IMF Bailout: Ghana to pay $18.9m interest on 2.84bn SDR debt

Ghana is expected to be granted a $2bn concessional loan from the International Monetary Fund as it seeks a Balance of Payment (BoP) support programme from the Fund.

The $2bn concessional loan to Ghana was disclosed during an interview by the Minister for Information, Kojo Oppong Nkrumah.

Currently, Ghana is indebted to the Fund by some SDR 1.34bn ($1.01bn).

With the expected $2bn (SDR 1.5bn) inflow from the IMF, Ghana’s debt exposure to the IMF is expected to shoot up to SDR 2.84bn ($2.13bn).

Interest rates on the Fund’s SDR loan is pegged at 0.89%, hence Ghana will be expected to pay some $18.9m in interest on its total debt to the Fund.

“Ghana’s exposure to the IMF is SDR1,347.69 million as at March 31, 2022. A new facility from the IMF will add on to our existing debt but this is cheaper than commercial loans,” stated the Finance Ministry in a Q&A document on the country’s request for a bailout from the IMF.

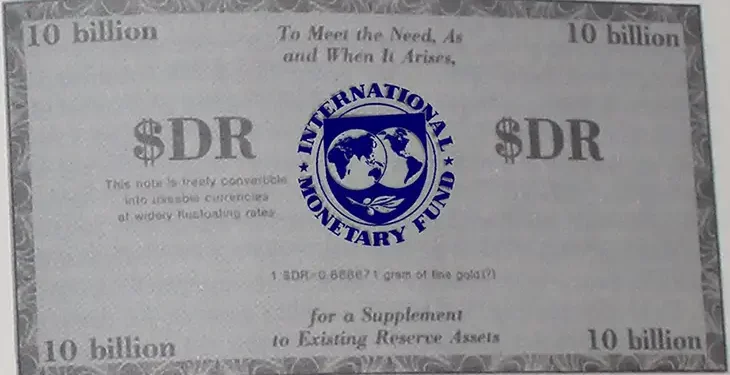

Special Drawing Rights (SDRs) can be described as an international reserve asset created by the IMF to supplement the official reserves of its member countries.

SDR allocations play a role in providing liquidity and supplementing member countries’ official reserves, as was the case with the 2009 allocations due to the global financial crises and is also the case amid the Covid-19 pandemic when the Fund made a historic allocation of 456 billion SDR ($650 billion).

The value of the SDR is based on a basket of five currencies—the Chinese renminbi, the Euro, the Japanese yen, the Pound sterling, and the U.S. dollar.

SDR allocation is a form of concessional loan provided by the IMF to member countries below market interest rate at 0.89 percent and long-dated loan repayment periods.

Meanwhile, the former Minister for Finance, Seth Terkper, has shared his thoughts on what he believes are the likely conditionalities to be imposed on Ghana by the IMF as the country prepares to undergo a Fund programme in the coming months.

Speaking to the media on Monday, July 4, 2022, on Ghana’s request to the IMF for a Balance of Payment (BoP) support programme, Mr Terkper noted that although the specific conditionalities to be imposed on the country will be known in the aftermath of the country’s negotiations with the Fund, there are some pertinent areas that are likely to come up in the negotiation talks between both parties.

These areas which the IMF is likely to consider and request the government to make some adjustments he noted, have already been pointed out in the Fund’s last Article IV assessment report on the Ghanaian economy.

Making reference to the Article IV report, the erstwhile Minister for Finance, noted the IMF is likely to impose some conditionalities in the area of the energy sector, the Central Bank’s financing of the budget deficit given that there could be a second round of the Bank of Ghana financing government’s deficit as was the case in 2020 during the peak of the pandemic.

The financing of the Free SHS – government’s biggest flagship programme – and its sustainability is also likely to be tabled as part of the broader discussions to take place between government and the IMF.

Q&A ON IMF by Fuaad Dodoo on Scribd