- GMP Energy Denies Misconduct in $94M Oil Fraud Allegations, Labels Dispute a “Commercial JV Matter”

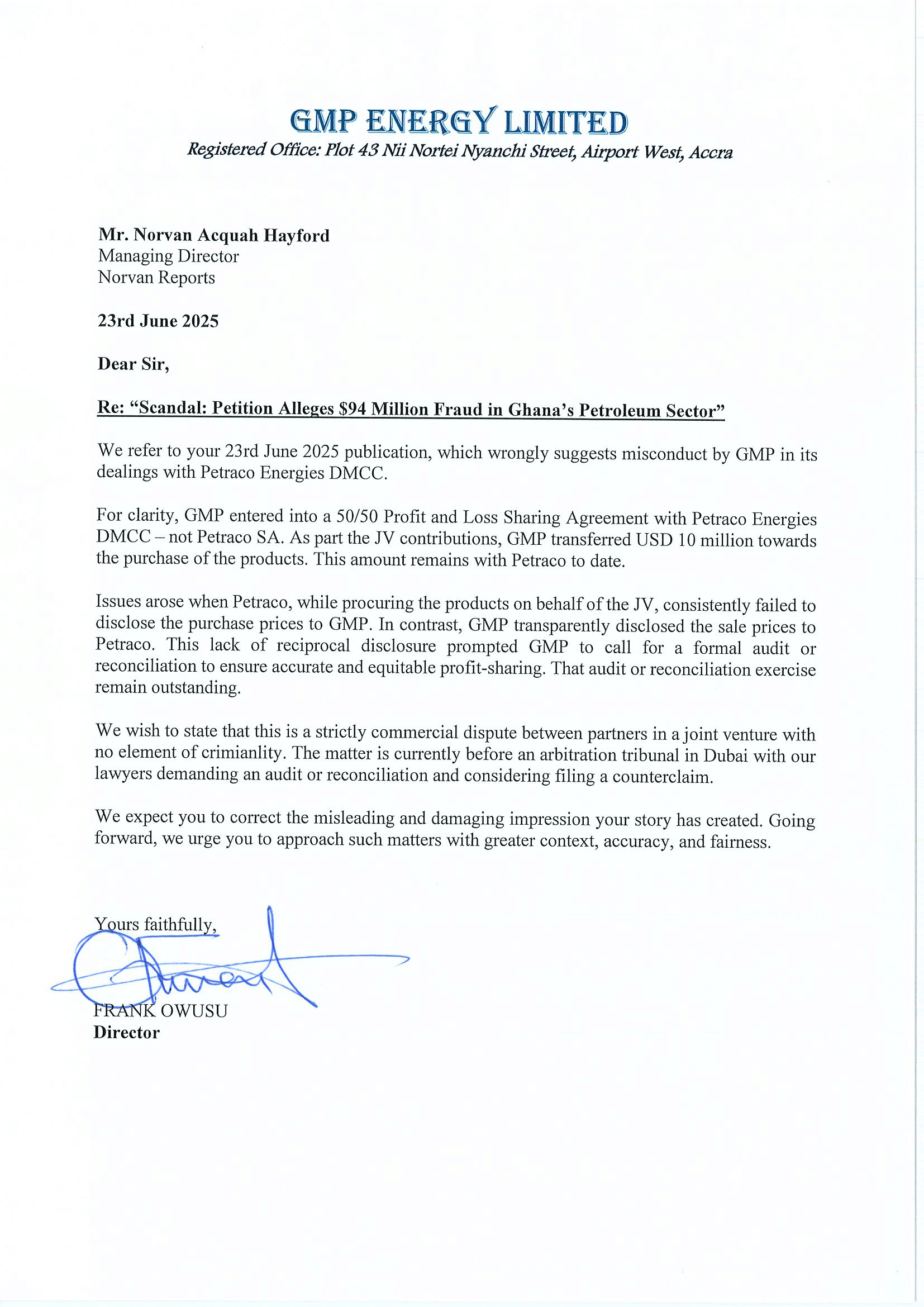

GMP Energy Limited has formally responded to recent fraud allegations in relation to a $94.35 million petition filed by Swiss oil trading firm Petraco Oil Company SA to the Economic and Organised Crime Office (EOCO), Ghana. In a letter dated 23rd June 2025, the company rejected claims of criminal wrongdoing, describing the matter as a “strictly commercial dispute between partners in a joint venture.”

In its letter addressed to NorvanReports, GMP Energy stated that it had entered into a 50/50 Profit and Loss Sharing Agreement with Petraco Energies DMCC, not Petraco SA. Under the joint venture, GMP contributed USD 10 million towards the purchase of petroleum products, a sum it claims “remains with Petraco to date.”

The statement, signed by Frank Owusu, Director at GMP, pushes back on suggestions of impropriety, asserting that its dealings were transparent and above board. “There is no element of criminality,” the company noted. It added that the dispute currently resides before an arbitration tribunal in Dubai, and GMP is considering filing a counterclaim.

Disputed Pricing and Audit Breakdown

According to the response, GMP alleges that the underlying dispute stems from Petraco’s failure to disclose purchase prices for petroleum products procured on behalf of the JV. GMP contrasts this with its own actions, asserting it transparently disclosed sale prices to its counterpart throughout the engagement.

The company argues that this lack of reciprocal financial transparency led to GMP demanding a formal audit or reconciliation to ensure fair and equitable profit-sharing under the JV arrangement. “That audit or reconciliation exercise remains outstanding,” GMP stated.

It is this unresolved financial disclosure, rather than any fraudulent concealment or criminal intent, that GMP claims is the true origin of the dispute.

Rejection of Criminal Framing

The company expressed concern over media coverage linking the JV disagreement to alleged fraud, insisting that NorvanReports’ initial publication on the EOCO petition “wrongly suggests misconduct by GMP.”

“We expect you to correct the misleading and damaging impression your story has created,” the letter stated. “Going forward, we urge you to approach such matters with greater context, accuracy, and fairness.”

The company confirmed that the matter is now subject to formal arbitration in Dubai, with lawyers on both sides engaged in preparing for proceedings. GMP also disclosed that it is actively considering a counterclaim and has maintained its demand for a third-party audit of the JV accounts and performance.

This aligns with portions of the whistleblower petition reviewed by NorvanReports, which notes that ongoing civil proceedings have been cited by some parties as a basis to defer or stall potential criminal investigations in Ghana.

With parallel responses now issued by both GMP and Springfield Exploration & Production Ltd—each rejecting the petition’s core allegations—the matter has now escalated into a high-stakes legal and reputational standoff. EOCO has yet to confirm whether it has opened a formal criminal investigation.

The broader implications of the dispute remain significant for Ghana’s petroleum sector, especially in terms of foreign investor confidence, contractual enforcement, and regulatory credibility.

NorvanReports will continue to provide updates as arbitration proceedings unfold and as EOCO and relevant regulators determine next steps.

Below is GMP’s full rejoinder to NorvanReports