Going Into New Trump Era, Risky Emerging Market Bonds Keep Luring Traders

Junk-rated dollar debt from developing nations is attracting fresh bets from money managers at UBS Asset Management, Lazard Asset Management Ltd. and PGIM Fixed Income in the wake of Donald Trump’s election.

The thinking is that improved fundamentals in some emerging nations — growing foreign reserves, funding agreements and structural economic reforms — will help keep these credits insulated from potential selloffs in global rates. They also offer some protection from currency volatility stoked by concerns about Trump’s tariff stance.

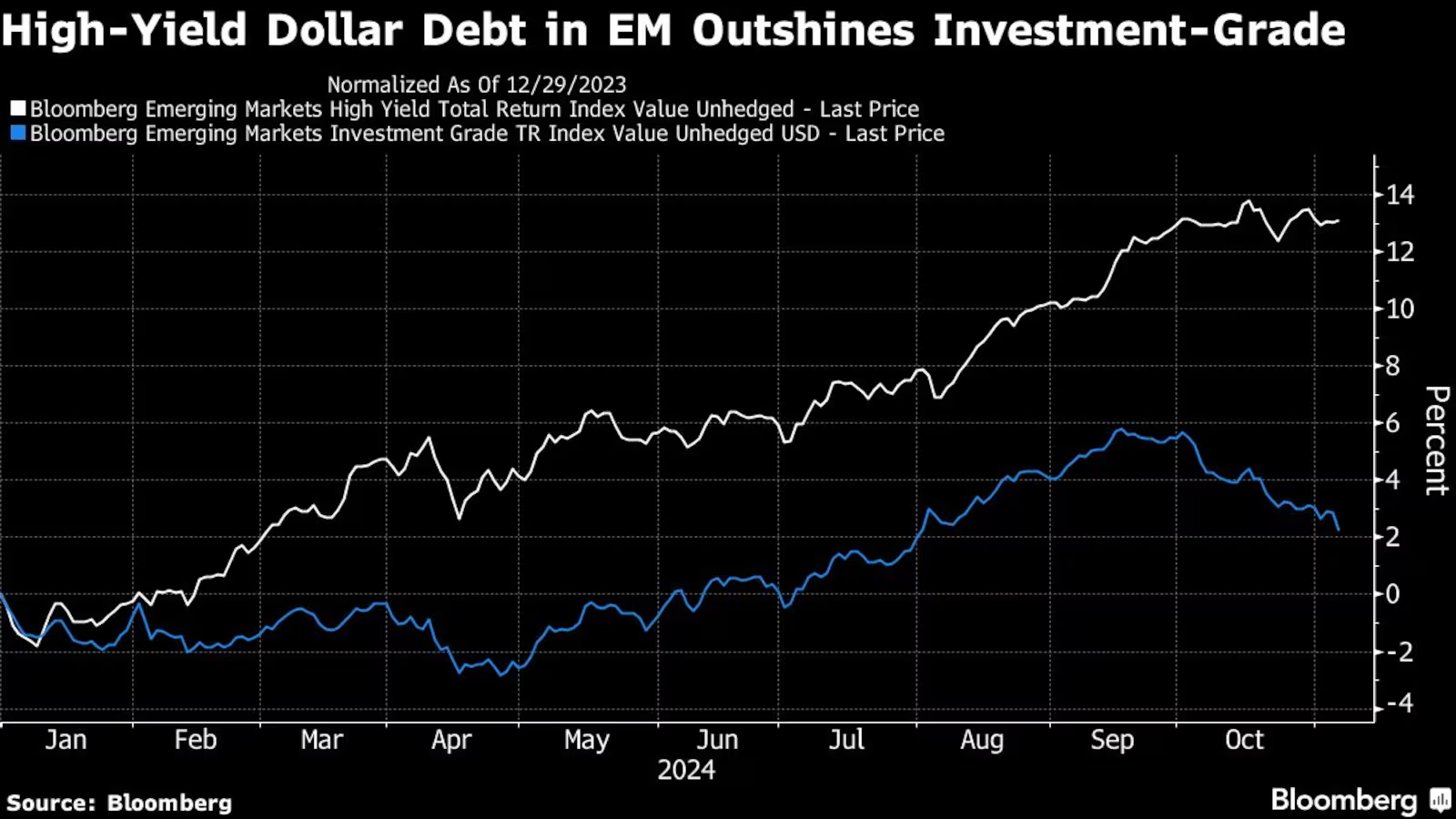

Portfolio managers have been riding a rally in high-yield notes for most of 2024. EM hard-currency junk bonds have handed investors a 14% gain year to date, topping a 2.8% return for investment-grade debt, data compiled by Bloomberg show.

