Growing inflation concerns to prompt more rate hikes in Ghana – Fitch Solutions

Growing concerns of Ghana’s upward trending Inflation rate is expected to prompt more policy rate hikes by the Central Bank, research agency Fitch Solutions has said.

According to Fitch Solutions, Ghana’s inflation will remain elevated – driven mainly by rapid depreciation of the cedi – and will only peak in the last quarter of the year – Q4 2022.

The elevated trajectory of the country’s inflation rate, it says, will incentivise the Central Bank to remain hawkish over the coming months.

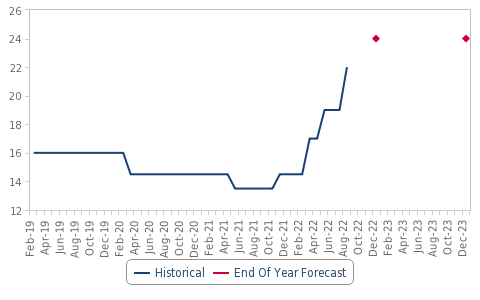

Fitch Solutions notes that it expects the BoG to continue hiking its policy rate to 24% by the end of the year.

The 24% end-year policy rate indicate a further 200 basis points increment in the monetary policy tool.

The monetary policy committee (MPC) increased the benchmark interest rate by 300 basis points (bps) to 22.00% at its emergency meeting on August 17, citing the need to address “risks to the inflation outlook”.

The BoG had announced the emergency meeting to review “recent developments in the economy”, following a rapid rise in consumer price growth – which reached 31.7% y-o-y in June – and the sharp depreciation of the cedi, which has lost roughly 35.0% of its value against the US dollar year-to-date.

“At Fitch Solutions, we expect that the Bank of Ghana (BoG) will continue its hiking cycle, raising the monetary policy rate to 24.00% by the end of 2022.

“The MPC’s decision to increase the policy rate in August signals growing concerns about inflation, informing our projection of an additional increase of 200bps over the remainder of 2022 (950bps cumulatively),” it said.

“Exchange rate weakness will continue to be the key driver of inflationary pressures in the near term. S&P Global and Fitch Ratings downgraded Ghana in August, further weakening investor sentiment and putting additional downward pressure on the cedi. With Ghana being dependent on imported fuel, machinery, vehicles and cereals, sharp losses of the cedi will continue to drive up import costs that will be largely passed on to consumers.

“In addition, the Ghanaian Public Utilities Regulatory Commission announced a 27.2% and 21.6% hike in electricity and water tariffs respectively, which will take effect on September 1 and add to already elevated inflationary. As such, we believe that inflation will continue to accelerate in the next two-three months and have revised up our 2022 average inflation forecast to 27.3%, from 25.0% previously,” it added.