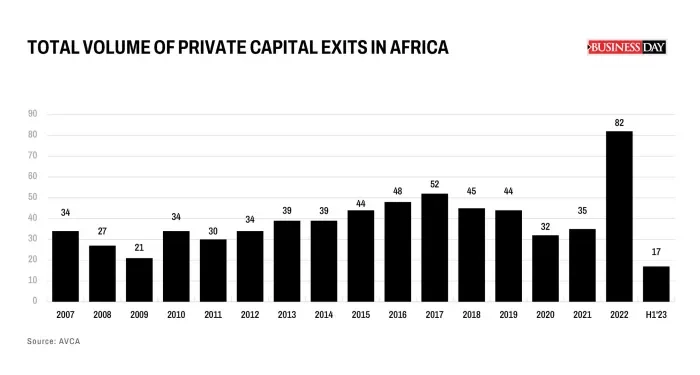

Only 17 companies were sold by private equity firms across Africa in the first six months of 2023, the lowest in nine years, according to data from the African Private Equity and Venture Capital Association (AVCA).

The slowdown is in contrast to the record breaking 2022, which saw 29 exits at this stage in the same period and a total of 82 exits by the end of the year, the most since at least 2007.

“The downward trends in exit activity across Africa in 2023 H1 mirror the challenges that fund managers face on a global scale when seeking to exit their portfolio companies amidst the current macroeconomic backdrop, necessitating longer asset holding periods,” AVCA said in a report.

Private equity firms based in Nigeria always knew there would be no repeat this year of a blockbuster 2022, when deals that had been struck since COVID-19 struck in 2020 came flying in.

The steep decline in exit activity has been worsened by the rapidly weakening naira value against the dollar, which is so volatile it upends valuations within days and has created uncertainty for investors.

Nigeria allowed the naira to weaken against the dollar in June, paving the way for a 40 percent devaluation in one fell swoop.

While the much-awaited reform, which had seemed stuck for eight years, was cheered by investors, the rapid decline in the currency since then has been unexpected and made the reform even more painful.

“Reforms are always painful and something has got to give,” said Danladi Verheijen, the co-founder and managing director of Verod Capital, a leading Anglophone West African private equity firm based in Nigeria.

“Nigeria is like a patient with a failed kidney who is first worse off after going under the knife but begins the healing process and gets better eventually,” said Verheijen, whose Verod Capital announced an investment in an ICT solutions provider this month.

Verod Capital and AfricInvest partnered to acquire a majority stake in iSON Xperiences, which specialises in delivering business process outsourcing, business process management and digital customer experience solutions across Africa, the United Arab Emirates, and India.

Like Nigeria, like the world

The slowdown in buyouts in Africa is not unique to private equity firms in Nigeria and Africa. Private equity firms globally are also facing the worst year since 2013.

In the first nine months of the year, buyout firms generated $584 billion from either selling companies outright or through taking them public, according to data from PitchBook.

The amount is more than $100 billion less than the amount generated during the same period last year and almost two-thirds below the record $1.4 trillion generated in 2021, when borrowing costs were low and US equities were still in a bull market.

Higher interest rates have hammered the market for initial public offerings and made companies wary of making acquisitions. The last time buyout firms made less from the sale of their portfolio companies was in 2013, the data shows.

The weak exit activity underlines the challenge confronting private equity firms as they try to monetise their investments and return money to investors.

Singapore’s GIC, one of the most influential investors, warned in July that a golden age for the buyout industry had ended.