Inside Details of Presco’s $172m Acquisition of SOP, Ghana Oil Palm Firm

Nigeria’s largest oil palm manufacturer, Presco Plc, recently announced the 100 percent acquisition of an equity stake in Ghana Oil Development Company (GOPDC) and Saro Oil Palm Limited (SOP) in a combined deal worth $171.6 million.

This expansion move will potentially reduce imports of edible and fat oils into the country by 40 percent, thereby freeing up scarce FX in Africa’s biggest oil palm producer.

GOPDC, once a subsidiary of SIAT Group, a major stakeholder of Presco, was acquired for a total amount of $124.9 million, which would be paid in phases. An initial payment of $64.96 million has been considered, while $59.96 million, being the balance, is expected to be settled through its N250 billion rights issue.

Incorporated in Ghana on 6 December 1995, GOPDC is an integrated agro-industrial company specialised in the cultivation of oil palm, extraction of crude palm oil and palm kernel oil, production of specialty oils and fats and distribution of refined oil products.

Net revenue at GOPDC stood at 668 million Ghanaian Cedis in 2024 and is projected to rise to 752.15 million in 2025. Meanwhile, operating profit was reported at 530.14 million Ghanaian Cedis last year, and it’s expected to shrink to 276 million this year, according to Presco’s filing on the Exchange.

New acquisition, SOP, linked to Presco’s chair

SOP, a subsidiary of SIAT SA, is a relatively new company reportedly controlled by the chairman of Presco Olakanmi Rasheed Sarumi. It was incorporated in 2019.

The company began operations in 2020 with 10,000 hectares (ha) and later expanded by acquiring an additional 12,500 ha, bringing its total concession to 22,500 ha.

As of January 2025, SOP has 5,000 ha of immature plantation, with an additional 3,000 ha expected by year-end. Harvesting of fresh fruit bunches (FFB) is expected to begin in 2026, which suggests planting started around 2022–2023, factoring in the typical 3–4-year gestation period. This has led to the company’s current status of no revenue.

However, with projected revenue of N4.8 billion in 2026, and factoring the current CPO price of N1.6/ton (excluding premiums), this means the plantation is likely targeting around 3,000 tonnes of palm oil in its first harvest year.

SOP would be acquired for a total sum of $46.7 million in the sale of five million ordinary shares at a price of $9.34 per share. This is the offer of Presco to the company which is still under consideration.

“Following the conclusion of Transaction 1, GOPDC has become a subsidiary of Presco; SOP will similarly become a subsidiary of Presco at the conclusion of Transaction 2,” the company said in a document on the NGX.

Benefits of acquisition

The acquisition will no doubt boost the capacity of Presco and strengthen its regional push cum customer base. With a current 43,547 hectares plantation size, acquiring SOP is expected to increase that size by 37 percent to 59,760 hectares, further solidifying its position as a leading oil palm producer in Africa.

The company will now have more access to capital through secondary stock offerings and bond issuances post- the transactions. Considering the increase in market value and investor confidence, the acquisition is poised to grow Presco’s valuation, making it more attractive to investors.

Presco currently generates almost all of its revenue in local currency, while GOPDC generates 41 percent of its revenue from export sales primarily in US dollars and Euros. The currency diversification mitigates the impact of adverse exchange rate movements on the company’s financial performance.

More expansion on the horizon?

Beyond the recent acquisitions that will further cement Presco’s position as the biggest palm oil maker in the country, the company has signalled that it’s leaving no stone unturned in its expansion strategy.

“Our objective is to triple what we had last year. And for that reason, we have a lot of acquisition targets that we are chasing,” said Felix O. Nwabuko, the Group CEO of SIAT Group, the parent company of Presco, while addressing journalists after the 2024 Annual General Meeting held recently in Lagos.

“Today, we have presented two. Watch this space, we’ll present more.”

With this positioning, Presco is in for a long term haul that would potentially lead to increased profitability, oil palm sovereignty for the country and bountiful returns for shareholders.

Kayode Eseyin, lead, consumer goods and agriculture sector research at CardinalStone said the company’s expansion move and investments are “a long-term play” that doesn’t necessarily translate to instant profit growth.

“I don’t see it boosting profits immediately but it supports long term growth and value accretion,” Eseyin said.

Record earnings seen in FY 2025

Presco is on track to have its best year yet as the company has already surpassed its full year net income in 2024 in the first six months of this year.

Half-year profit at the oil palm company soared to N88.7 billion, far ahead of N77.7 billion recorded in the whole of 2024 while revenue climbed to N198.7 billion in the period ended June, 2025.

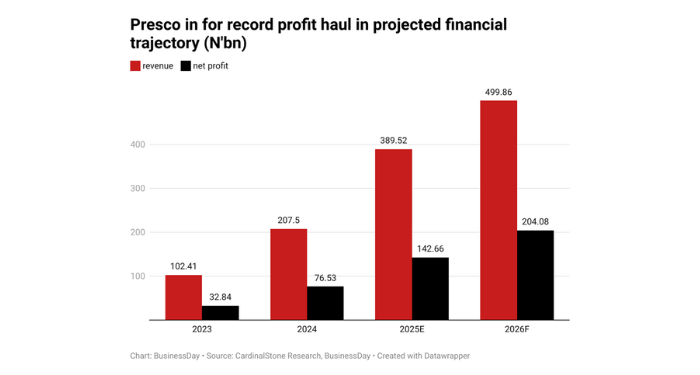

CardinalStone, a Lagos-based advisory and research firm, projects that profit after tax will rise to N142.67 billion by the end of this year while revenue surges to N389.52 billion.

If this forecast materialises, that would be the best performance of the company in its over three decades of existence.

Palm oil now ‘investors’ darling’

The oil palm industry has become a veritable investment target for institutional investors both in Africa and Asia, following the recent boom in the industry driven by elevated crude palm oil prices and slower imports from Indonesia, the world’s largest oil palm producer.

According to Alphonsus Inyang, the National President of Palm Produce Association of Nigeria (NPPAN), the industry is now the “darling of investors” who have patient capital for generational wealth.

Inyang noted that palm oil price which is projected to hit $1,200 per metric ton by year end from about $900, according to a report by Afrinvest West Africa, will continue to rally, stressing that Nigeria is the next frontier.

“The oil palm boom is not ending now. It will continue for as long as food, chemical industry and renewable energy are thriving,” NPPAN president told this reporter in a telephone call.

“There’s less palm oil from Indonesia and so we’re proposing a 2.5 million hectares oil palm cultivation project that would run for five years to the government to plug this gap.”

Presco on a bull run

Presco Plc is currently the 19th most valuable stock on the NGX with a market capitalisation of N1.48 trillion, which makes about 1.67 percent of the Nigerian Stock Exchange equity market.

The stock sold for N475 at the beginning of the year but has gained more than twice that price now on growing investors’ confidence in the company’s fundamentals.

Shares of Presco went as high as N1550 at the beginning of August before slipping to its current share price at N1480 as of Thursday, August 21, 2025.

Ranked as the 12th on the NGX in terms of year-to-date performance, Presco is the 96th most traded stock on the bourse over the past three months.

It has traded a total volume of 25 million shares—in 21,357 deals—valued at N30 billion over the period, with an average of 396,306 traded shares per session. A volume high of 2.34 million was achieved on July 21st, and a low of 30,605 on August 13th, for the same period.