Inflationary pressures may hike policy rate by up to 2% — market watchers

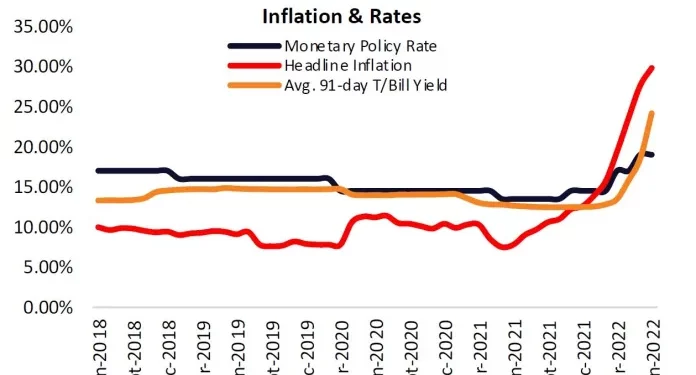

As the Monetary Policy Committee (MPC) meets this week to determine a new policy rate, market analysts are predicting it may see another upward adjustment by about 200 basis points.

The analysts are backing their forecast with the rising inflation rate which has hit 29.8 percent as of June 2022 from the 27.6 percent recorded the previous month, largely caused by hike in petroleum and transport prices which have reflected in food prices and other items.

Constant Capital, a broker-dealer, in its comments on the current inflation and its impact on the policy rate, said it expects the MPC to adjust the rate by a 100 basis points. Currently, the policy rate stands at 19 percent.

“While we do not rule out an additional 100bps increase in the policy rate during the July 2022 MPC meeting, we think BoG may decide to pause to assess the impact of the recent hikes on the economy, especially given the weaker than expected growth in Q1-2022.

“The softer pace of advance in inflation could also give some room to the BoG to pause its rate hikes and anchor MPR for some time. In this context, we expect the real policy rate to remain negative at least until Q2-2023,” the broker-dealer added.

Another market watcher, Apakan Securities, also predicts that despite the consecutive slower growth in headline inflation, it still remains elevated and expects the MPC to increase the policy rate by 150bps ± 50bps in its next meeting.

It further adds that the current inflation and policy rate direction will further push short-term bills up. “Relatedly, we expect to see an upward repricing of yields on the market, particularly T-bills, in this week’s auction, but a slower pace given the recent robust demand for treasury bills.”

Inflation to further increase

In the coming months, the market anticipates inflations to persist although the momentum of price pressures will continue to moderate across both the food and non-food baskets.

Consumer inflation data showed a 29.8 percent year-on-year (y/y) increase in June 2022 from 27.6 percent in May 2022, reflecting elevated domestic food, petroleum and transport prices, as well as the pass-through effects of a weaker cedi. This marks a 13th consecutive increase and the highest inflation print since January 2004.

However, a perusal of the data from the Ghana Statistical Service (GSS) reveals that the pace of inflation has noticeably slowed from 4 percentage points to 2.2 percentage points. Similarly, headline inflation rose at a slower pace on a month-on-month (m/m) basis by 3 percent in June 2022 from 4.1 percent.

“For the first time in four months, the speed of growth of national year-on-year inflation rate has slowed down. However, it is too soon to suggest that inflation will subside gradually in the coming months,” Market Analyst with Fincap Securities, John Nani, said.

The sharp rise in inflation in Q2-2022 propelled the average quarterly inflation to 27 percent from 16.3 percent in Q1. Due to forex (FX) pressures in recent months, imported inflation rose by 3.1 percentage points to 31.3 percent y/y, while inflation for locally produced items was reported at 29.2 percent up from 27.3 percent.

The staple crop harvesting season could provide some ease for food inflation from late Q3/Q4, but higher fuel costs and a weaker local currency could keep non-food inflation elevated in the near term.

The central bank’s aggressive policy rate hike by 450bps this year is beginning to take effect to some extent, slowing the growth in monthly inflation, and expected to support in subsequent releases.

Moreover, the downtrend of crude oil prices by -9.85 percent on the global market, triggered by global recession fears, could pull the breaks on soaring ex-pump prices. This could slow the transitive effect on other sub-groups and support a slower growth momentum of the headline inflation.

Nonetheless, the market fears that the restoration of the margin in the petroleum price build-up, which government initially reduced to cushion the Ghanaian consumer for three months, coupled with further cedi depreciation, highlights a significant risk ahead.

Mr. Nani indicated that the global outlook on inflation is upward looking, and he does not expect Ghana to be any different. However, considering government’s engagement with the IMF, market players are more hopeful than worried about the worst-case scenario and what its impact will be.

“We are hopeful that the negotiation between the Ghana Government and the IMF on government’s recovery programme will shape up a robust and effective plan that will drive fiscal consolidation and macroeconomic stability in the medium to long term,” Mr. Nani said.