- IMF Commends Ghana’s FX Stabilisation, Says Currency Gains Reflect Progress

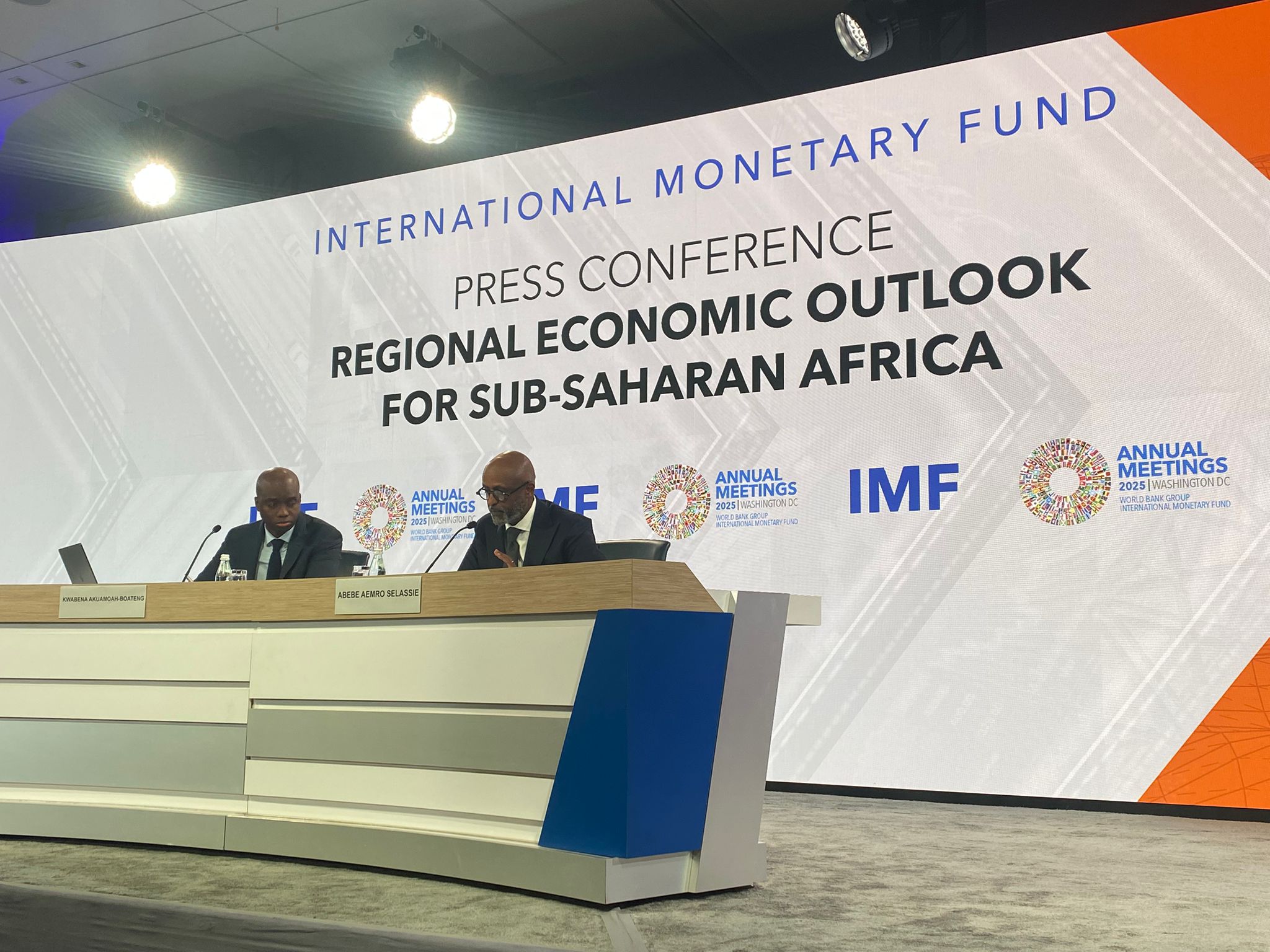

At the launch of the October 2025 Regional Economic Outlook for Sub-Saharan Africa in Washington, D.C., the International Monetary Fund’s (IMF) Director for Africa, Abebe Aemro Selassie, commended Ghana’s recent foreign exchange (FX) market performance, describing the cedi’s stabilisation as a reflection of improving fundamentals, renewed policy credibility, and investor confidence.

