Global exchange copper stocks sink to 15-year lows

There’s a renewed scramble for copper sitting in London Metal Exchange (LME) warehouses.

Headline LME copper stocks have slid from 100,100 tonnes to 77,050 over the last three weeks despite almost 30,000 tonnes of arrivals.

What’s arriving is just as quickly turning around and going out again. Available tonnage stands at just 31,900 tonnes, enough to supply the global market for around 11 hours.

Unsurprisingly, the stocks raid has ignited LME time-spreads, the benchmark cash-to-three-months period closing Monday valued at a backwardation of $31 per tonne. It’s the highest premium for cash since November last year.

The drain on LME copper stocks is puzzling given weakening manufacturing activity in both Europe and the United States.

The closure of Swedish producer Boliden’s Ronnskar smelter has opened up a 220,000-tonne supply gap in the European market, but the swoop on LME stocks started before the June 13 fire at the plant and has been focused on Asian and US locations not European.

It wouldn’t be the first time that the LME stocks signal has been refracted, and the lower the stocks, the easier it is to bend the light.

But this is not just a London market phenomenon. Visible stocks everywhere are low.

Global problem

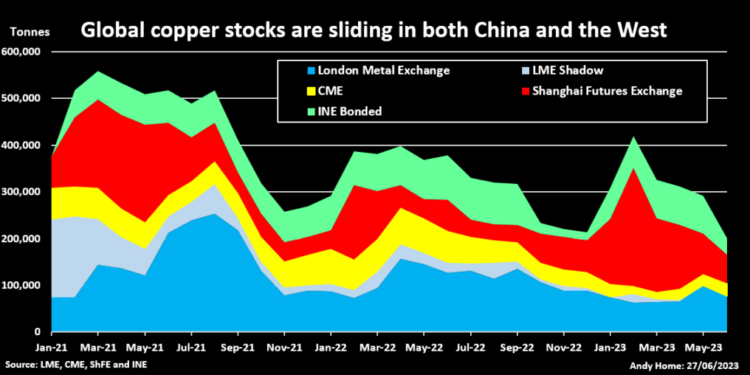

Combined copper stocks registered with the LME, its US counterpart the CME and the Shanghai Futures Exchange (ShFE) totalled 165,000 tonnes at the end of last week.

Global exchange inventory is now down by 45,500 tonnes on the start of the year and the lowest it’s been since 2008.

A small rebuild in LME inventory over April and May has gone into reverse this month.

CME inventory is rising but from a very low base, and at 27,859 tonnes is still down by 3,975 tonnes on the start of the year.

ShFE stocks rose sharply during the seasonal demand lull over the Lunar New Year holidays, but leveled out at 252,455 tonnes in February and have since shrunk rapidly to just 60,424 tonnes.

The Shanghai exchange has experienced tightness across the front part of the curve since March, with time-spreads now also the widest since November.

Shadow movement

Tightness on the Shanghai Futures Exchange seems to be pulling in metal from the city’s bonded warehouse zones.

Bonded stocks held by ShFE’s international arm, the International Energy Exchange, have slumped from almost 89,000 at the start of the month to just 35,000.

Local data provider Shanghai Metal Markets estimates other bonded stocks stand at 66,400 tonnes, down from a March peak of 185,600 tonnes.

The last two months’ trade figures also suggest movement out of bonded warehouses into mainland China.

China “imported” close to 30,000 tonnes of Chinese copper in April and May, likely denoting metal that qualified for duty-free export under a tolling contract being channeled back into the domestic market.

The counter-flow significantly offset China’s “exports” of 45,000 tonnes over the same two months.

More imports?

Higher domestic production should help alleviate the Shanghai tightness.

China imported a record 2.56 million tonnes of concentrates and churned out a record 1.1 million tonnes of refined copper in May.

But the country’s net draw on copper from the rest of the world also picked up last month to 276,000 tonnes, the highest monthly total since January.

The Yangshan copper premium, a closely watched indicator of China’s import appetite, has perked up from $22.50 per tonne in May to a current $47.50.

It’s noticeable that LME stocks in Asia have been particularly in demand, with only 4,475 tonnes still available in the region.

Is all the recently cancelled copper heading to China to refill empty bonded warehouses?

Conflicted signals

Or is that just the picture that is being painted?

Doctor Copper seems undecided. LME three-month copper briefly spiked to a two-month high of $8,868 per tonne last week but has since retreated to a current $8,380.

The limited price reaction and the relatively constrained backwardation across the front part of the curve imply the market is betting that there is a lot more copper out there in private stocks.

The pace of LME arrivals in recent days shows there are available units for exchange warranting. Physical premiums are soft across all three regions due to weak spot demand, according to Fastmarkets.

Surplus metal, however, is not sticking in the LME warehouse system, leaving visible inventory a bull flag in an otherwise bearish landscape.

Either global exchange inventory rebuilds over the seasonal summer soft spot for northern hemisphere demand, or the market is going to have to rethink just how much copper is really out there.