Debt from Argentina, Sri Lanka and Pakistan, which has returned at least 23% this year, is poised for more gains, according to Shamaila Khan, head of fixed income for emerging markets and Asia Pacific at UBS Asset Management, which oversees $1.8 trillion.

“Fundamentals are improving and countries emerging out of default will continue to perform,” Khan said. “We may not have another 60%, 70% gain, but you can still see attractive double-digit returns. If you see weakness in the space, it’s a fantastic opportunity.”

The more niche nature of these credits — not all investors can dip into, let alone load up on, junk-rated debt from emerging nations due to liquidity or rating concerns — comes in handy at a shaky time for risk assets.

On Wednesday, the day after Trump secured his return to the White House, dollar notes from Ukraine and El Salvador to Ecuador and Argentina rallied. The gains stood out in a volatile session for markets. A soaring dollar and rising US yields sent an index of emerging-market currencies to its worst day since February 2023. Eastern European currencies spiraled and the Mexican peso sank as much as 3.3% before rebounding.

Investors are still trying to gauge paths for global interest rates and the dollar under a new Trump administration, whose policy promises are largely seen as stoking inflation in the world’s largest economy. Moreover, Trump’s tariffs plans will likely take a disproportionate toll on some of the larger emerging markets, such as Mexico and China.

There’s still a lot that the market doesn’t know — including key policies and how they will impact economic growth and liquidity, said Cathy Hepworth, head of emerging-market debt at PGIM.

“For now, we assume there will be some volatility at the margin” for emerging markets, Hepworth said. “Higher-yielding spreads, which have idiosyncratic drivers, are likely to continue to outperform.”

Sri Lanka is getting closer to restructuring almost $13 billion of bonds, following similar steps by Ghana, Zambia and Ukraine. Serial defaulter Argentina has so far avoided any rework of its debt, winning over investors with a harsh austerity agenda.

Potential deals with the International Monetary Fund or buybacks also make these investment opportunities stand out, said Sabrina Jacobs, senior fixed-income portfolio manager at Pictet Asset Management Ltd.

Ahead of the US election, Jacobs and her colleagues reduced risky positions, zeroed in on uncorrelated longs, including Turkey and Egypt, and bet on heightened yuan volatility. Those moves remain largely in play, she said.

“We still have a small bias to the high yield space across corporates and sovereigns,” she said. “We’re looking for positions not too linked to Trump.”

Corporate Havens

Still, risk assets remain vulnerable to potential geopolitical fallout, strained trade relationships and liquidity challenges during Trump’s second administration.

His pledges of stronger restrictions on imports and immigration are fueling bets on higher US borrowing costs and a stronger greenback — all of which should crimp emerging market returns, putting pressure on currencies and limiting easing cycles in the developing world.

For some, that’s adding to the appeal of corporate debt. High-yield corporate bonds have handed investors returns of about 10% since the beginning of the year, beating the 5% gain for investment-grade peers, according to data compiled by Bloomberg.

“It’s a table-pounding yes, no question,” said Eric Fine, head of emerging-markets active debt at VanEck Associates. “They pay you a higher spread. High-yield corporates are a high-yield trade, and investment grade is a Treasury trade.

Fine likes corporate bonds from China’s real estate sector given cheap pricing and attractive valuations. Still, some of these instruments can become illiquid very quickly, he said.

The country’s developers have been struggling through a years-long property crisis, with least 20 Chinese developers having faced wind-up petitions, according to data compiled by Bloomberg. Corporate defaults for high yield in Asia ex-China and Hong Kong, however, are very low.

Stone Harbor Investment Partners, on the other hand, prefers high-yield credits from Latin America, high-growth companies from Africa and gaming firms from Macau.

“The low hanging fruit in emerging markets is high-yield sovereign and corporate debt,” said Arif Joshi, who oversees about $8 billion as co-head of emerging-market debt at Lazard Asset. “We view any selloff in high yield, low duration sovereign and corporates as an attractive buying opportunity.”