Government reform driving biggest returns in emerging bond markets

Bond investors are signaling that good government counts for more than monetary policy in emerging markets.

Since the start of April, investors have started to more aggressively sell bonds from high-yielding countries where governments have loosened fiscal policies. They’re also willing to buy debt with low or even negative yields, as long as the countries are pushing for fiscal vigilance.

This is showing up in the performance trend for the second quarter. Top performers — including Argentina, Turkey and Egypt — are all undertaking fiscal reforms. At the opposite end of the scale are countries with growing deficits, like Mexico and Brazil.

“Fiscal dynamics are moving to the center of investors’ radars,” said Adriaan du Toit, director of emerging-market credit research at AllianceBernstein. “It’s partly due to surprising election outcomes and the fact that politics and fiscal dynamics are intertwined. It could also be a sense that monetary easing might not be as deep or helpful if higher-for-longer plays out.”

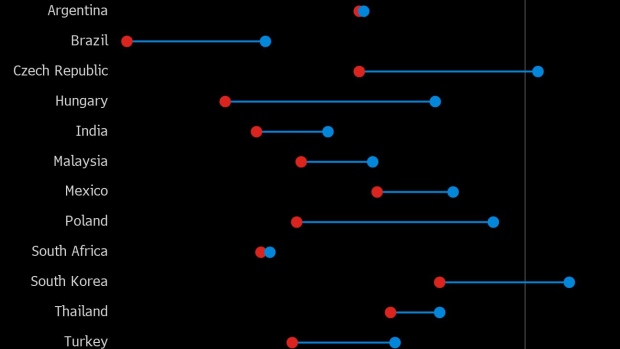

For two years through March, emerging-market bond investors were chasing high yields, and the countries with the most hawkish central banks delivered the best returns.

Mexico handed local-bond investors 37% over this period, Brazil returned 22% while Poland and Colombia yielded 18%. The worst performers, including Turkey, Argentina and South Africa, were penalized because their monetary policies were deemed as too dovish.

Since then, a resurfacing of currency volatility has prompted money managers to change tack. Risk premiums were deemed important once again as carry strategies unwound, with the extra yield on dollar-denominated government debt over Treasuries posting the biggest quarterly jump since 2022.

Now, governments which are making hard fiscal policy choices are getting rewarded the most.

Argentina, for instance, is the top local-currency bond performer for the quarter through June after President Javier Milei overcame setbacks to win approval for tax measures that would help the country reach fiscal targets and tame runaway inflation.

Similarly, Egypt’s bonds are reaping the benefit of President Abdel-Fattah El-Sisi’s preparations for an economic overhaul. Investors are also rewarding Turkey for a return to fiscal orthodoxy.

“This focus on fiscal reforms in emerging markets is certainly present,” said Yvette Babb, a portfolio manager at William Blair Investment Management. “Market participants are in our view likely to continue to focus on the credibility of macro-economic policies.”

Brazil has pared bond losses this week after Finance Minister Fernando Haddad announced spending cuts to shore up the country’s finances. The country’s debt was the worst performer in emerging markets last quarter.

Indonesian bonds have also initially sold off following reports that the incoming administration will raise debt levels, though it has since backtracked on this. Elsewhere, Nigerian bonds fell after President Bola Tinubu’s government didn’t extend exchange rate reforms to the fiscal front.

“Investors will expect to see both fiscal restraint and monetary tightening,” said Joseph Cuthbertson, an emerging-markets sovereign analyst at Pinebridge Investments.

Still, recent weeks’ riots in Kenya show just how difficult the implementation of fiscal reforms could be, with protests against the proposed tax increases by the administration of President William Ruto leaving at least 41 people dead. The government has since announced additional borrowing to compensate for abandoning its tax plan.

“The problem with fiscal reforms is they are adding pain to populations who have already suffered,” said Charles Robertson, the head of macro-strategy at FIM Partners. “Kenya’s protests do signal there are limits on how fast these fiscal reforms can go. That is the key uncertainty investors have to wrestle with.”

While the eventual start of monetary easing by the US Federal Reserve would help to push global borrowing costs costs lower, emerging markets need to find a way to stabilize debt without derailing economic growth, AllianceBernstein’s Du Toit said.

“It’s important for governments to not over-promise and under-deliver as the negative market reaction can be quite strong,” said Nathalie Marshik, an emerging-market sovereign risk analyst at HSBC.