Central Bank of Ghana Maintains Prime Rate at 29% for Second Consecutive Time

The Bank of Ghana (BoG) has announced the retention of its Monetary Policy Rate at 29 percent, marking the second consecutive time the rate has been held steady.

This decision follows a 100 basis points reduction to the current rate in January.

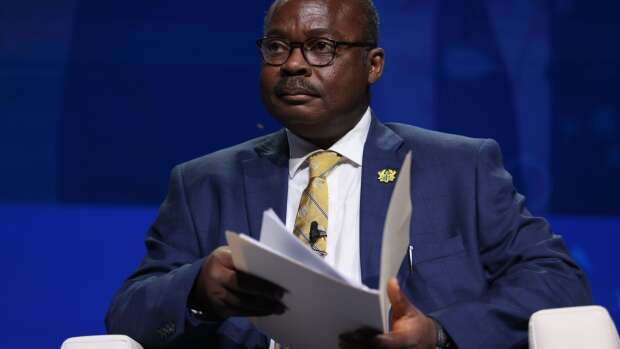

The announcement was made by Dr. Ernest Addison, Governor of the Bank of Ghana, during the 118th Monetary Policy Committee (MPC) press briefing.

The decision comes after a thorough review of the country’s macroeconomic developments over the past two months.

In March, at the 117th MPC press briefing, the BoG initially maintained the prime rate at 29 percent, reflecting a cautious approach to monetary policy amidst ongoing economic evaluations.

The stability of the policy rate is anticipated to keep commercial banks’ lending rates to businesses unchanged, providing a consistent financial environment for corporate borrowers.

The BoG’s decision underscores its ongoing efforts to balance economic growth with inflation control in Ghana’s dynamic economic landscape.

Addressing the media at the 118th MPC briefing, Dr. Ernest Addison noted that the Committee took the decision to help keep inflation stable.

He explained that the latest forecast shows a slightly elevated inflation profile on account of recent exchange rate pressures and adjustments in transportation fares.

According to Dr. Addison, the projections show that inflation will remain within the monetary policy consultation clause of 13-17% at the end of the year.

“These forecasts are contingent on sustaining the tight monetary policy stance, including aggressive liquidity management operations. Given these considerations, the committee decided to maintain the Monetary Policy Rate at 29%”, he said.