Investor Demand Strengthens for Short-Term Government Debt as Treasury Bill Auction Oversubscribed by GHS 6.33bn

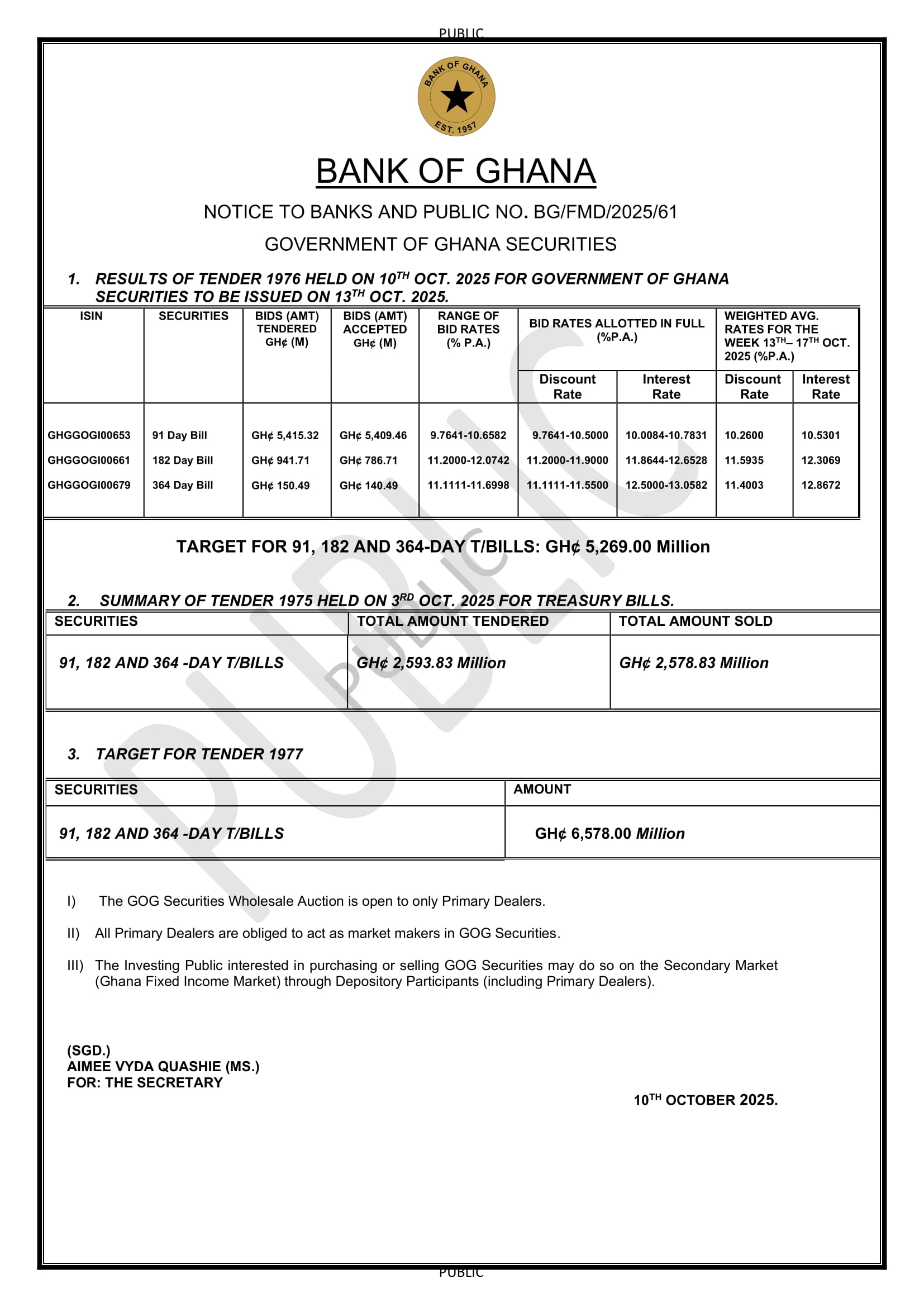

The Government raised GHS 6.33 billion in its latest Treasury bill sale, surpassing its GHS 5.26 billion target by GHS 1.06 billion, signalling renewed investor appetite for short-term government securities amid improving market liquidity.

Data from the Bank of Ghana showed that total bids amounted to GHS 6.50 billion, with nearly all accepted, marking a return to oversubscription after weeks of mixed auction outcomes.

The 91-day bill cleared at 10.53 per cent, up from 10.47 per cent at the previous auction. The 182-day and 364-day tenors were auctioned at 12.30 per cent and 12.86 per cent, respectively.

The short end of the market continues to attract strong participation from banks and money market funds seeking low-risk instruments.

The government is scheduled to return to the market on October 17, aiming to raise GHS 6.57 billion to refinance maturing obligations and manage funding pressures as part of its short-term debt strategy.