International credit rating agency, Fitch Ratings, has said Ghana’s slow pace of fiscal consolidation as outlined in the 2021 budget, leaves Ghana exposed to a heavy debt-service burden and risks of fiscal slippage.

Fitch posits that the country’s gradual pace of projected fiscal consolidation means Ghana’s ability to absorb new shocks will remain weak for an extended period, with such new shocks increasing the likelihood of government debt remaining on an upward trajectory beyond 2022.

Public debt presently stands at 76.1 percent of Gross Domestic Product (GDP) with fiscal deficit end-2020 being 11.7 percent excluding energy and financial sector costs.

According to the government, interest costs were equivalent to 6.4% of GDP in 2020, or 45% of total fiscal revenue. The large increase in debt in 2020 means that interest costs will increase in 2021 – we forecast interest spending to breach 50% of government revenue in 2021, said Fitch.

Read below details of Fitch’s assessment:

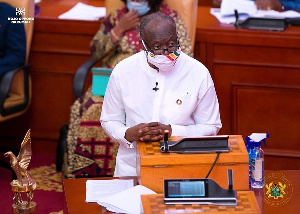

The slow pace of the consolidation path outlined by Ghana’s 2021 budget statement, presented on 12 March, and by the accompanying medium-term fiscal framework leaves Ghana exposed to a heavy debt-service burden and risks of fiscal slippage, says Fitch Ratings.

The path is supported by new revenue measures and the gradual implementation of expenditure cuts.

We indicated that our assessment of the medium-term trajectory of public debt would be an important rating sensitivity when we affirmed Ghana’s Long-Term Foreign-Currency Issuer Default Rating at ‘B’ with a Stable Outlook in October 2020.

The budget aims to reduce the fiscal deficit from 13.8% of GDP in 2020 (including off-budget energy and financial-sector restructuring costs) to 10.8% of GDP in 2021, 7.5% in 2022 and below 5% by 2024. The Ghanaian government reports that debt hit 76.1% of GDP at end-2020, about 4pp higher than we had previously forecast.

There is a significant risk that public finances could fall short of the goals outlined in the budget, particularly given the government’s lack of a clear majority in parliament.

The gradual pace of projected consolidation will mean Ghana’s ability to absorb any new shocks will remain weak for an extended period. Any such shocks would increase the likelihood of government debt remaining on an upward trajectory beyond 2022.

The high cost of the government’s debt burden is an important rating weakness and will continue to squeeze the government’s other spending priorities. According to the government, interest costs were equivalent to 6.4% of GDP in 2020, or 45% of total fiscal revenue.

The large increase in debt in 2020 means that interest costs will increase in 2021 – we forecast interest spending to breach 50% of government revenue in 2021, well above the median of around 11% for ‘B’ rated sovereigns.

Fitch expects Ghana’s interest expense to fall as a share of revenues and GDP from 2022, although it will remain above the ‘B’ median for many years to come. We estimate that the weighted-average interest rate on domestic debt fell to 17% in 2020 from over 20% in 2016.

Ghana has one of the highest real policy rates among emerging-market sovereigns, which indicates that interest rates may have further room to fall, so long as the government can maintain its policy credibility and the global environment supports a falling rate of inflation.

New international debt issuance may also reduce the government’s calls on domestic debt markets, as well as ease external funding pressures and support overall macroeconomic stability. The authorities plan to raise up to USD5 billion on international capital markets in 2021.

Fitch also sees risks to the budget’s revenue forecasts. The government plans to increase fiscal revenues, aided by 1pp increases in VAT and the National Health Insurance Levy. However, achieving total revenue of an average of 16.8% of GDP over 2021–2024 may be difficult. Government revenue averaged 15.4% of GDP over 2016–2019.

Nonetheless, there are factors that could provide some headroom for the public finances. Projected public capex, at 4.1% of GDP in 2021, is high compared with the 2% average in 2018–2019, and may fall short of target.

The government’s 5% forecast for average annual economic growth in 2021–2024 also appears conservative, given Ghana’s pre-pandemic performance and the low base of comparison in 2020, which may point to some upside potential for revenue.