Europe’s consumers are sitting on 1 trillion Euros in pandemic savings

In ordinary times, Europeans save around 12 percent of their income. But as families stayed at home and furlough schemes supported income during the pandemic, this savings rate increased sharply to almost 19 percent in 2020 and 2021.

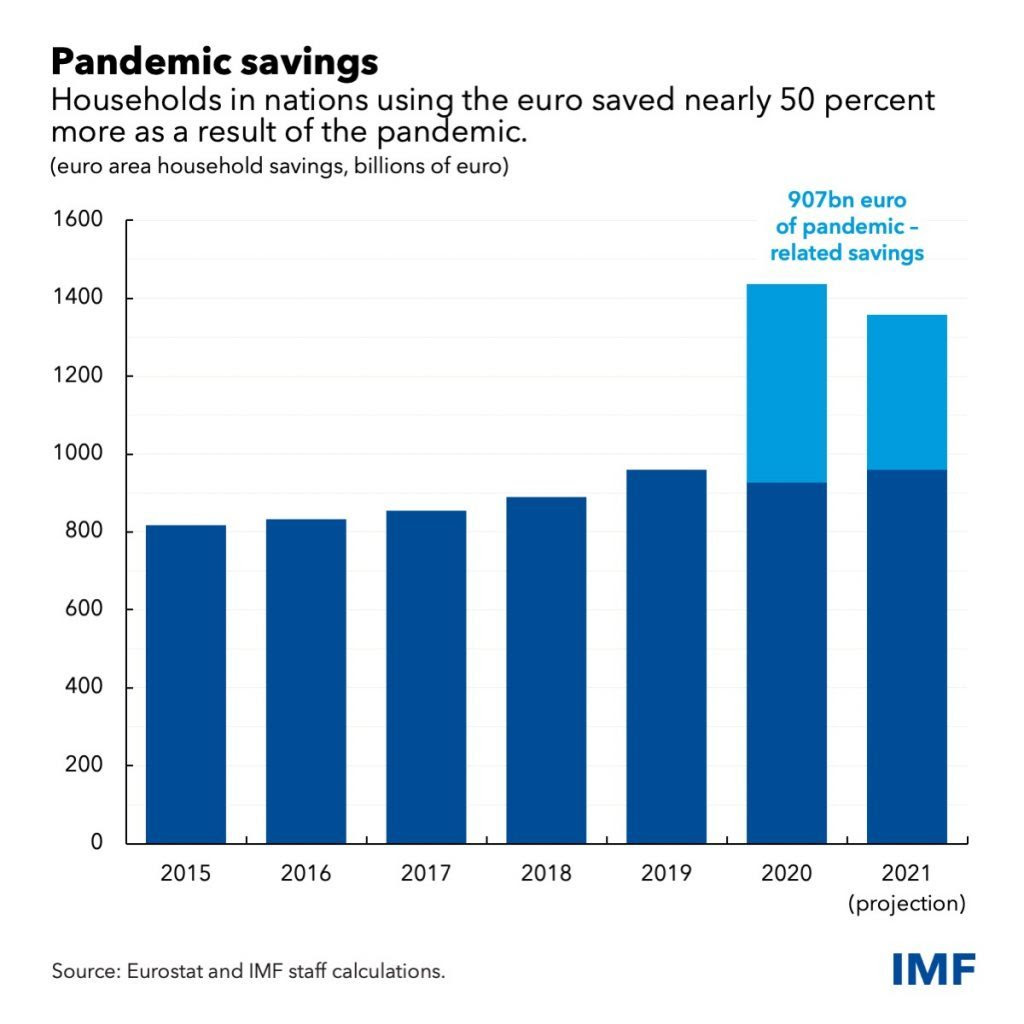

As shown in this Chart of the Week, we estimate that households in the euro area saved nearly 1 trillion euros more in those two years than they would have done if the pandemic never happened. In other words, people saved a record sum—equivalent to around 8 percent of total euro-area gross domestic product.

Euro-area economic growth and potentially inflation would get a big boost if consumers were to spend part of their excess savings by temporarily reducing the rate at which they save to below that seen prior to the pandemic.

This would be consistent with the pattern after some previous pandemics and severe economic shocks, when households saved a much smaller proportion of their income than they had done historically.

Even a moderate increase in spending—if households were to use about one-third of their excess savings for higher consumption over two years, say—would add 2.5 percentage points to GDP and up to 0.75 percentage point to inflation by the end of the second year.

Some unwinding but no spending spree

Half of the euro area’s excess savings are in bank accounts, meaning they could, in principle, be easily accessed and spent once pandemic restrictions are lifted.

And most of the savings were forced, not precautionary as is more common during recessions when people worry about future income, suggesting that they may be spent soon.

Yet there are four reasons these savings may not be released into the real economy in a hurry.

First, the sort of expenditure that households were forced to forgo during the pandemic is not easily replaced. Almost 80 percent of the total spending drop in 2020 stemmed from declines in hospitality and transport. Consumers are unlikely to ever make up for all the cancelled airline flights, hotel stays or restaurant meals.

Second, excess savings mostly accrued to those with high incomes. In France, for example, the richest 10 percent of households increased savings substantially even as some poorer families reduced savings, bank data show. High-earners typically save a larger share of their income and so are less likely to spend their savings.

Third, supply chain problems mean many may struggle to spend their savings—even if they wish to. Long delivery times and higher prices are making it harder for consumers to substitute what they would ordinarily have spent on services with increased spending on goods (though this pent-up demand could boost consumption of goods in the future).

And fourth, the spread of the Omicron variant means Europeans may be forced to save for a little longer.

Uncertainty surrounding the outlook for consumption remains exceptionally high. Policymakers should keep a close watch on savings rates as they assess the strength of the recovery—and, if necessary, adjust monetary and fiscal policy to ensure sustained and equitable growth and to preserve price stability.