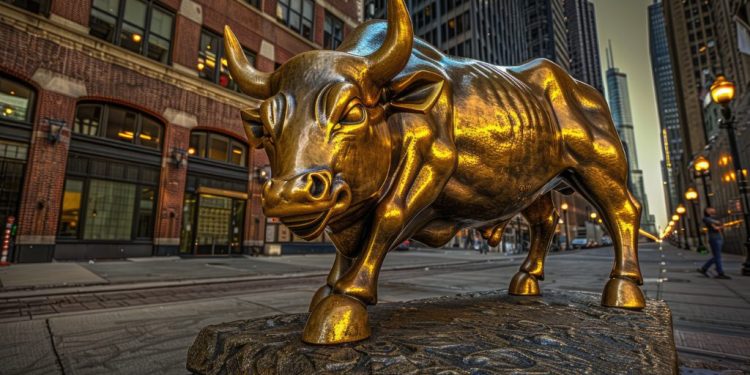

HSBC Expects Gold’s ‘Bull Wave’ to hit $5,000 in 2026

HSBC on Friday forecast that gold’s bull rally would drive prices as high as $5,000 an ounce in 2026, supported by elevated risks and the impact of new entrants into the market.

Spot gold breached the $4,300 level on Thursday and was headed for its strongest week since December 2008.

The advance has been fueled by geopolitical tensions, robust central bank buying, rising exchange-traded-fund inflows, expectations of US rate cuts and tariff-related economic uncertainties.

“The bull market is likely to continue to press prices higher for 1H’26 and we could very well reach a high of $5,000/oz some time in 1H 2026,” HSBC said in a research note.

HSBC also raised its 2025 average gold price forecast to $3,455 per ounce from $3,355 previously. It increased its 2026 average gold price forecast to $4,600, up from its previous estimate of $3,950.

The bank cited geopolitical risks, economic policy uncertainty and rising public debt as factors supporting the price.

HSBC said that, given the sharp rise in prices during the second half of 2025 and heightened risks from new market entrants, it expects gold prices to remain elevated and potentially spike further through early 2026.

But the bank also expects significant volatility and some price moderation in the second half of 2026.

“Unlike previous rallies we believe many of these new buyers are likely stay in the gold space – even after the rally ends – not so much for appreciation necessarily as for gold’s diversification and ‘safe haven’ qualities,” the bank said.

HSBC joins analysts at the Bank of America and Societe Generale, who earlier in the week forecast that gold could reach $5,000 an ounce in 2026.