Five observations on Nigeria’s Central Bank Digital Currency

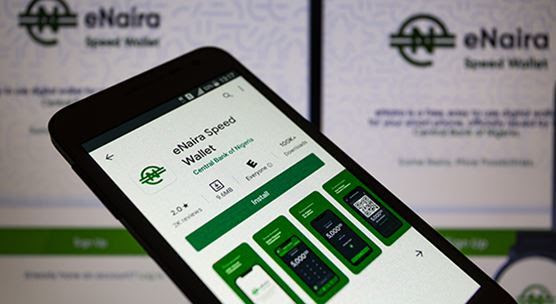

The Central Bank of Nigeria (CBN) officially launched the “ eNaira”—a central bank digital currency (CBDC)—on October 25, 2021. This is the second CBDC fully open to the public after the Bahamas.

Other countries and regions, such as China and the Eastern Caribbean Currency Union, have been conducting CBDC pilots with a subset of their citizens. Given the size and complexity of Nigeria’seconomy, this launch is drawing substantial interest from the outside world—including from central banks.

1. What is eNaira?

Like coins or cash, the eNaira is a liability of the CBN. The eNaira uses the same blockchain technology as Bitcoin or Ethereum and, like them, the eNaira is stored in digital wallets and can be used for payment transactions; and it can be transferred digitally and at virtually no cost to anyone in the world with an eNaira wallet. There are, however, important differences. First, the eNaira features stringent access right controls by the central bank. Second, unlike these crypto-assets, the eNaira is not a financial asset in itself but a digital form of a national currency and draws its value from the physical naira, to which it is pegged at parity.

2. Why did Nigeria introduce eNaira?

According to the CBN, the eNaira is envisaged to bring multiple benefits, which are expected to materialize gradually as the eNaira becomes more widespread and is supported by a robust regulatory system. Key benefits include the following:

- Increase in financial inclusion. For now, the eNaira wallet is provided only to people with bank accounts, but its coverage is expected to eventually expand to anyone with a mobile phone even if they do not have a bank account. A large number of people do not have bank accounts (38 million people; 36 percent of the adult population), and allowing those of them with a mobile phone to have access to the eNaira would increase financial inclusion and facilitate more direct and effective implementation of social transfers programs. It is expected that the move would enable up to 90 percent of population to use the eNaira.

Read: 2022 Budget: Chamber of Commerce call for sustainable stimulus packages for MSMEs

- Facilitation of remittances. Nigeria is among the key remittance destinations in sub-Saharan Africa, with remittance receipts amounting to $24 billion in 2019. Remittances typically are made through international money transfer operators (e.g., Western Union) with fees ranging from 1 percent to 5 percent of the value of the transaction. The eNaira is expected to lower remittance transfer costs, making it easier for the Nigerian diaspora to remit funds to Nigeria by obtaining eNaira from international money transfer operators and transferring them to recipients in Nigeria by wallet-to-wallet transfers free of charge. Exchange rate reforms, including a unified market-clearing rate, that reduce the gap between official and parallel market exchange rates would enhance the incentives for using eNaira wallets to send remittances.

- Reduced informality. Nigeria has a large informal economy, with transactions and employment equivalent, respectively, to over half of GDP and 80 percent of employment. The eNaira is account-based, and transactions are in principle fully traceable, unlike token-based crypto asset transactions. Once the eNaira becomes more widespread and embedded into the economy, it may bring greater transparency to informal payments and strengthen the tax base. Informal and formal businesses may also benefit if eNaira adoption enhances consumption through greater financial inclusion.

3. What are the potential risks?

Like digital currencies elsewhere, the eNaira carries risks for monetary policy implementation, cyber security, operational resilience, and financial integrity and stability. For example, eNaira wallets may be perceived, or even effectively function, as a deposit at the central bank, which may reduce demand for deposits in commercial banks. Relying as it does on digital technology, there is a need to manage cybersecurity and operational risks associated with the eNaira.

4. What are the authorities doing to mitigate the potential risks?

The authorities have taken measures to manage the risks. The transfer of funds from bank deposits to eNaira wallets is subject to daily transactions and balance limits to mitigate risks of diminishing the roles of banks and other financial institutions. Financial integrity risks, such as those arising from the potential use of the eNaira for monetary laundering, are mitigated by using a tiered identity verification system and applying more stringent controls to relatively less verified users.

For example, for now only people with a bank verification number can open a wallet, but over time coverage will be expanded to people with registered SIM cards and to those with mobile phones but no ID numbers. The latter categories of holders would be subject to tighter transactions and balance limits. Even so, wallet holders who meet the highest identity verification standards cannot hold more than 5 million naira (about $12,200) each in their eNaira wallets. To address cybersecurity risk, regular IT security assessments are expected to be conducted.

5. What can the IMF do?

The IMF remains available to help with technical assistance and policy advice. The IMF’s Monetary and Capital Markets Department has been involved in the eNaira rollout process, including by providing reviews of the product design.

The 2021 IMF Article IV mission emphasized the need for monitoring risks and macro-financial impacts associated with a central bank digital currency. [1] The IMF is ready to collaborate with the authorities on data analysis, cross-country studies, sharing the eNaira experience with other countries, and discussing further evolution of the eNaira including its design, regulatory framework, and other aspects.