High energy prices boost Spanish renewables, new project risk rises

High electricity prices support merchant renewable projects’ performance in Spain, Fitch Ratings says, although we do not expect prices to remain at these elevated levels in the longer term.

Project construction costs have also increased due to high inflation and supply-chain disruptions, making it difficult for developers to transfer completion risk to contractors under fixed-price turn-key contracts, thereby increasing projects’ risks.

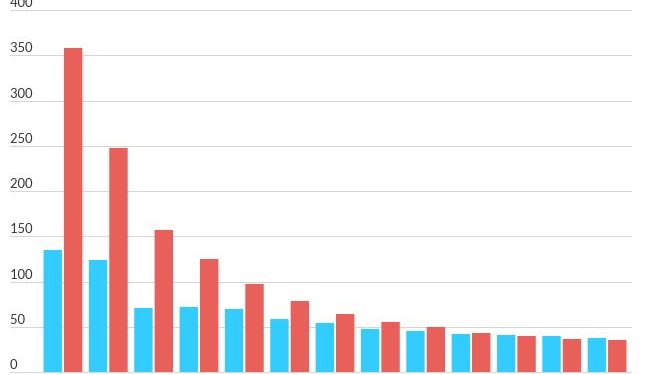

Significant falls in unsubsidised levelised costs of energy (LCOE) of renewable projects in recent years have enabled such projects to compete with conventional power generation and made merchant projects (independent producers that sell energy to wholesale markets) a viable option for developers.

High electricity prices benefit merchant projects in the short term. However, sponsors will seek the optimal mix of merchant exposure and fixed-price revenue streams from power purchase agreements or the government’s contract-for-difference (CfD) tariffs to reduce volatility and long-term risks for new capacity to be developed.

The average price of around EUR30/MWh granted for 12 years in the 2021 government CfD auction, well below the prevailing market price at the time, demonstrates sponsors’ willingness to sacrifice short-term upside for longer-term price visibility.

Lenders’ appetite for merchant projects has been increasing as debt structures have been able to incorporate features that reduce price risk. Banks dominate the provision of financing for merchant projects, but many pension funds and insurers are now changing their approach to these projects. Debt issued to finance merchant projects could reach investment-grade ratings under our criteria, if credit metrics are adequate and documentation contains bondholder protection features limiting price risk, such as cash sweeps, springing reserves, cash traps, and increased lock-up covenants that allow faster de-leveraging if electricity prices drop.

Our base-case assumption is for inflation to moderate in 2023, but sustained high inflation may materially increase project construction costs. Projects under construction are experiencing delays and cost overruns driven by supply-chain disruptions and higher equipment costs.

Developers face difficulty transferring completion risk to engineering, procurement and construction contractors through turn-key agreements at reasonable prices and may have to purchase equipment directly from manufacturers, accepting a risk of cost overruns. This increases projects’ exposure to developers’ credit quality.

High energy prices also raise risks of government and regulatory intervention. For example, in May 2022 the Spanish government set a temporary gas price cap to contain rising electricity prices. More recently, it announced a temporary windfall tax on profits of large utilities, to be applied in 2023 and 2024. This could increase investors’ concerns over the long-term visibility of expected returns. However, this mostly limits sponsors’ upside potential as regulatory intervention is unlikely under the lower-price scenarios we assume in our ratings to test projects’ resilience.

We view high price levels as temporary, resulting from imbalances in the energy markets due to the pandemic and gas shortages caused by the war in Ukraine. While long-term fundamentals for electricity prices in Spain are largely unchanged from pre-pandemic years, short-term price volatility has increased.

Long-term price levels will depend on the pace of deployment of renewable energy capacity and its integration into the grid, the phase-out of nuclear plants and fossil technologies, as well as changes in demand, including electric vehicles penetration levels and energy-efficiency improvements.

Battery storage will play an important role in further renewables development. Spain has an ambitious target to invest about EUR13 billion to expand storage capacity to 20GW by 2030 and 30GW by 2040 from 8.3GW, mainly in the form of pumped hydro. However, such storage development is constrained by the absence of a regulatory framework.