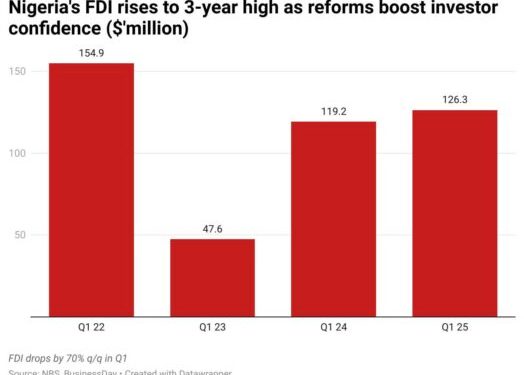

FDI Rises to 3-Year High as Reforms Boost Investor Confidence

Foreign Direct Investment (FDI) into Nigeria surged to its highest level in three years, buoyed by policy reforms of the government that have made investors more bullish on Africa’s most populous nation’s long-term prospects.

FDI rose marginally by 5.97 percent year-on-year to $126.29 million in the first three months of 2025, up from $119.2 million last year. However, on a quarter-on-quarter basis, investment declined by approximately 70 percent, according to the National Bureau of Statistics.

Though analysts consider the direct inflows “materially low,” the steady rise indicates a renewed appetite in an economy that’s chronically dollar-starved and marked by unpredictability.

After being sworn into office two years ago, President Bola Tinubu scrapped a long-standing petrol subsidy and relaxed currency rules, a move that made the economy more market-driven as opposed to the artificial controls that kept the country on its knees.

The radical reforms, which sparked the worst cost-of-living crisis in a generation and led to the exit of some multinational giants like GSK and P&G, have begun to yield results as inflation, which hit a record, has slowed to 22.2 percent in June 2025.

Analysts have also argued that the provisions of the new tax reform, which is scheduled to begin next year, will also lure in much-needed FDI that’d boost economic growth and create employment opportunities.

FBNQuest Merchant Bank analysts said that as macroeconomic conditions continue to improve, Nigeria is expected to become increasingly attractive to long-term investors seeking stable and predictable returns.

“We expect a gradual recovery in FDI inflows, driven by improving macroeconomic fundamentals, as recent policy reforms, stable exchange rate conditions, and concerted efforts to stabilise inflation are beginning to rebuild investor confidence,” the analysts wrote in a note Wednesday.

“However, heightened global trade uncertainty—exacerbated by President Trump’s trade protectionist measures—could dampen foreign capital inflows into Nigeria.”

Total foreign investment rose 67% to $5.6bn

Nigeria raked in $5.6 billion in Q1 as combined foreign investment into the country increased by 67 percent YoY on rising investor confidence. The value rose by 11 percent QoQ, marking the highest quarterly capital inflow recorded since Q1 2020.

The notable growth in capital importation was largely driven by a substantial increase in portfolio investment inflows (PFIs) to $5.2 billion in the reviewed period, up from $4 billion in Q4’24 and $2.1 billion in the corresponding period of the previous year.

PFIs, which typically dominate total capital imports, accounted for approximately 92 percent of the total foreign investments, up from around 79 percent in Q4 ’24.

Money market instruments, which made up 81 percent of the total PFI inflow, attracted the largest share of capital inflows, totaling $4.2 billion. This reflects QoQ and YoY increases of 20 percent and 162 percent, respectively.

Investment inflows into the bond market, on the other hand, increased by 166 percent QoQ and 109 percent YoY, totalling $877.4 million, while bond investments declined by 19 percent QoQ but rose by 138 percent YoY to $117.3 million.

“The sustained inflow from offshore investors into the fixed income market was primarily driven by carry-trade opportunities, supported by the CBN’s tight monetary policy stance.”