IMF talks on debt deadlock stuck between China, private lenders

Global creditors are increasingly at odds over how to level the playing field among lenders when governments default, jamming up efforts led by the International Monetary Fund to expedite sovereign debt restructurings.

Talks set for Thursday at the IMF’s annual meeting in Marrakech, Morocco, between various groups involved in restructurings — including China and private creditors — are unlikely to produce any breakthroughs, according to people who will be attending the session.

Among the issues are questions about whether private creditors should take the same level of losses as bilateral lenders when countries default, and how the various types of loans provided by China should be treated, the people said.

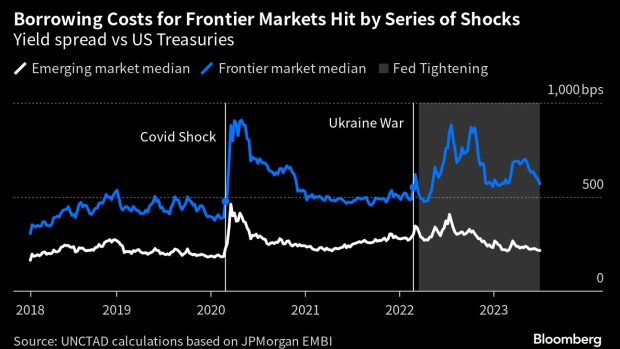

The meeting of the global sovereign debt roundtable, as the group is called, coincides with a concerted push by international organizations to find ways to simplify and hasten debt restructurings. Rapidly rising US bond yields have added to the urgency, choking off demand for developing countries’ debt and pushing some of them closer to default.

“You have to be realistic about what this group can accomplish” said Sonja Gibbs, managing director at the Institute of International Finance, which represents the financial industry. “The fundamental issue is that debt restructuring is hugely complex. There are no silver bullets and no one should expect any.”

Gibbs said the meeting is intended as a progress update and that a more realistic timeline for concrete agreements is at next year’s IMF spring meetings in Washington. The group is likely to release a report that summarizes recent developments, according to people familiar with the plan.

The roundtable — co-chaired by the World Bank and the Group of 20 — was launched early this year to give momentum to slow-moving debt discussions, including those under a new “common framework” for handling debt relief for low-income countries. It brings together bilateral lenders from wealthy nations, new creditors such as China and India, Wall Street banks, private bondholders and borrowing countries.

Since it was launched, progress has been made to bring some countries, such as Zambia, Sri Lanka and Suriname, out of default — though none of those countries have finalized restructuring deals, which are negotiated separate from the roundtable. Debt from more than a dozen developing nations is trading more than 1,000 basis points over Treasuries, a level that suggests investors are bracing for default.

“This is not a systemic crisis, but it is a development crisis,” said Richard Kozul-Wright, director of globalization and development strategies at the UN’s trade agency. “The debt crisis is becoming a development crisis given the servicing pressures on many countries who need to be mobilizing resources for the basics, much less for climate adaptation.”

Slow Progress

China’s recalcitrance to restructure debt has been cited as a main sticking point. Of particular concern is the fragmented landscape of its lending institutions and the relative recency of its experience dealing with sovereign defaults, given its lack of participation in the Paris Club, an informal group of mostly developed countries.

Despite more than a year of efforts at the debt roundtable to incorporate China, there are still signs of a disconnect. Earlier this week, the Export-Import Bank of China suddenly announced a deal with Sri Lanka on its restructuring. This took both the IMF and the creditors committee — which includes India and members of the Paris Club — by surprise. While the group said they’re nearing their own deal during the Marrakech meetings, two people familiar with the situation said it’s increasingly unlikely an announcement comes this week.

The slow progress hints at a larger sense of friction between the parties. That includes Wall Street, which now has a bigger stake in the issue. Commercial and private creditors held 27% of public debt from poorer countries in 2021, up from 11% in 2011, according to the IIF. That larger chunk of creditors is now being asked to take more of the burden in debt restructurings.

The private sector “doesn’t come to the table in a generous mood,” said Mark Plant, a former IMF official and senior policy fellow at the Center for Global Development. “The private sector, particularly through funds, has diffuse ownership, and those funds have a fiduciary responsibility to their investors.”

Private investors, as well as Chinese creditors, have been frustrated by the level of haircuts they’ve been expected to take, as well as the assumptions underlying the debt analysis undertaken by the IMF. The IMF has started to become more transparent on how it calculates inputs such as growth forecasts and revenues, according to people familiar with the situation, who asked not to be identified as the talks are private.

Private vs Public

Private and sovereign creditors also differ on what they prefer in terms of relief, according to an adviser close to the talks. The private sector would rather take haircuts — or losses — on their loans than wait out payments during a suspension. The public sector is more comfortable with the opposite approach, according to the adviser.

Another private sector investor close to the talks, who asked not to be identified, said the IMF and the Paris Club seemed so intent on keeping China involved in the discussions that they were largely excluding private sector investors from substantive talks and dismissing concerns raised by them. That, the investor said, was also leading to concerns that private creditors’ interests were being treated as secondary to those of China, whose own conduct has been opaque.

Still, the private sector is being pushed to lend more to lower-rated countries as part of broader efforts by the US and other G7 countries to counter Chinese lending in the developing world. They’re also urging the private sector to jump in to close the gap between what western governments offer and what poor countries need to tackle poverty and deal with the impact of climate change.

Ajay Banga, the new World Bank president, established a high-level “laboratory” for private-sector investment earlier this year to identify innovative ways for poor countries to raise the capital they need in international markets. But efforts like those are coming alongside the discussions about handling debt relief for poor countries that investors are feeling increasingly grumpy about.

IIF’s Gibbs said pushing more of the burden onto private bond buyers will cause them to pull back from lending.

“If you make fundamental changes to the rules of the game, you risk decimating appetite for this type of investing in developing and emerging economies,” she said.