Ghana’s Rapid GDP Growth Fueled by Fiscal Imbalances Led to 2022 Debt Crisis – World Bank

Ghana’s strong economic growth over the past decade was sustained by increasing fiscal and external imbalances, ultimately leading to a full-fledged debt crisis in 2022, according to the World Bank’s latest Ghana Public Finance Review Report.

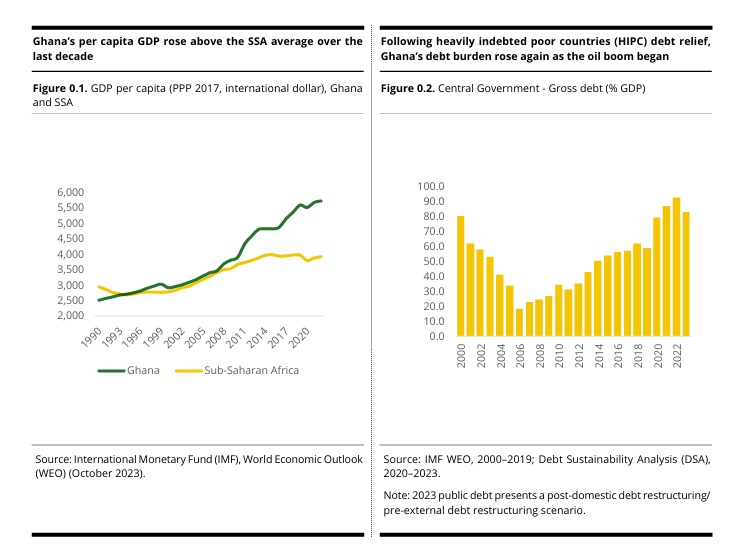

The report, themed “Building the Foundations for a Resilient and Equitable Fiscal Policy,” highlights that between 2009 and 2019, Ghana’s economy expanded at an average rate of 6.8% per year, outpacing regional and global averages of 4.4% and 2.7%, respectively. By 2019, Ghana’s GDP per capita in 2017 PPP dollars had reached $5,540, marking a 65% increase from 2007 and a level 33% higher than the regional average.

Despite this economic expansion, the report notes that fiscal deficits and unsustainable debt accumulation posed significant risks. Ghana’s total fiscal deficit averaged 4% of GDP between 2008 and 2019—more than twice the average recorded between 2000 and 2007. Public expenditure also surged, averaging 19% of GDP, six percentage points higher than in the earlier period.

While Ghana had benefited from substantial debt relief under the Heavily Indebted Poor Countries (HIPC) initiative between 2002 and 2004, public debt resumed its upward trajectory in the following years. By 2019, Ghana’s debt-to-GDP ratio had reached 60%, equally split between domestic and external liabilities. The country’s annual interest payments also rose sharply, climbing from 1.4% of GDP in 2007 to 5.5% in 2019, reflecting the growing cost of debt servicing.

Weak Fiscal Discipline and Governance Issues

The World Bank attributes Ghana’s debt crisis to a lack of fiscal discipline, weak budgetary institutions, and insufficient revenue collection. The report highlights ineffective spending controls, frequent budget overruns—particularly on the public wage bill—and inadequate procurement practices as key factors exacerbating the fiscal challenges.

These weaknesses led to a cycle of increasing deficits, which were financed through costly external borrowing, particularly through Eurobond issuances. As debt service obligations increased, fiscal space shrank, necessitating further borrowing and deepening Ghana’s debt vulnerabilities.

Policy Recommendations for Fiscal Stability

To address Ghana’s fiscal challenges, the World Bank emphasizes the need for robust fiscal rules and stronger institutions to curb pro-cyclical spending and enhance debt sustainability. The report points out that Ghana’s fiscal rule framework has remained suspended since the onset of the COVID-19 pandemic, leaving the country without a structured approach to managing fiscal risks.

“Policy makers should consider a combination of an expenditure rule and a debt rule with well-defined escape clauses,” the report suggests, adding that such measures could foster debt sustainability and reduce the volatility of government spending.

Given the risks associated with external borrowing, the World Bank also recommends introducing a capping mechanism within Ghana’s fiscal rule framework. Additionally, the report calls for a review of the fiscal council’s structure to enhance its independence and clarify its mandate, ensuring stronger oversight and accountability in public financial management.

With Ghana still recovering from its 2022 debt crisis, the World Bank’s recommendations underscore the urgency of implementing structural reforms to restore fiscal discipline and safeguard long-term economic stability.