- International Monetary Fund Endorses Rwanda’s Economic Program While Flagging Debt Risks

- Rwanda Secures $185m IMF Funding Despite Mounting Debt Concerns

Rwanda’s robust economic performance has won fresh IMF backing, despite mounting concerns over the East African nation’s rising debt levels which are projected to hit 80 per cent of GDP next year.

The International Monetary Fund has reached a staff-level agreement to provide Rwanda with $185m in new funding, split between its sustainability facility and stand-by credit arrangements. The deal, subject to board approval in December, comes as Rwanda maintains its position as one of Sub-Saharan Africa’s fastest-growing economies, with projected growth of 8.3 per cent this year.

“Rwanda’s growth momentum remained strong, notwithstanding the challenging external environment,” said Ruben Atoyan, who led the IMF mission to Rwanda. However, he warned that “fiscal and external vulnerabilities remain high.”

The country’s currency has depreciated 6.6 per cent against the dollar this year, a move the IMF described as “necessary” to facilitate external adjustment. Foreign reserves stand at 4.5 months of import cover, providing what officials called a reasonable buffer against external shocks.

Yet beneath the impressive headline growth figures, structural challenges persist. The current account deficit has widened, driven by a combination of high capital goods imports and disappointing coffee exports. Public debt continues its upward trajectory, raising eyebrows among international observers.

“Increased access to concessional financing is welcomed… but does not substitute for domestic revenue mobilization,” Mr Atoyan cautioned, highlighting a key concern about Rwanda’s fiscal sustainability.

The country has won praise for its climate initiatives, completing its sustainability commitments six months ahead of schedule. However, the IMF stressed that Kigali needs to accelerate the development of green projects and lending operations to fully capitalize on available climate financing.

Rwanda’s vulnerabilities were thrown into sharp relief last year by poor harvests and floods that affected its predominantly rain-fed agricultural sector. A recent Marburg virus outbreak, while successfully contained, further highlighted the country’s exposure to external shocks.

Despite these challenges, Rwanda has met all its quantitative targets under existing IMF programmes through June 2024. The country’s inflation has stabilized within the central bank’s target range, credited to tight monetary policy and favorable food price developments.

Looking ahead, the IMF emphasized that risks remain tilted to the downside. Global geopolitical fragmentation, potential spikes in energy and food prices, or slowdown in trading partners’ growth could all weigh heavily on Rwanda’s economic prospects.

The new funding package, while significant, comes with clear policy prescriptions: accelerate domestic revenue collection, rationalize government spending, and maintain a data-driven monetary policy approach while allowing for exchange rate flexibility.

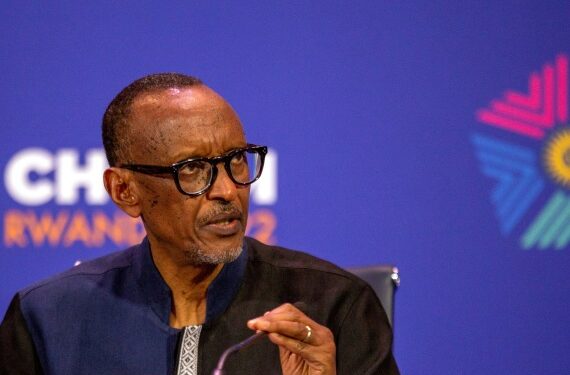

For President Paul Kagame’s government, the challenge will be balancing these fiscal imperatives with Rwanda’s ambitious development agenda in an increasingly uncertain global environment.