Global Growth Steady Amid Slowing Disinflation and Rising Policy Uncertainty

Our global growth projections are unchanged at 3.2 percent this year and slightly higher at 3.3 percent for next year, but there have been notable developments beneath the surface since the April World Economic Outlook.

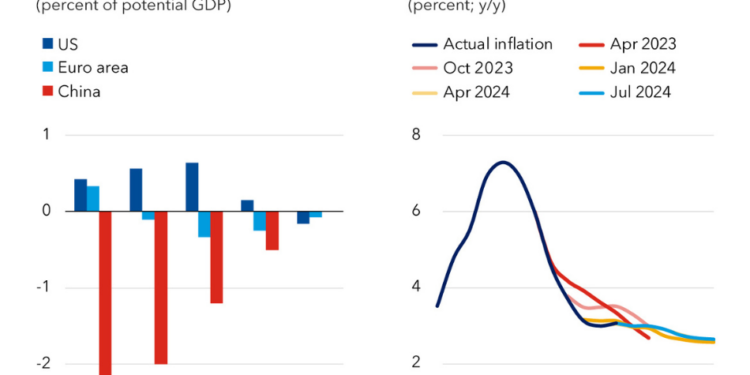

Growth in major advanced economies is becoming more aligned as output gaps are closing. The United States shows increasing signs of cooling, especially in the labor market, after a strong 2023. The euro area, meanwhile, is poised to pick up after a nearly flat performance last year.

Asia’s emerging market economies remain the main engine for the global economy. Growth in India and China is revised upwards and accounts for almost half of global growth. Yet prospects for the next five years remain weak, largely because of waning momentum in emerging Asia. By 2029, growth in China is projected to moderate to 3.3 percent, well below its current pace.

As in April, we project global inflation will slow to 5.9 percent this year from 6.7 percent last year, broadly on track for a soft landing. But in some advanced economies, especially the United States, progress on disinflation has slowed, and risks are to the upside.

|

In our latest WEO update, we find that risks remain broadly balanced, but two downside near-term risks have become more prominent.

First, further challenges to disinflation in advanced economies could force central banks, including the Federal Reserve, to keep borrowing costs higher for even longer. That would put overall growth at risk, with increased upward pressure on the dollar and harmful spillovers to emerging and developing economies.

Mounting empirical evidence, including some of our own, points to the importance of global ‘headline’ inflation shocks—mostly energy and food prices—in driving the inflation surge and subsequent decline across a broad range of countries.

The good news is that, as headline shocks receded, inflation came down without a recession. The bad news is that energy and food price inflation are now almost back to prepandemic levels in many countries, while overall inflation is not.

One reason, as I emphasized previously, is that goods prices remain high relative to services, a legacy of the pandemic initially boosting goods demand while restricting their supply. This makes services comparatively cheaper, increasing their relative demand—and, by extension, that of the labor needed to produce them. This is putting upward pressure on services prices and wages.

Indeed, services prices and wage inflation are the two main areas of concern when it comes to the disinflation path, and real wages are now close to prepandemic levels in many countries. Unless goods inflation declines further, rising services prices and wages may keep overall inflation higher than desired. Even absent further shocks, this is a significant risk to the soft-landing scenario.

Second, fiscal challenges need to be tackled more directly. The deterioration in public finances has left many countries more vulnerable than foreseen before the pandemic. Gradually and credibly rebuilding buffers, while still protecting the most vulnerable, is a critical priority. Doing so will free resources to address emerging spending needs such as the climate transition or national and energy security.

More importantly, stronger buffers provide the fiscal resources needed to address unexpected shocks. However, too little is being done, magnifying economic policy uncertainty. Projected fiscal consolidations are largely insufficient in too many countries. It is concerning that a country like the United States, at full employment, maintains a fiscal stance that pushes its debt-to-GDP ratio steadily higher, with risks to both the domestic and global economy. The increasing US reliance on short-term funding is also worrisome.

With higher debt, slower growth, and larger deficits, it would not take much for debt trajectories to become much less comfortable in many places, especially if markets send government bond spreads higher, with risks for financial stability.

Unfortunately, economic policy uncertainty extends beyond fiscal considerations. The gradual dismantling of our multilateral trading system is another key concern. More countries are now going their own way, imposing unilateral tariffs or industrial policy measures whose compliance with World Trade Organization rules is questionable at best. Our imperfect trading system could be improved, but this surge in unilateral measures isn’t likely to deliver lasting and shared global prosperity. If anything, it will distort trade and resource allocation, spur retaliation, weaken growth, diminish living standards, and make it harder to coordinate policies that address global challenges, such as the climate transition.

Instead, we should focus on sustainably improving medium-term growth prospects through more efficient allocation of resources within and across countries, better education opportunities and equality of chances, faster and greener innovation and stronger policy frameworks.

Macroeconomic forces—desired national savings and domestic investment together with global rates of return on capital—are the primary determinants of external balances. Should these imbalances be excessive, trade restrictions would be both costly and ineffective at addressing the underlying macroeconomic causes. Trade instruments have their place in the policy arsenal, but because international trade is not a zero-sum game, they should always be used sparingly, within a multilateral framework, and to correct well-identified distortions. Unfortunately, we find ourselves increasingly at a remove from these basic principles.

As the eight decades since Bretton Woods have shown, constructive multilateral cooperation remains the only way to ensure a safe and prosperous economy for all.