French companies are rushing to sell junk debt ahead of election

French companies are rushing to secure funding ahead of any potential disruptions following the first round of parliamentary elections this coming weekend.

Car maker Renault SA’s financing arm and frozen food chain Picard Groupe SAS are among those hitting the market. There is a brief window for firms to do so as a gauge of credit risk has eased in recent days, after it surged in the wake of President Emmanuel Macron calling a snap election.

The idea is that the market could be about as good as it’s going to get for borrowers. With the far-right National Rally and a leftist alliance leading Macron’s party in polls, investors are bracing for potentially drastic shifts in economic policy including greater indebtedness, a risk that has blown out spreads on French sovereign debt to the highest in a decade.

“Some French issuers want to get deals done ahead of the election to play it safe,” said Hugo Squire, a high-yield portfolio manager at Schroders. “In an absolute worst case scenario, they could be locked out of the market in a couple of weeks time.”

The deals include Picard marketing a €1.225 billion ($1.3 billion) high-yield bond, with initial price talk in the high 6% — nearly double the rate on its existing 2026 debt. Renault’s finance company RCI Banque showed there is demand, pulling in an orderbook of over €2.2 billion on Tuesday for a sale of tier 2 bonds, designed to absorb losses if a bank is no longer viable. Next up is shipping company CMA CGM, looking to raise €400 million.

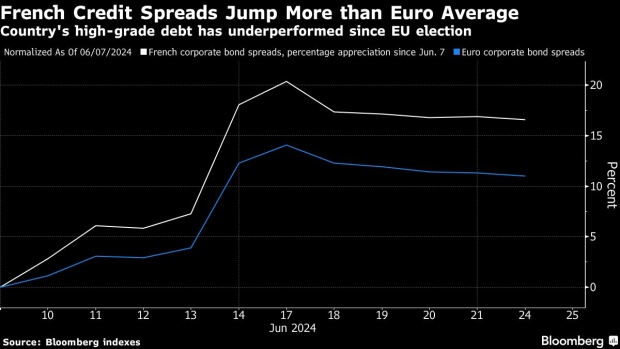

The sales represent a test of how fragile market sentiment is, given the iTraxx Crossover gauge of credit risk for European junk firms is on track for its biggest monthly increase this year. The deals will also be closely watched as France has an outsized impact on the region: nearly 20% of all European high-yield bonds are from the country, the highest concentration, according to Bloomberg indexes.

“As such, France is likely to drive the direction of European credit spreads more broadly over the next few weeks as election risk amplifies,” wrote Bank of America Corp. analysts led by Neha Khoda.

The dash for debt at a time of high election risk reflects overall strength in credit markets, which have shrugged off a higher-for-longer interest rates narrative this year and concerns over recent political volatility elsewhere in Europe.

CLO Cash

Investors in collateralized loan obligations, the biggest buyers of leveraged loans and a pool of demand for floating-rate bonds, have cash on hand, and are desperate for new supply. Picard is catering to that investor base, with at least half of its jumbo bond in a floating-rate format.

“There’s a strong CLO technical, which means if you’re issuing term loans or floating-rate instruments right now there’s a lot of demand, and traditional high-yield investors will need to think carefully about whether there’s enough left on the table for them,” said Squire.

Overall, the performance of credit market spreads has not been as negative as that seen in government debt, and conditions may get worse later on, according to Thomas Neuhold, responsible for fund management at Gutmann Kapitalanlage AG.

“You might say that it’s still worth securing the spread right now than in two weeks’ time when investors could be negatively surprised,” he said. “Take it right now, even though it would have been cheaper some weeks ago.”