Fidelity Bank Asset Value Surpass GHS 22Bn Amid Strong Cash Growth

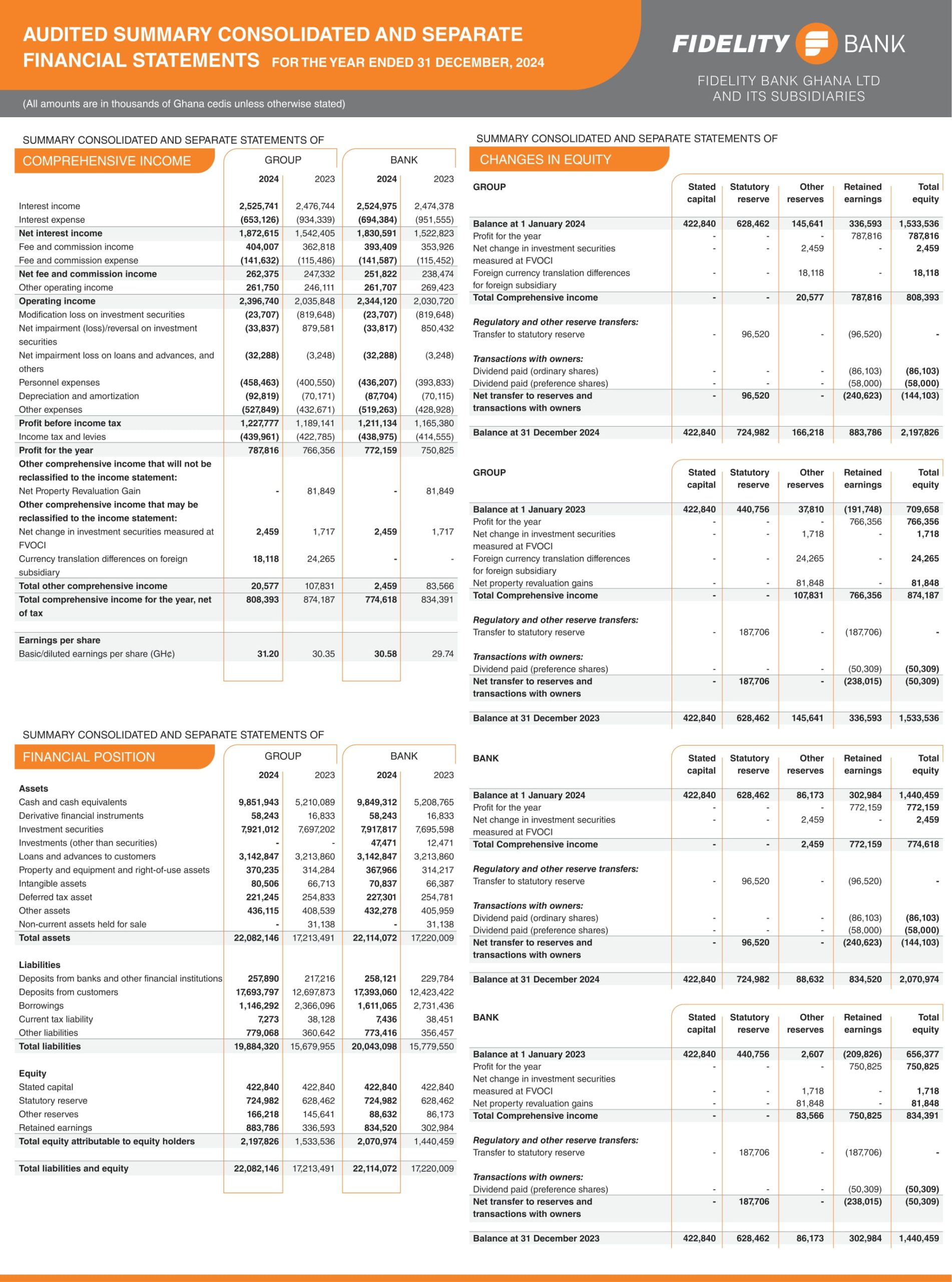

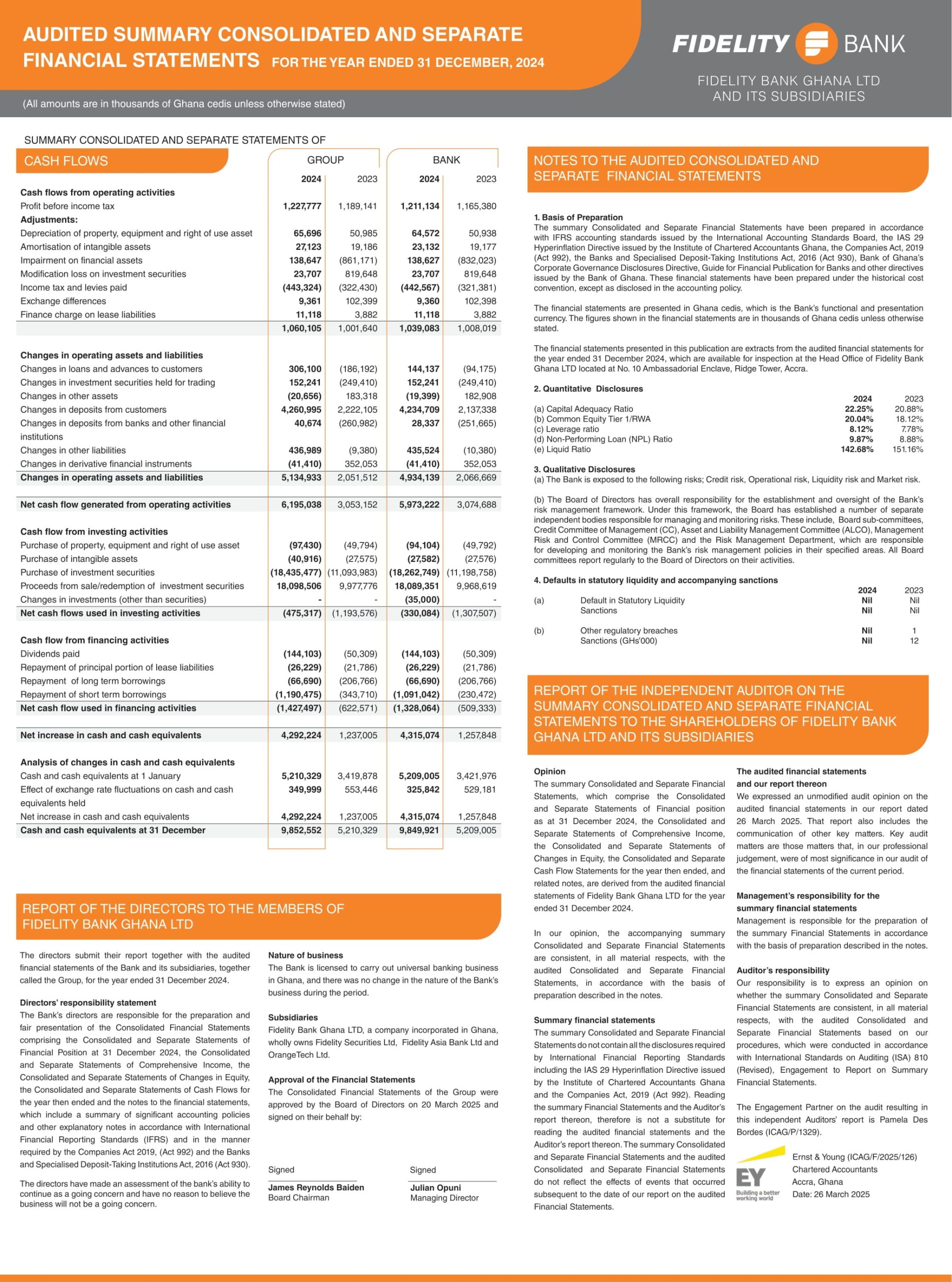

Fidelity Bank expanded its balance sheet significantly in 2024, growing total assets by GHS 4.89 billion to close the year at GHS 22.1 billion, up from GHS 17.2 billion in 2023.

The surge in assets was primarily driven by a sharp increase in cash and cash equivalents, which rose by GHS 4.64 billion year-on-year to GHS 9.84 billion.

Liabilities also grew over the period, rising from GHS 15.77 billion in 2023 to GHS 20.04 billion by year-end. Deposits from customers accounted for a substantial portion, reaching GHS 17.39 billion.

Shareholders’ equity strengthened, climbing from GHS 1.44 billion to GHS 2.07 billion, reflecting improved capitalization. Meanwhile, net profit edged higher to GHS 772.1 million from GHS 750.8 million in the prior year.

The bank’s capital adequacy ratio (CAR) improved to 22.25% from 20.88%, signaling resilience. However, the liquidity ratio dipped slightly to 142% from 151%.

Fidelity Bank’s non-performing loan (NPL) ratio deteriorated to 9.87% from 8.88%, though it remains significantly below the industry average of 22.6%.