Ghana bondholders demand sweetener for $13 billion debt deal

Ghana is resisting calls by holders of the country’s eurobonds to offer a sweetener for restructuring $13 billion of debt, risking a self-imposed deadline for a deal.

Investors have asked Ghana to link interest payments on some of the debt to the future economic growth of the West African nation, according to people with knowledge of the matter who asked not to be identified as the discussions are private.

Bondholders want Ghana to mirror Suriname, which last year issued a so-called value-recovery instrument that pays out if the nation becomes oil-rich. Under the proposal put to Ghana’s authorities, interest payments will increase should economic growth accelerate faster than targets set by the International Monetary Fund.

The instruments are opposed by Ghana’s new finance minister, Mohammed Amin Adam, as they were by his predecessor Ken Ofori-Atta, the people said. The impasse may delay Ghana’s self-imposed deadline to finalize an accord — needed to secure further payments from the IMF — by end of March.

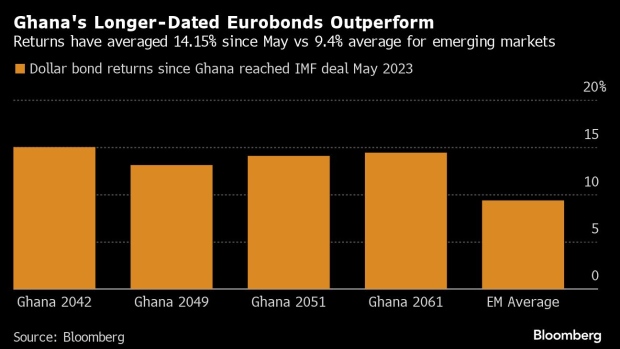

Ghana’s longer-dated dollar bonds have outperformed peers since the nation finalized a $3 billion bailout with the IMF in May. Returns for debt due 2042, 2049, 2051 and 2061 have averaged 14.15% since May, compared with a 9.4% average for emerging markets.

The Washington-based lender forecasts the West African nation’s economy will expand 2.8% this year, with growth accelerating to 5% in 2027 and 2028. Ghana’s economy expanded an average 6.9% between 2017 and 2019, before growing 0.5% in 2020, the slowest pace in 37 years.

A spokeswoman for Ghana’s finance ministry declined to comment on the bondholders’ proposal.

Ghana began restructuring almost all of its debt a little over a year ago as part of an IMF deal. The country reached an agreement in principle with bilateral creditors in January to rework $5.4 billion of obligations, under the Group of 20’s Common Framework for Debt Treatment.

The focus now is on finalizing a pact with eurobond investors using the “comparability of treatment” guiding principle of the framework.

Bondholders may accept upfront losses — or so-called haircuts — of between 25% and 30% if Ghana agrees to issue the value-recovery instruments, one of the people said. In October, Ghana’s government proposed as much as a 40% haircut for dollar-bond investors.

While Suriname’s issue of oil-linked notes helped that country emerge from a three-year long default in 2023, Sri Lanka opposed bondholders’ offer for a 20% haircut and the issuance of macro-linked bonds, Bloomberg News previously reported.

Ofori-Atta said in October that the completion of a domestic debt exchange will ensure that debt declines to 72% of GDP by 2028 from 109% prior to the restructuring. In order to achieve the IMF’s requirement of 55% by that date, bondholders will be required to take losses of 30% to 40%, he said.

Ghana has received $1.2 billion from the IMF since its extended credit facility started in May. Further disbursements hinge on the progress of ongoing talks with its private creditors.