Government Records Second Consecutive Undersubscription in T-Bill Auction

Investor demand for Government’s short-term debt instruments weakened for the second consecutive week, as the latest Treasury auction recorded a significant undersubscription.

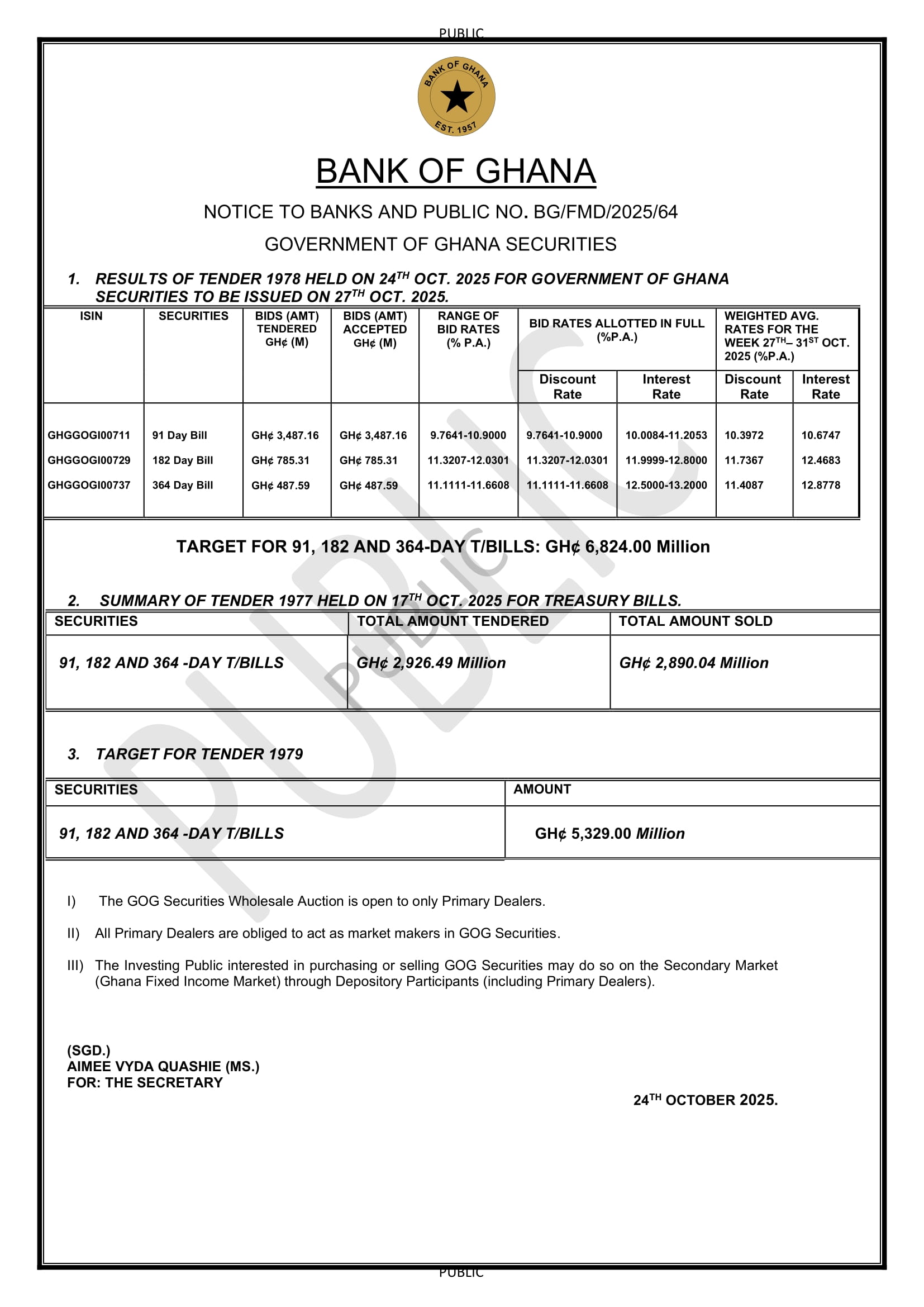

According to auction results released by the Bank of Ghana, Government successfully raised GH¢4.75 billion against a target of GH¢6.82 billion, resulting in a shortfall of approximately GH¢2.06 billion, representing an undersubscription rate of 30.2 percent.

Yields on the short-term instruments showed mixed movements as the 91-day bill declined marginally to 10.67 percent from 10.69 percent at the previous auction, while the 182-day and 364-day bills cleared at 12.46 percent and 12.87 percent respectively, compared to 12.43 percent and 12.92 percent earlier.

Market analysts suggest the weak investor participation is not primarily due to unattractive yields, given that the average T-bill rate of 12.01 percent remains well above the current inflation rate of 9.4 percent.

Instead, investors appear to be shifting their funds toward Bank of Ghana securities, which currently offer higher returns of up to 21 percent.

Meanwhile, in the upcoming auction, the Government aims to raise GH¢5.32 billion across the 91-, 182-, and 364-day maturities. Market participants will be closely observing whether investor appetite strengthens or the undersubscription trend continues.