Gold Prices Climb as Cedi Weakens, BoG Fixes 1oz Gold Coin at GHS 36,272

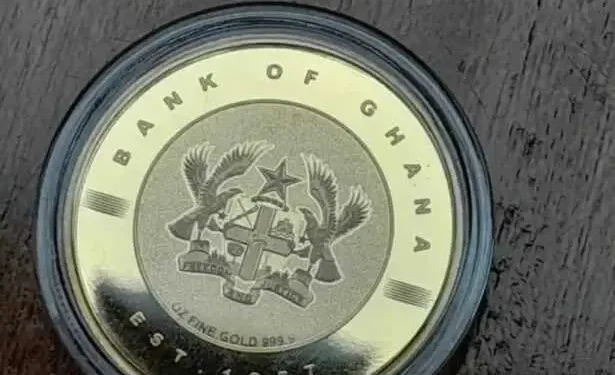

The Bank of Ghana has revised the pricing of the Ghana Gold Coin, with the 1-ounce denomination fixed at GHS 36,272.01 as of Monday, June 23, 2025 — a reflection of both rising international gold prices and a marginal depreciation of the local currency.

According to the Central Bank’s official publication, the half-ounce and quarter-ounce gold coins are now priced at GHS 18,471.60 and GHS 9,592.47 respectively.

The pricing is benchmarked against the London Bullion Market Association (LBMA) PM gold price, which closed the previous trading day at $3,368.25 per ounce and a Bloomberg-referenced USD/GHS exchange rate of 10.3000.

The surge in the cedi equivalent of the gold coin follows two key dynamics: a strong global bullion market driven by safe-haven demand amid geopolitical and inflationary concerns, and persistent currency pressures that have seen the cedi trade above GHS 10 to the US dollar.

Analysts say the elevated local price of the Ghana Gold Coin underscores the broader inflationary environment and the strategic role of gold in preserving value. The Ghana Gold Coin, launched in 2021 as a store-of-value instrument, is increasingly seen as a hedge against cedi depreciation and currency volatility.

With the gold market poised for continued momentum, pricing adjustments are likely to persist in the coming weeks, especially if the dollar strength endures and global economic uncertainty remains elevated.