Indian steel maker plans Nigeria exit after $30m investment

Indian steel maker, Aarti, is exiting the Nigerian manufacturing sector, joining a long list of companies leaving the country on account of economic woes, BusinessDay can authoritatively confirm.

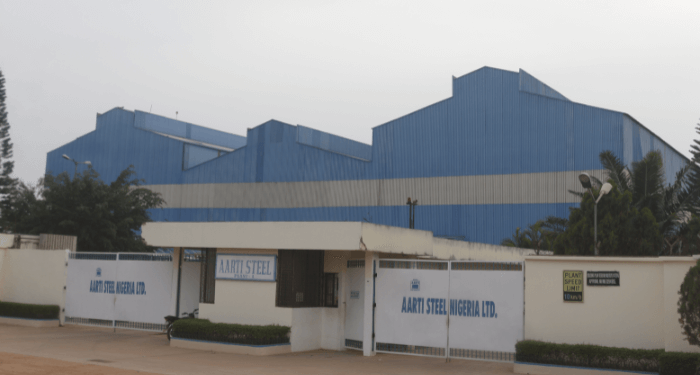

The Ota, Ogun State-based steel maker, has already been put up for sale and big players have submitted unconfirmed bids ranging between $50 million and $100 million.

The steel maker’s exit is attributed to a combination of factors, notably high rate of indebtedness, challenging economy, fluffing currency, surging inflation and high energy cost, a source who spoke on condition of anonymity told BusinessDay.

“We are aware that Aarti Steel Nigeria has been put up for sale but we are yet to make our bid,” a reliable source from one of the bidding companies, who is not authorised to speak on the issue, said.

According to the source, African Industries and Bharti are bidding to buy the Indian-owned steel manufacturer for $50 million to $100 million. The process is expected to be completed in a few months.

The company is asking investors to submit their profiles, another source noted, saying that the management of the company wants to hand over Aarti to a credible investor.

This will make it the sixth company to exit Nigeria in the first half of 2024 after Microsoft Nigeria, Total Energies Nigeria, PZ Cussons Nigeria PLC, Kimberly-Clark Nigeria and Diageo PLC left the shores of Africa’s most populous nation.

The exit of Aarti will further dent the country’s perception as an investment destination and its $1 trillion gross domestic product (GDP) target, experts told BusinessDay.

“The continuous exiting of multinationals from the economy is a serious cause for concern and this is because of the implication that it has,” said Muda Yusuf, chief executive officer of the Centre for the Promotion of Private Enterprise.

“It has a negative implication for employment and the country’s perception as an investment destination,” Yusuf added.

In 2017, Aaarti spent $20 million to $30 million to establish a 120,000-capacity cold-rolled mill in Ota, Ogun State, to serve Nigeria’s downstream players using the steel to produce home appliances, roofing sheets, metal furniture and filing cabinets, tables and chairs, among others.

But the investment does not seem to matter much now.

G C Tripathi, a director at Aarti Steel Nigeria, told BusinessDay that he is not aware that the company has been put up for sale, noting that key operating decisions come from Indian – the business headquarters.

Tripathi however said the business is trying to get more finance and bank commitments to increase production.

But a senior management of the company had confirmed to BusinessDay in March 2024 that the company was seeking investors.

The official said the company’s indebtedness was high and suppliers were worried that timelines for delivery had been missed several times.

“We are seeking a lifeline,” the official told one of our reporters.

On a quarter-on-quarter basis, growth in the basic metal, iron and steel subsector of the manufacturing industry slowed to 0.57 in the first quarter of 2024 from 1.1 percent in the fourth quarter of 2023. On a year-on-year basis, it grew by 0.11 percent from 0.46 to 0.57 percent.

Manufacturers have attributed the continuous exit of multinationals to the country’s worsening business environment and insecurity that are crimping profits and wiping off shareholders’ funds.

Segun Ajayi-Kadir, director general of the Manufacturers Association of Nigeria (MAN), said that rising energy costs, foreign exchange (FX) volatility, accelerating inflation and worsening insecurity are hurting manufacturers in the country and hampering their growth.

He said that the issue for manufacturers is further compounded by the uncleared forwards by the Central Bank of Nigeria (CBN), which have made several operators lose billions of naira.

He noted that the steel industry is highly vulnerable to the negative impact of these challenges, noting that most of the operators in the industry are struggling to survive.

“The escalating costs of power, low consumer spending and low access to competitive credit and high rate of unplanned inventory and depreciation of the naira is hurting the country’s steel industry,” Ajayi-Kadir said.

Earlier, Oluyinka Kufile, former chairman of MAN Steel Group and chief executive officer of Qualitec Industries, had told one of BusinessDay’s reporters that “poor policies and lack of seriousness by the government are killing steel companies in Nigeria.”

He had noted that only few players participate in meetings held by steel producers who were members of MAN.