Gold Bulls Set Sights On Previously Dismissed Record $3,000 Milestone

Gold market bulls are locking in bullion prices surging to fresh records, with a milestone of $3,000 per ounce coming into focus, fired up by monetary easing by major central banks and a tight US presidential election race.

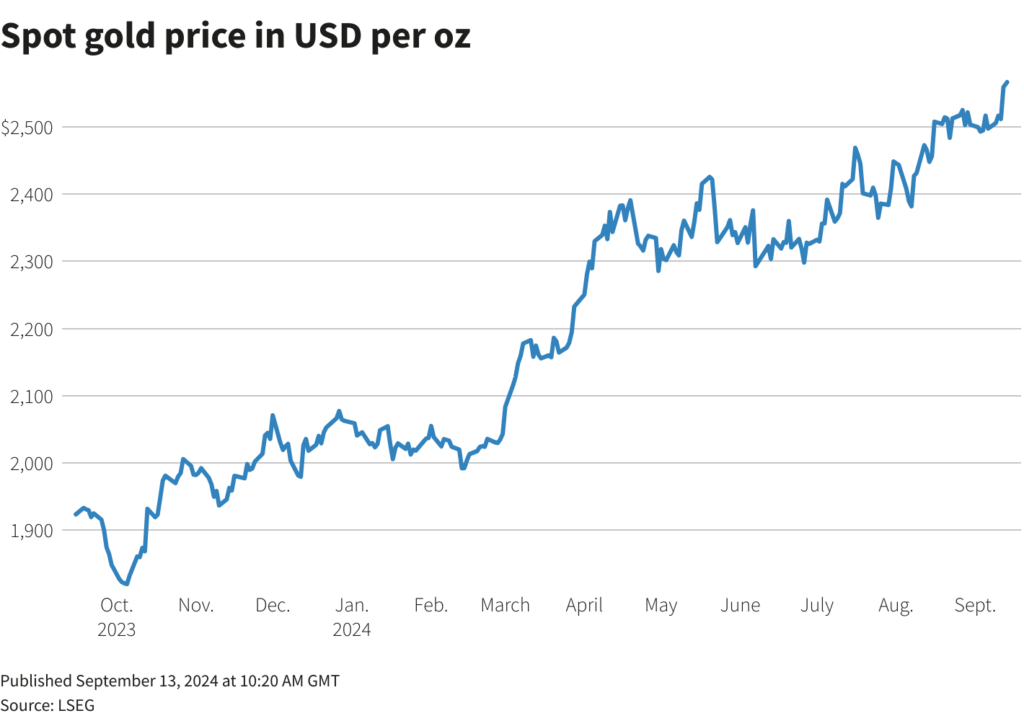

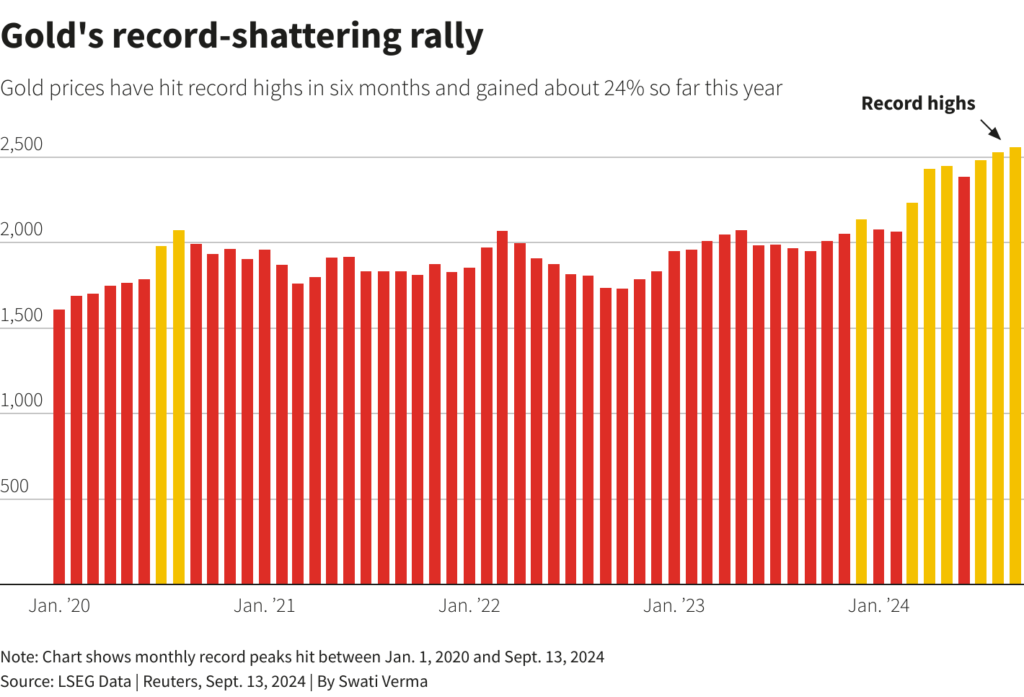

Spot gold reached a historic high of $2,572.81 an ounce on Friday and is on track for its strongest annual performance since 2020, with a rise of over 24% driven by