Ghana’s bonds gain signal confidence in debt restructure progress

Ghana’s dollar bonds have dodged the unease in debt markets this week as the nation makes progress with its debt restructuring.

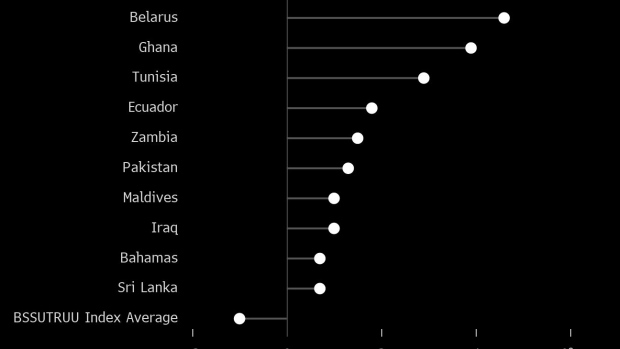

The country’s eurobonds have risen 3.9% this week, beaten only by the largely untradeable debt of Belarus in an index of 69 emerging and frontier markets. That compares to an average loss of 1% for peers in the gauge.

The gains follow West Africa’s third-largest economy striking a deal last week with bilateral creditors, including China, to rework $5.4 billion of loans.

The agreement clears the way for the International Monetary Fund board to make a second disbursement of $600 million to Ghana under the country’s $3 billion IMF program when it meets later Friday.

Ghana’s bonds maturing in 2029, 2042 and 2061 were among the top performers Friday, ahead of the IMF board meeting at 3:00 p.m. London time.

The World Bank said it viewed the debt agreement as a potential means to unlock financial support from international financial institutions, including a $300 million budget support operation backed by the International Development Association.