South Africa ramps up coordinated efforts to get off gray-list

South Africa is intensifying efforts across key institutions to secure the country’s removal from a global financial watchdog’s so-called gray list, which denotes nations with shortcomings in tackling illicit financial flows.

“The implications are too ghastly to contemplate should we not be able to be removed from the gray list within the 24-month period,” Unathi Kamlana, commissioner at the Financial Sector Conduct Authority, said in an interview with Bloomberg on Thursday. “Our focus is on getting ourselves off.”

The Paris-based Financial Action Task Force placed South Africa on its watchlist in February, citing deficiencies in tackling illicit financial flows and terrorism financing. It gave the country until Jan. 31, 2025, to address the shortfalls.

The gray-listing followed an era of endemic government corruption — referred to locally as state capture — under former President Jacob Zuma that his successor Cyril Ramaphosa estimates cost the economy at least 500 billion rand ($26.6 billion). While the FATF’s decision hasn’t had an immediate impact on South Africa’s credit ratings, missing the 2025 deadline may damage investor sentiment toward South Africa, leading to capital and currency outflows.

Some of the measures South Africa must take to exit the gray list include stepping up corruption investigations and prosecutions, and ensuring the authorities have timely access to accurate and up-to-date beneficial ownership information.

The National Treasury is leading talks with government departments, the central bank and regulators including the FSCA on the steps that need to be taken. The authority is primarily focusing on increasing capacity by hiring more people, developing supervisory expertise and skills, as well as deepening the stringency of its sanctions and penalties, in line with FATF’s recommendations, according to Kamlana.

“We have already started with the work around that and allocated a budget to increase headcount, so that’s not an issue that will be outstanding for long,” he said. “The second part, which is tricky, one needs to be very risk-based and proportional in terms of that, so you don’t just increase the amount of the fine for the sake of it.”

‘Desperate People’

South Africa is also battling with a cost of living crisis as rising interest rates, inflation, high unemployment and stagnant economic growth continue to bring pressure to bear on consumers and households. The FSCA has engaged organizations in the financial industry about the inherent risk that the tough macroeconomic situation poses to customers, according to Kamlana.

“I think that customer resilience or household resilience is definitely challenged significantly,” he said. “The more desperate people get, the more they are prone to making less informed financial decisions.”

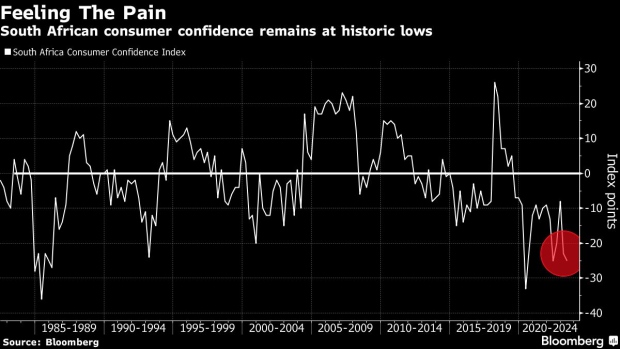

Consumer confidence dropped to its lowest level in a year in the second quarter, according to data from FirstRand Ltd.’s First National Bank and the Bureau for Economic Research. Household debt outstripped growth in incomes in the first quarter, climbing to 62.1% from 61.6% in the previous quarter, the SARB said in its latest quarterly bulletin.

The South African central bank predicts interest rates may remain higher for longer, as inflation remains sticky. The central bank’s monetary policy committee has raised the benchmark rate by 475 basis points since it began tightening monetary policy in November 2021.

Read More: South Africa Central Bank Governor Sees Rates Higher for Longer

“The answer to the question of what gets us out, is all of us working together in the spaces that we are mandated and have instruments and tools to influence,” Kamlana said. “So it’s the SARB, it’s the FSCA, it’s the National Treasury as the fiscal authority, and getting growth going in general.”