safe-haven demand, due to geopolitical and economic uncertainty, and robust central bank buying.

Gold could reach $3,000 per ounce by mid-2025 and $2,600 by the end of 2024 driven by US interest rate cuts, strong demand from exchange traded funds and over-the-counter physical demand, said Aakash Doshi, head of commodities, North America at Citi Research.

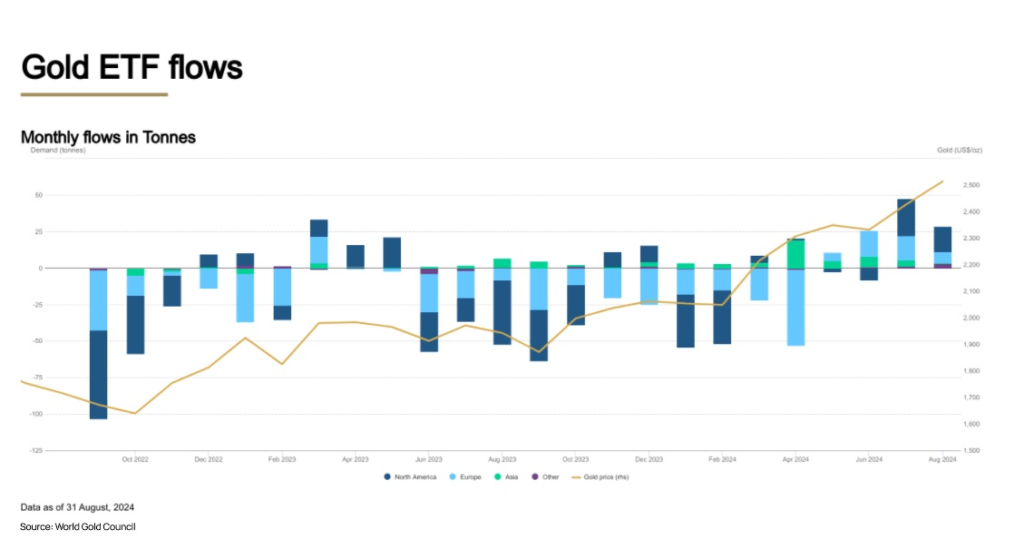

Last week, the World Gold Council said global physically backed gold exchange traded funds saw a fourth consecutive month of inflows in August.

