Gold Exploration Spend Trending Down Despite Higher Prices – S&P Global

The gold mining sector continues to rely on older discoveries for reserve growth despite a sustained gold price rally in recent years, an annual analysis by S&P Global finds.![]()

According to the database of gold discoveries tracked by S&P, the gold sector added three new major discoveries in 2024, taking the global inventory (reserves, resources and past production) to nearly 3 billion oz. across 353 deposits.

The gold ounces represent an increase of 3% or 82 million oz. over 2023, which had 350 deposits containing a total of 2.9 billion oz.

The S&P analysis points out that — consistent with its previous reports — almost all of the new additions to its list were discovered decades ago and have only recently met its 2-million-oz. criteria for a “major gold discovery”.

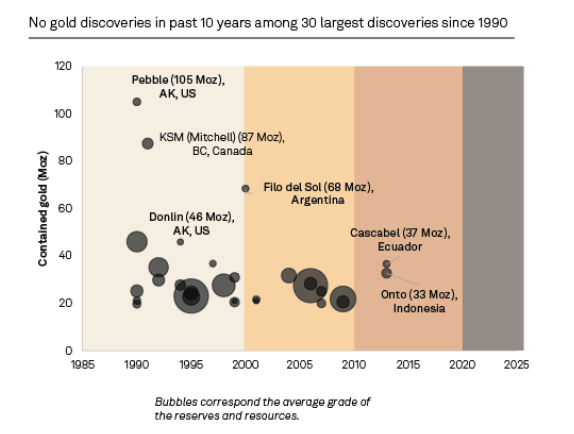

Notably, no major discoveries occurred during the 2023–24 period, and since 2020, only six major discoveries have been made, contributing a total of 27 million oz. in reserves and resources, it said.

Declining budget

The absence of new major discoveries in the past two years can be linked to reduced exploration budgets. According to S&P estimates, global exploration spending fell 15% in 2023 and 7% in 2024, ending an uptrend that began in 2017.

The decline, S&P says, was driven by reduced allocations by junior companies, which faced tighter financing conditions as interest rates rose, and the higher gold prices did little to encourage more spending.

In addition to the lower budgets, the share of grassroots or early-stage exploration within the total budgets continued to decline, reaching just 19% in 2024 — a significant drop from the 50% in the mid-1990s.

While part of this decrease is attributable to the natural progression of assets from early-stage exploration to production, explorers have become more risk-averse over the past couple of decades, S&P says, noting that companies have increasingly focused on known assets that offer lower risks. Its analysis shows that more than half (56%) of the initial resource announcements during 2020-2024 came from existing projects.

The overall quality of recent discoveries is also on the decline. The average size of new deposits over the five-year period was 4.4 million oz., down from the average of 7.7 million oz. in the decade prior. Moreover, none of the discoveries made in the past 10 years have ranked among the largest 30 gold discoveries, S&P adds.

Looking ahead, the firm is expecting increased interest in exploration as gold prices stabilize above the $3,000/oz. level. However, it also warned that even an increase in exploration spending may not contribute to increased discovery rates, given that the industry has been reluctant to allocate funds to untested areas, and instead has focused more on expanding known deposits.