Ghana’s Inflation Cools But for Many, the Heat Remains

In June 2025, Ghana’s headline inflation fell to 13.7%, a milestone that should, on paper, suggest a return to macroeconomic stability. But before anyone pops the champagne, it’s worth asking: has your kenkey really gotten cheaper?

Let’s be clear, this figure is a victory. After months of soaring costs, double-digit inflation, and financial anxiety across the economy, a 13.7% inflation rate represents progress. It signals that the central bank’s tightening measures, government fiscal restraint, and perhaps even international support have started to work. Ghana is cooling off from the fever of high inflation.

Yet the everyday Ghanaian may not feel this cooling sensation.

Why? Because inflation is falling does not mean prices are falling. It simply means prices are rising more slowly than before. For households that saw their food bills double over the past two years, that’s a technical nuance, not an emotional relief. Your trotro fare hasn’t gone down. Rent is still pegged at new highs. And kenkey, well, it’s not half-priced.

In this joint analysis, we unpack what the numbers truly mean, who benefits, who doesn’t, and why Ghana must resist the temptation of statistical comfort in the face of lingering economic hardship.

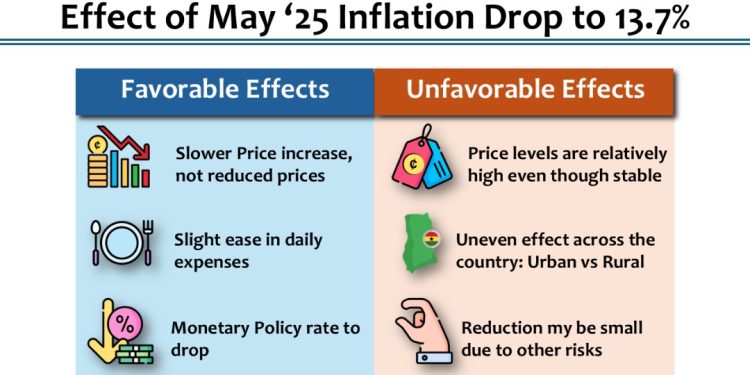

Find below the analysis from Mr Joe Jackson, CEO of Dalex Finance

Beyond the Numbers: A Call for Realism and Responsibility

At 13.7%, Ghana is turning a page, but not closing the book. Inflation may be tamed, but the structural pressures driving the cost of living remain: poor logistics, supply chain inefficiencies, housing shortages, and low productivity.

What’s needed now is not just macro stability but micro-level interventions, a budget that makes room for rural infrastructure, targeted subsidies that actually reach the poor, and labour reforms that empower the informal sector to earn more.

As a country, we must avoid falling into the trap of statistical satisfaction. Numbers are not lived experiences. The true test of recovery lies not in percentages but in the purchasing power of the average Ghanaian. When kenkey costs less and wages go further, then we can celebrate.

Until then, don’t pop the champagne; pop open your budget.