Ghana Faces Tightrope Walk on Tax Cuts Amid IMF Programme

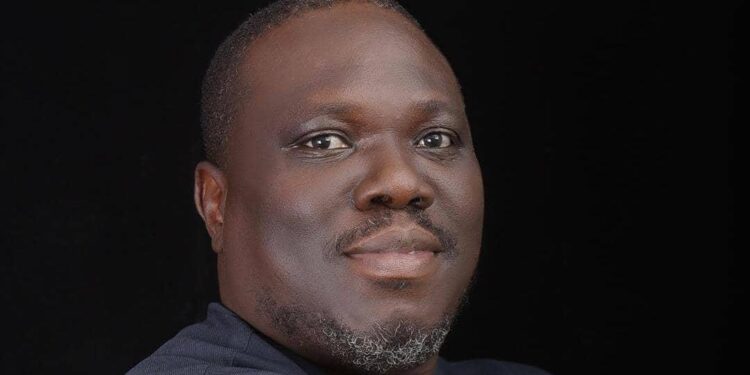

Ghana must tread cautiously on implementing manifesto-promised tax cuts to avoid derailing its progress and the gains made so far under the ongoing IMF programme as the Fund will not take kindly to it, says Associate Professor of Economics at the University of Ghana, Ebo Turkson.

Prof Ebo Turkson has called for adherence to fiscal targets, highlighting that the country’s recovery remains fragile despite notable gains made in reducing inflation, successfully restructuring domestic and external debts, and restoring economic stability.

Speaking during the NorvanReports X Space Discussion on the topic, “Fiscal Sustainability Amid Tax Cuts and Manifesto Promises”, Prof. Turkson underscored the risks posed by tax policy shifts asserting any fiscal adjustments must align with IMF programme targets to maintain the country’s current economic trajectory.

Tax Cuts and Fiscal Strains

The fiscal landscape, according to Prof. Turkson, leaves little room for manoeuvre. He revealed that government revenue receipts by late 2024 were 9.5% below target, while expenditures exceeded expectations by 5.4%.

“Any tax cuts, including the removal of contentious levies like the e-levy, must come with clear plans to offset lost revenue,” he said. “The fiscal space is tight, and there is limited capacity to absorb shocks without affecting programme targets.”

Prof. Turkson suggested that replacing regressive taxes with business-friendly measures or expanding the tax base could help mitigate revenue shortfalls. However, he cautioned that Ghana’s vast informal sector might not yield substantial gains, complicating efforts to boost tax revenues.

Maintaining IMF Compliance

A key concern is the risk of jeopardizing the IMF programme, which is set to run until 2028. Prof. Turkson warned that fiscal slippage could force the government to renegotiate its commitments, potentially undermining confidence in the economy.

“Tax cuts must be accompanied by expenditure rationalisation to ensure fiscal discipline,” he said. “The objective should be to exit the IMF programme in a stronger position, ensuring the gains achieved are not merely one-off improvements.”

Policy Dilemmas

The government faces a challenging balancing act between fulfilling electoral promises and maintaining fiscal discipline.

While tax cuts could ease the burden on households and businesses, the absence of alternative revenue streams risks undermining the economic recovery.

With the IMF programme serving as the cornerstone of Ghana’s economic stabilisation efforts, policymakers must navigate these decisions carefully.

Building Long-Term Resilience

Meanwhile, former Finance Minister Seth Terkper has emphasized the need for Ghana to establish a robust economic framework to avoid recurrent reliance on the International Monetary Fund (IMF).

Mr Terkper attributed Ghana’s economic fragility to the absence of long-term mechanisms to cushion the country during financial crises.

Referring to past IMF engagements, Mr Terkper underscored the importance of learning from other nations that have successfully exited IMF dependency.

“Greece, Portugal, and Ireland implemented mechanisms to stabilize their economies after their crises. Ghana must do the same by building resilience to manage future challenges independently,” he noted.