Gold price down 1%, but set for second straight weekly gain

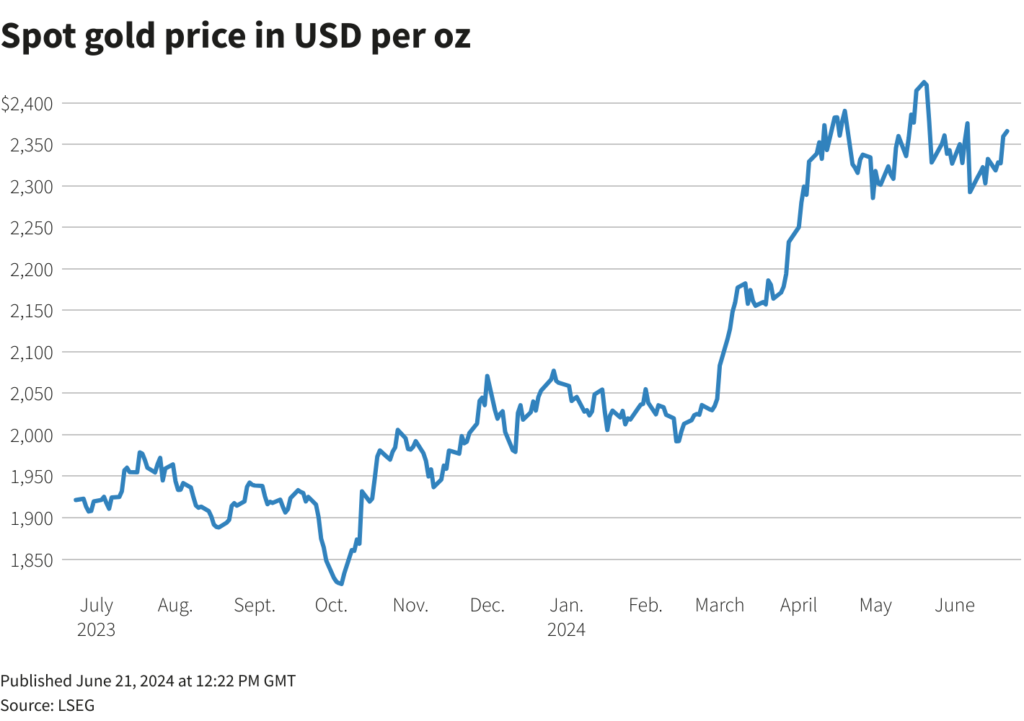

Gold fell by over 1% on Friday but remains on track for a second straight weekly gain amid expectations of a US interest rate cut coming in the second half of the year.

By 11:00 a.m. ET, spot gold traded at $2,331.24 per ounce for a 1.2% drop, while three-month gold futures in New York lost 0.8% at $2,350.40 per ounce.

Still, bullion has gained about 0.6% so far this week, adding to its 1.7% increase from the week before.

“Gold has benefited from a run of soft economic data this week and traders continue to consider bad news as ‘good news’ which will lead to earlier and more rate cuts,” said Tai Wong, a New York-based independent metals trader, in a Reuters report.

Data on Thursday showed first-time applications for US unemployment benefits fell moderately last week, while new housing construction dropped. This, along with tepid retail sales last month, keeps the chance of a September rate cut on the table.

The market is currently pricing in one to two rate cuts of 25 basis points each from the Fed this year, according to Reuters.

Palladium rebound

Meanwhile, palladium — the key metal ingredient in auto-catalysts — rose 7.5% to $995.50 per ounce, near a one-month high.

However, spot prices are still down 10% so far this year, after a 39% slump in 2023.

“The (palladium) market is tight this morning and has been relatively tight all week. Note the excessively high outright short positions on NYMEX; as the quarter (and is some cases fiscal year) end approaches next week there may be some book-squaring-related covering going on,” StoneX analyst Rhona O’Connell said.

Elsewhere, platinum was up 1.3% to $996.59 per ounce, while silver fell 2.9% to $29.85 an ounce. But like gold, both precious metals are heading for a weekly gain.