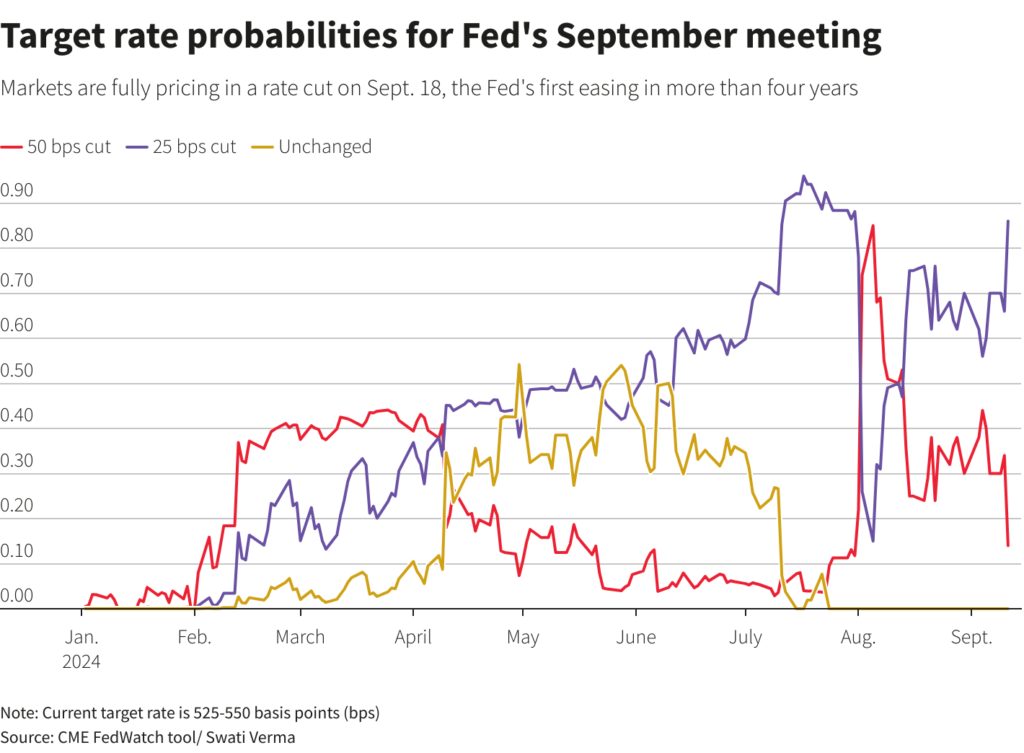

With the next Federal Reserve meeting approaching on September 18, markets are gripped by the likelihood of the first US interest rate cut since 2020. Low rates tend to be supportive for gold, which bears no interest.

Investors are currently pricing in a 55% chance of a 25-basis-point US rate cut and a 45% chance of a 50-bps cut, the CME FedWatch tool showed.

If incoming data points to growth risks and weakness in the labor market, it will raise the chance of a 50 bp rate cut in either November or December, which would increase the tailwind for gold and pull forward the timing for attainment of $3,000, said Peter A. Grant, vice president and senior metals strategist at Zaner Metals.

Interest rate cuts from major central banks are well underway, with the European Central Bank on Thursday delivering its second quarter-point cut of the year.

“We’re also evaluating other factors stirring up demand from the Western investor, including the upcoming US election arguably adding to the uncertainty and gold serving as a hedge against immediate event risks,” said Joseph Cavatoni, market strategist at World Gold Council.

The upcoming Nov. 5 presidential election could boost gold prices as potential market volatility may drive investors towards safe-haven gold.

Attaining the $3,000 per ounce target is possible, said Daniel Pavilonis, senior market strategist at RJO Futures, adding that the scenario could be driven by political unrest following elections.

Investment banks and analysts have turned increasingly bullish on gold, with Wall Street bank Goldman Sachs showing the highest confidence in near-term upside in gold, which remains its preferred hedge against geopolitical and financial risks.

Australia’s Macquarie raised its gold price forecasts this week and is now looking for a quarter average cyclical peak in the first quarter next year of $2,600 per ounce, with potential for a spike towards $3,000.

“While the backdrop of challenged developed market fiscal outlooks remains structurally positive for gold, a lot is arguably already in the price, with the potential for cyclical headwinds to emerge later next year,” analysts at Macquarie said.