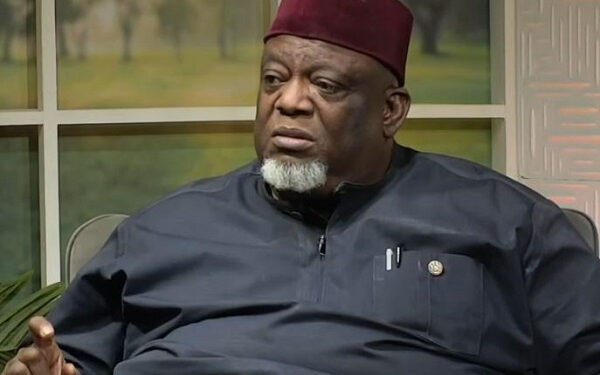

Falling T-bill Yields Could Ease Borrowing Costs – Joe Jackson

Chief Executive of Dalex Finance, Joe Jackson, has suggested that the recent decline in Ghana’s Treasury bill (T-bill) rates if sustained, could translate into lower borrowing costs for businesses and individuals.

Speaking during a NorvanReports and Economic Governance Platform (EGP) X Space discussion on the topic, “Fiscal Vs Monetary Tug-of-War: Economic Salvation or Damnation?” on Sunday, Mr Jackson highlighted the weighted average cost of funds as the primary determinant of lending rates for financial institutions.

“The most significant part of my cost is the price at which I acquire funds. The biggest influence on the rate at which I lend is the rate at which I am buying money,” he said. “If the government is not crowding out liquidity, there is more flexibility in the rates we offer.”

Mr Jackson noted that Ghana’s policy rates, reference rates, and T-bill yields all play a role in setting borrowing costs. A sustained decline in T-bill rates, he argued, could lower the cost of capital for lenders and, in turn, drive down interest rates on loans.

“This current regime of falling T-bill rates, if it persists, will result in lower lending rates for my customers,” he stated.

However, he acknowledged that investors remain wary, as real returns on savings have turned negative due to persistent inflation.

“Many clients dislike the lower rates because inflation erodes their returns. But they also recognize that if the fiscal authorities remain committed to lower rates, it could ultimately benefit the economy,” Mr Jackson added.

His comments come amid ongoing debate over the balance between fiscal and monetary policy in Ghana, as the government seeks to navigate inflationary pressures while ensuring adequate liquidity in the financial system.