Responding to a question from NorvanReports’ Norvan Acquah-Hayford, Mr Selassie acknowledged the difficult path Ghana has taken to restore macroeconomic stability following years of severe fiscal strain and uncontrolled depreciation. “A year ago, perhaps a couple of years ago, all of the concern in Ghana was about uncontrolled depreciation and a lot of challenges,” he said. “It’s been generally positive to see stabilisation returning to the economy, growth beginning to recover, inflation decelerating, and confidence allowing the cedi to stabilise and maybe even begin to appreciate.”

The IMF’s tone marks a notable shift from two years ago, when Ghana’s currency turmoil epitomised broader debt distress across frontier African markets. The cedi lost nearly half its value in 2022 amid fiscal slippages, depleted reserves, and investor flight following the government’s decision to suspend external debt service.

Under the Fund-supported US$3 billion Extended Credit Facility (ECF) programme, however, Ghana has achieved measurable stabilisation: headline inflation has fallen from a peak of 54 percent to single-digit inflation in four years, reserves have improved largely, and fiscal consolidation has started to anchor expectations. The cedi has appreciated since the beginning of 2025 against the dollar, supported by restrained import demand, Bank of Ghana interventions, and a recovery in cocoa and gold inflows.

According to Mr. Selassie, these developments signal “a direction of travel that is the right one and the appreciation reflective of some fundamentals.” Yet, he cautioned that policymakers must “strike a balance”, warning that excessive currency strength could undermine external competitiveness and slow export recovery.

The Fund’s endorsement underscores a familiar policy dilemma: how far should Ghana’s authorities go in defending currency stability without eroding export competitiveness or depleting reserves?

For now, the Bank of Ghana has opted for a managed float regime, intervening selectively to smooth volatility while maintaining market confidence. This approach has restored a sense of order to a previously chaotic market.

“Too much interference can itself cause problems,” Selassie observed, noting that in relatively shallow FX and money markets such as Ghana’s, “volatility can be very disruptive to the real economy.” His remarks implicitly endorse a gradual transition toward a more flexible exchange-rate framework, guided by data and supported by continued fiscal restraint.

As Ghana eyes a return to the international capital markets post-2026, the IMF’s measured optimism sends a clear message: sustaining credibility will require more than short-term exchange-rate management. Analysts expect the Fund to push for three key priorities, maintaining fiscal discipline, enhancing reserve buffers, and deepening domestic financial markets, as conditions for market re-entry.

With external financing still constrained, Ghana’s ability to anchor expectations through credible policy frameworks could determine whether it can secure new Eurobond issuance without punitive yields.

“Restoring access to international markets will depend on tangible progress,” says one Accra-based fund manager. “Investors will be looking for sustained primary surpluses, a credible medium-term debt strategy, and structural reforms that ensure the cedi’s current stability is not artificial.”

For the IMF, Ghana’s recovery narrative is emblematic of a broader trend in sub-Saharan Africa, where several countries are emerging from debt distress under Fund-supported programmes. The October 2025 Regional Economic Outlook projects regional growth at 4.1 percent with ghana in 2025 having a projected growth of 4.0 percent, driven by easing inflation and gradual fiscal consolidation, but warns that resilience remains fragile amid global uncertainty and capital outflows.

In Ghana’s case, the Fund’s commendation reflects both progress made and challenges ahead. While exchange-rate stability and disinflation have improved public confidence, the government’s room for policy error remains narrow. The energy sector’s arrears, slow revenue mobilisation, and infrastructure spending pressures all pose risks to the cedi’s newfound strength.

Still, Selassie’s assessment carries symbolic weight. It signals that Ghana, once the cautionary tale of fiscal profligacy, is now being recognised as a potential comeback story, if it maintains discipline beyond the IMF’s watch.

For investors, the IMF’s positive tone reinforces Ghana’s improving risk profile, potentially lowering spreads on future sovereign issuance. Yet, markets will scrutinise the durability of reforms once programme oversight ends.

The cedi’s performance over the next 12 months will serve as a critical barometer: sustained stability could unlock cheaper borrowing costs and restore investor confidence, while renewed volatility would reignite fears of policy slippage.

As Ghana prepares for its post-programme era, the task is clear: preserve gains, deepen confidence, and avoid complacency. The IMF’s message is both congratulatory and cautionary, acknowledging progress but reminding Accra that macroeconomic stability is a journey, not a destination.