From Ethiopia to Rwanda, Africa bonds ride wave of rate-cut bets

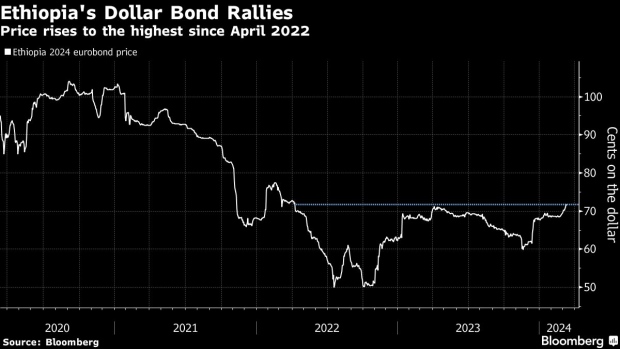

The rally in Africa’s sovereign bonds is barely taking time for a breather, with the prices of bonds in countries including Ethiopia, Ghana, Rwanda rising to almost two-year highs.

That’s brought the average risk premium for African debt over US Treasuries to the lowest since April 2022.

Appetite for African sovereign eurobonds — all of them rated junk — was initially sparked by an influx of money from multilateral lenders, and by defaulting nations showing signs of progress in restructuring their debt.

Now, global markets are becoming even more certain that a US interest-rate reduction is on the horizon, which may lead investors to look at riskier markets to get juicy returns.

“We are in a period where the market anticipates the end of the rate-hike cycle and even rate cuts later this year,”said Franck Bekaert, senior emerging-market analyst at Gimme Credit. “High-yield debt offers returns comparable to equity returns. The premium of African bonds is still quite high and attractive versus developed debt.”

Individual stories also continue to support sentiment.

Egypt and the International Monetary Fund on March 6 agreed to an $8 billion loan program, and the World Bank will provide the North African nation a further $3 billion, buoying that market.

“The extraordinary quantum of Egypt support has lifted many boats on the stressed and distressed side,” said Maciej Woznica, fixed-income portfolio manager at Coeli Frontier Markets AB.

Earlier this year, Kenya’s sale of $1.5 billion in eurobonds took pressure off the nation and eased stress in the general market, Woznica said.

While dropping risk premiums theoretically could encourage more nations on the continent to issue new debt, there’s unlikely to be a rush.

“We are still some distance from where we were especially pre-Covid as net issuance from high-yield markets is still exceptionally low,” said Thys Louw, portfolio manager at asset manager Ninety One Plc. “And although we’ve seen some issuance from single B credits, it’s still pretty selective.”