GNCCI Calls for Overhaul of Ghana’s Tax Regime Under New Government

The Ghana National Chamber of Commerce and Industry (GNCCI) has urged the incoming administration of President-elect John Mahama to tackle Ghana’s tax regime, starting with the removal of what it calls burdensome levies, including the COVID-19 tax and the controversial e-levy.

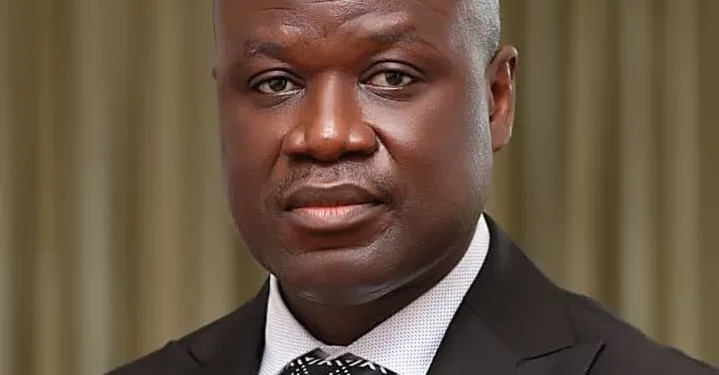

Mark Badu-Aboagye, Chief Executive of the GNCCI, warned that the current tax structure is stifling businesses, contributing to a harsh operating environment and undermining economic growth.

Speaking on PM Express, Mr Badu-Aboagye described the COVID-19 levy as obsolete.

“For me, the first tax I expect President-elect John Mahama to take out is the COVID-19 levy. We’ve said it repeatedly at the Chamber of Commerce—there is no need for this tax anymore,” he said.

E-Levy Under Scrutiny

Mr Badu-Aboagye also aimed the e-levy, describing it as a “brilliant idea” that has been poorly implemented.

“They also have to take [the e-levy] out because it’s been promised. Now, we are going to hold them accountable for the promises they’ve made to the business community because the taxes themselves are killing businesses,” he stated.

High VAT Rates Add Pressure

The GNCCI Chief Executive also expressed concerns over Ghana’s VAT structure, which combines a standard rate of 15% with additional levies to push the effective rate close to 21%.

“These levies translate directly into the cost of production and have a cascading effect on prices and consumers,” he said.

Pledges Versus Delivery

While welcoming the Mahama administration’s manifesto commitments to reduce taxes, Mr Badu-Aboagye cautioned against complacency.

“It’s one thing saying it, and it’s another thing doing it. We were here in 2016 and 2017 when the NPP said they were going to remove nuisance taxes. They did scrap about 15 taxes, but they brought back the taxes in harsher forms,” he observed.

The GNCCI intends to hold the incoming administration to its promises, stressing the urgency of delivering meaningful relief to businesses. “Businesses need relief, and we’ll ensure these promises are kept,” he concluded.

The Chamber’s call highlights growing demands from the private sector for a policy shift that fosters a more supportive business climate amid mounting economic challenges.