Asia’s Economic Growth Is Weathering Tariffs and Uncertainty

Asia’s economic growth next year is poised to hold up more than previously estimated despite weaker external demand, elevated tariffs, and persistent policy uncertainty.

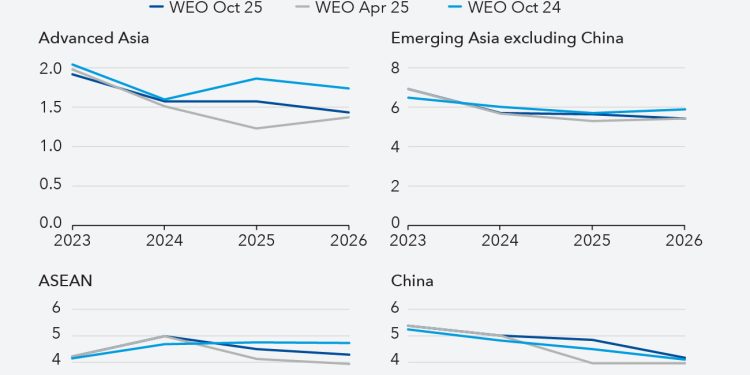

Growth in the Asia and Pacific region is likely to slow to 4.1 percent next year from 4.5 percent this year, our latest projections show. Inflation is likely to remain moderate.

China’s economic growth is forecast to slow from 4.8 percent this year to 4.2 percent next year, while Japan’s decelerates from 1.1 percent to 0.6 percent. India will still expand at a healthy pace of 6.6 percent this year, the most among major emerging economies, while slowing to 6.2 percent next year. Korea’s growth will accelerate from 0.9 percent this year to 1.8 percent. The Association of Southeast Asian Nations (ASEAN) economies will expand by 4.3 percent for a second straight year.

While Asia is at the center of the global trade-policy reset, it will remain the biggest driver of global growth, contributing about 60 percent this year and next. The shock from trade tensions has been cushioned by a front-loading of exports ahead of new levies, stronger-than-expected investment in artificial intelligence, ongoing supply-chain reconfiguration within the region, and policy easing in some countries.

But several risks to the outlook underlie this resilience. They include renewed escalation of tariffs and more rules-of-origin restrictions to avoid transshipments, further supply-chain disruptions, and tighter global financial conditions.

Trade remains a key part of the resilience narrative. The United States in April raised effective tariff rates to multi-decade highs, and they remain high even after various pauses, agreements, and reinstatements. Exporters accelerated shipments ahead of implementation, contributing to a first-quarter surge that cooled in the following three months.

There’s also more to the story than shifting trade and tariff policies. Drawing on lessons from the 2018 tariffs, production and sourcing are shifting within the region, with a larger share of intermediate goods flowing to—and through—Southeast Asia and other hubs. Parallel to this regional trade boost is a powerful AI-driven cycle that has bolstered exports of advanced technology from economies including Korea and Japan, deepening intra-Asian trade.

These dynamics are reinforced by monetary easing across many economies and targeted fiscal support in some, notably China, Korea, Indonesia, and Vietnam. This helped support economic growth and cushion the external-demand shock. Financial conditions also eased across much of Asia, reflecting the depreciation of the dollar, compressed credit spreads, higher stock-market valuations and, in emerging economies, lower government bond yields.

Beyond the near-term resilience, a weakening in historical growth engines is compounding the effects of the uncertain trade environment. Aging is diminishing the demographic dividend in some major economies. Productivity growth is slowing because investment isn’t always reaching the most dynamic firms. In addition, with post-pandemic scarring still weighing on domestic demand, especially in emerging Asia, external imbalances have widened. Moreover, recent unrest underscores how a lack of jobs and other opportunities are fueling social strains, particularly where institutions are weaker and perceptions of corruption are widespread.

Rebalancing growth

The task for policymakers is to convert today’s resilience into strong, durable and inclusive growth that harnesses new drivers to better realize economic potential.

In coming months, policies should focus on absorbing recent shocks and lowering policy uncertainty. With inflation below target in many economies, measured monetary easing remains appropriate. Exchange-rate flexibility should help absorb shocks, with intervention reserved for disorderly conditions, in line with the IMF’s Integrated Policy Framework. Temporary, targeted fiscal measures can protect the most vulnerable people and support viable businesses. In addition, horizontal reform policies, including a concerted streamlining of regulations and improving the business environment, will be essential to unleashing the role of the private sector.

In coming years, policies should prioritize securing durable growth and expanding the share of private consumption in the economy. Successful rebalancing can be achieved by strengthening social safety nets so that people don’t feel obligated to save precautionarily. It will also be important to scale back industrial policies. And in China, where property markets remain strained, repairing balance sheets and completing pre-sold homes can help restore confidence in housing markets and ultimately boost private consumption.

Across the region, rebalancing also requires governments to repair their finances to protect against shocks and meet important needs without raising private sector borrowing costs.

Capital must flow to its most productive uses. Regulatory obstacles and high borrowing have weighed on investment and productivity in parts of the region, our analysis shows. Reforms to broaden market-based finance, deepen stock and bond markets, and help borrowers restructure debt will better allocate capital and help viable enterprises grow.

Although Asia’s economies are relatively open, that’s not uniformly the case. South Asia’s services industries, for example, are relatively closed. Our analysis shows that deeper regional integration would increase competition and productivity, cut costs, and diversify markets. Lowering non-tariff barriers, expanding trade agreements to reflect the growing role of services and digital trade, and easing restrictions on foreign direct investment would attract investment and complement the ongoing reconfiguration of supply chains.

In conclusion, resilience endures, but mounting headwinds are straining a growth engine already challenged by the trade-policy reset. Countries should rebalance toward domestic demand, fortify medium-term fiscal frameworks, and deepen regional trade and financial integration to keep growth durable and inclusive.