Three-Tier Pension Scheme AUM Reaches GHS 61.8 Billion as Participation Rates Hit 95%

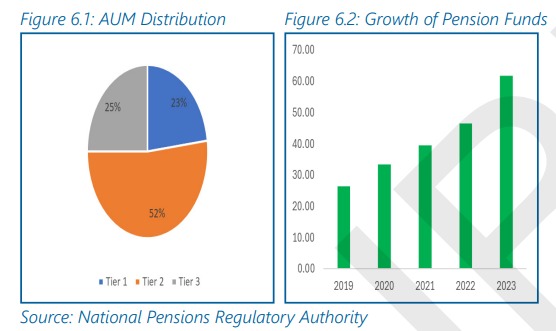

Ghana’s pension sector experienced significant expansion in 2023, as assets under management (AUM) for the Three-Tier Pension Scheme surged by 33% to GH¢61.8 billion by year-end, up from GH¢46.6 billion in 2022, according to the Bank of Ghana’s latest Financial Stability Report.

The growth, up from a 20% increase in 2022, reflects the strong participation in an alternative offer for pension funds—boasting a 95% uptake—and the government’s concerted effort to meet its payment obligations under the scheme.

Further, partial government redemption of contributions and intensified enforcement against defaulting employers helped boost inflows.

The Basic National Social Security Scheme (BNSSS) also demonstrated robust growth, with AUM rising 26.3% to GH¢15.3 billion, compared to a modest 4.9% rise in the previous year, largely due to the government settling arrears on contributions.

However, private pension funds outpaced other segments, expanding by 32% to reach GH¢46.5 billion, largely driven by improved investment returns and stringent measures against employers failing in Tier 2 contributions.

Government securities remained the preferred asset class, constituting 80% of private pension fund investments.

Despite this growth, the report underscores key vulnerabilities in the sector, highlighting ongoing challenges from public and private sector indebtedness to the scheme, rising benefit payments, and persistently low real investment returns—exposures that may weigh on the scheme’s sustainability amid an uncertain economic environment.