Gold price extends over 6-month peak as dovish Fed expectations prevail

Gold prices rose for a fourth consecutive session on Tuesday to hit a more than six-month high, driven by a retreating dollar and expectations that the US Federal Reserve has finished hiking interest rates.

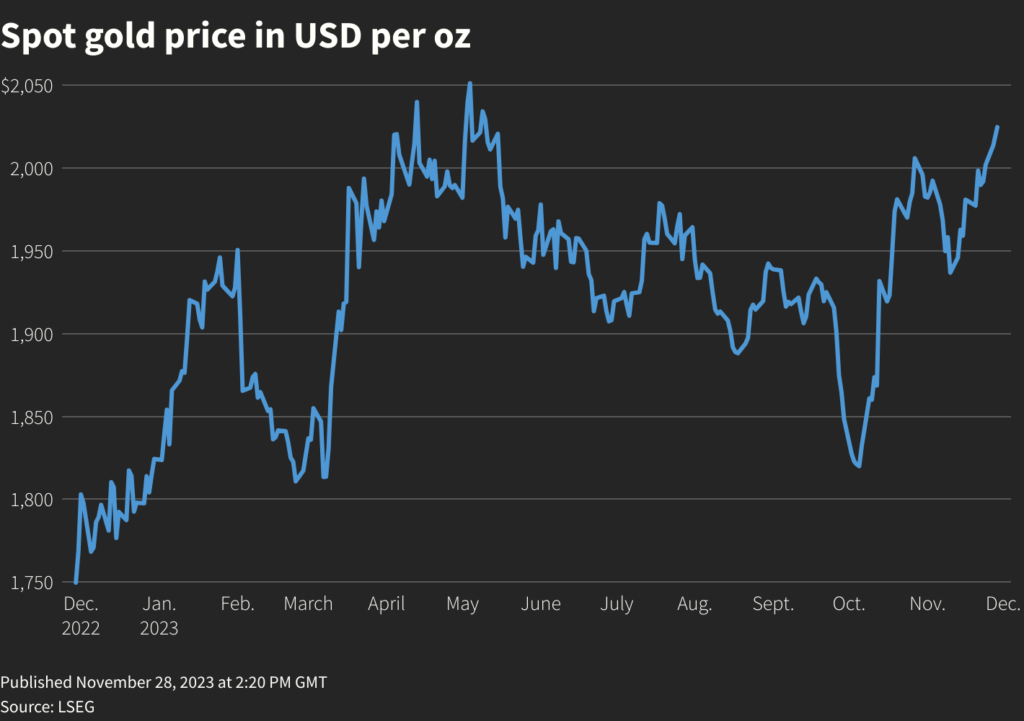

Spot gold gained 1.2% to $2,039.79 per ounce by noon EDT, its highest since May 11. US gold futures for December delivery rose 1.3% to $2,039.90 per ounce.

[Click here for an interactive chart of gold prices]

Gold continues to be bullish in the near term, with the dollar index in a downtrend on hopes the Fed will no longer raise interest rates and will maybe even cut rates by springtime, Jim Wyckoff, senior analyst at Kitco Metals, said in a Reuters note.

However, “if (US) GDP numbers and inflation indicators are stronger than expected, it will dent traders’ enthusiasm in bullion,” Wyckoff added.

Traders widely expect the Federal Reserve to leave rates unchanged in December, and are pricing in about a 50% chance of cuts in May next year, CME’s FedWatch Tool shows.

US Fed Governor Christopher Waller said he is “increasingly confident” that policy is in the right spot.

Making bullion less expensive for overseas buyers, the dollar index touched its lowest since mid August on Tuesday.

Investors will monitor Thursday’s US personal consumption expenditures data, the Fed’s preferred inflation indicator. The focus is also on the revised US third-quarter GDP figures scheduled for Wednesday.

“A sense of caution ahead of another busy week for global financial markets is also lending support to the precious metal. Given how the $2,000 level proved an extremely tough resistance to conquer, gold could end up dipping without a potent fundamental catalyst,” FXTM senior research analyst Lukman Otunuga said.