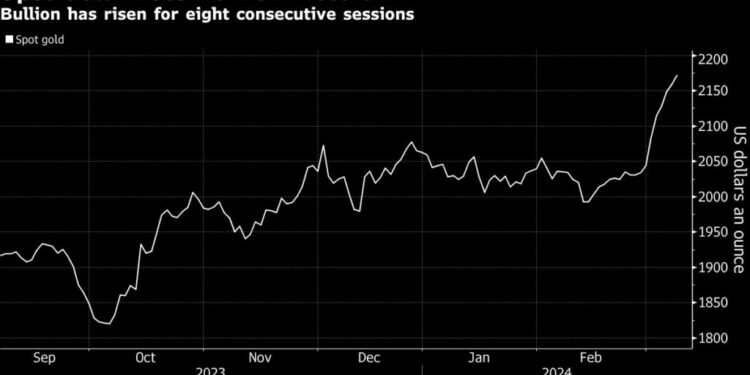

Gold price closes in on $2,200 per ounce

Gold extended its rally to a new record high and is now closing in on the $2,200/ounce level after a key US jobs report bolstered expectations that the Federal Reserve will soon cut interest rates.

Spot gold climbed as much as 1.3% to $2,187.30 per ounce by 12:15 p.m. ET, rising for an eighth straight day. US gold futures gained 1.5%, trading at $2,196.80 per ounce in New York.

Bullion’s momentum grew on Friday after data showed US employment surpassed expectations in February while wage gains moderated, adding to signs of healthy economic growth and softer inflation.

Meanwhile, the central bank’s long-anticipated pivot to looser monetary policy is widely expected to boost gold’s appeal compared with yield-bearing assets like bonds. Persistent geopolitical tensions in the Middle East and Ukraine have also bolstered the precious metal’s role as a safe haven asset.

The frenzied nature of this month’s gains has led some analysts to conclude that major new buyers are stepping into the market, such as investment funds making bold bets on the global macroeconomic outlook.

The broad question is what might fuel the next leg of the rally.

“We expect gold prices to trade higher this year as safe-haven demand continues to be supportive amid geopolitical uncertainty with the ongoing wars and the upcoming US election,” ING Groep commodities strategist Ewa Manthey said in a note to Bloomberg.

“Gold tends to become more attractive in times of instability when investors pile into safe-haven assets as a hedge against the economic climate, geopolitical tensions or inflation,” Manthey added.

“We still believe the same underlying premise remains, which is the combination of the expectation that the Fed is still going to cut rates later this year and dollar weakness,” David Meger, director of metals trading at High Ridge Futures, told Reuters.