Gov’t to Scrap VAT Flat Rate Scheme in Push for Unified VAT Rate Structure

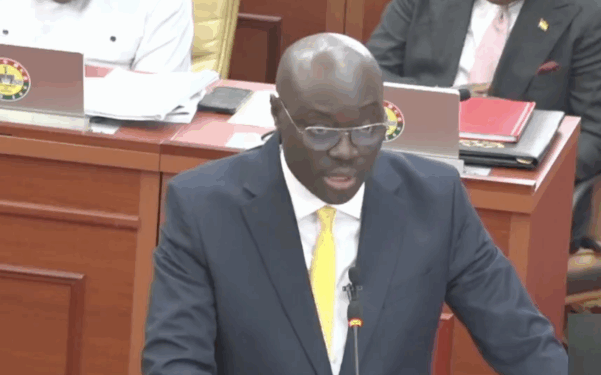

Finance Minister, Dr Cassiel Ato Forson, has announced plans to abolish the country’s VAT Flat Rate Scheme, replacing it with a unified rate structure as part of a broader overhaul of the tax system aimed at easing compliance and improving efficiency.

Delivering the 2025 Mid-Year Budget Review to Parliament on Thursday, Dr Forson said the flat rate regime long criticised by tax experts and businesses, will be scrapped in favour of a more transparent and equitable system.

“We are taking steps to remove the VAT flat rate and introduce a unified VAT rate structure,” the Minister told lawmakers. “This reform will help lower the effective VAT rate and ease compliance for businesses.”

The VAT reform forms part of the Mahama administration’s wider tax policy agenda to simplify Ghana’s revenue framework, reduce distortions, and provide relief to the private sector.

Health Levies to Be Discontinued

In a further signal of policy recalibration, Dr Forson also announced the impending removal of the COVID-19 Health Levy and the National Health Insurance Levy (NHIL), both of which were introduced during the pandemic period.

“These two levies have served their purpose and will be removed,” he said, adding that the measure aligns with the government’s objective to stimulate demand, support business activity, and drive medium-term growth.

The reforms are expected to enhance transparency within the tax system and improve voluntary compliance while supporting revenue mobilisation in a more business-friendly environment. Analysts say the shift towards a unified VAT rate could help address long-standing structural inefficiencies and restore competitiveness in pricing—particularly for small and medium-sized enterprises.

Dr Forson framed the changes as part of a comprehensive strategy to restore macroeconomic stability and lay the groundwork for sustainable growth, as the government continues to implement reforms under its IMF-supported programme.