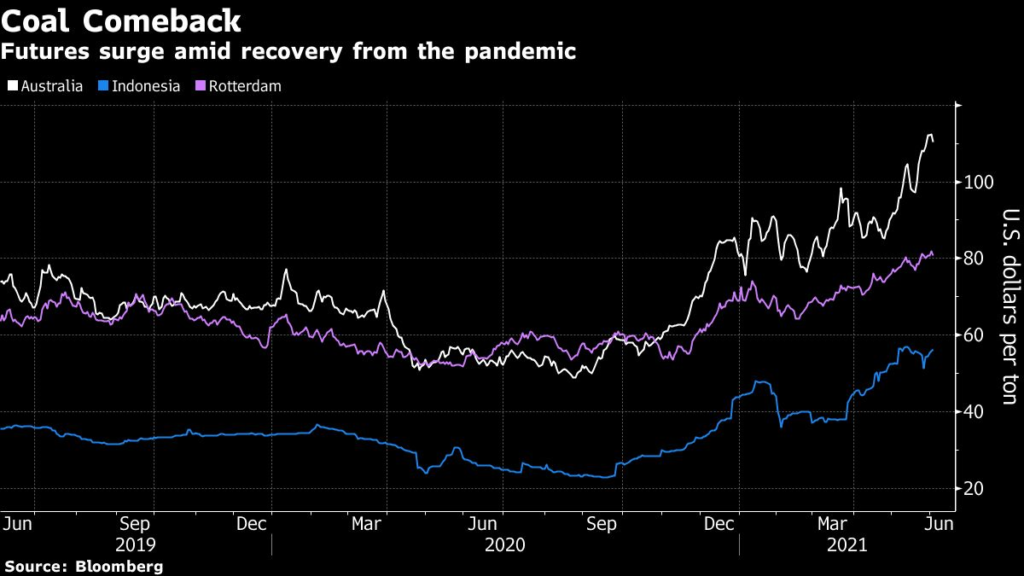

Coal is seeing a dramatic spike in demand just as several major miners are hit with production problems, sparking a surge in prices from China to Europe and the US.

Prices for the dirtiest fossil fuel are soaring as sweltering temperatures in North Asia increase air conditioning needs, adding to already strong demand due to the industrial recovery from the pandemic. Mine safety issues in China, heavy rainfall in Indonesia and disruptions in Colombia are constraining output.

The price spike comes amid an existential crisis for coal, with climate policies making it increasingly difficult to invest in new projects. The squeeze might not change that, but it’s providing miners with a windfall while it lasts.

“We could have strong prices into the fourth quarter,” said James Stevenson, lead researcher for coal, metals and mining at IHS Markit Ltd. in Houston. “But this isn’t structurally strong demand. You’re probably best optimized enjoying the higher revenue than investing it in new production.”

As is often the case with coal, the story begins in China, which mines and burns half the world’s supply. As the first major economy to rebound from Covid-19, factories there have been running hot for a while, and that’s recently been given an extra boost as the recovery takes off elsewhere. However, a spate of deadly mining accidents has spurred Beijing to crack down on unsafe practices.

The resulting drop in output has been exacerbated by rising electricity consumption amid a hotter-than-normal summer, which followed extreme cold last winter. Higher demand meant several provinces had to curtail power supply to factories in December, and more than 20 cities in southern China have done the same in the past few weeks.

Coal prices have also been aided by problems at least partially of Beijing’s own making. The government refuses to accept coal from Australia, once its No. 2 supplier, amid a geopolitical spat. China’s benchmark thermal coal futures hit a record last month and are 60% higher than they were a year ago.

Indonesia, currently the No. 1 source of coal for Asia’s largest economy, has been hit by heavy rainfall. That’s seen total shipments drop about 15% below pre-virus levels, Morgan Stanley said in a note this week. Indonesian coal futures on the Singapore Exchange also rose to an all-time high in May.

Colombia also faced disruptions, with the Cerrejon mine gradually restarting operations on May 29 after protests suspended activities about a week earlier.

Even with China’s import ban, Australian coal futures are surging thanks to buying from Japan, South Korea and Taiwan. Spot prices for high-quality thermal coal in the port of Newcastle rose to the highest level since 2011 on Monday.

The spike is rippling out of Asia and across the globe. Northwest European coal jumped 19% this year and reached a two-year high on Tuesday. Spot coal in Pennsylvania is up 22% this year.

European prices have rallied this year due to colder-than-usual weather in the continent and a drawdown in stockpiles at ports, said Matthew Boyle, head of coal and Asia power analytics at S&P Global Platts.

“There has been disruptions with Colombian exports, which is a large supplier into Europe, whereas Russian coal has been diverted towards Asia as selling prices are higher there than in Europe,” he said.

The question now is, how long it will last? Goldman Sachs Group Inc. raised its 2021 and 2022 forecasts for Newcastle coal this week on the demand strength and the difficulty of permitting and building new mines in Australia. Morgan Stanley, on the other hand, expects a correction in the northern hemisphere fall as it sees the market in surplus when supply begins to pick up.

Even with rising Chinese demand, IHS sees global consumption of seaborne thermal coal at least 55 million tons lower this year than in 2019 as major users like India battle the virus. While the market will be tight in the near term, there’s still ample capacity for later in 2021, Stevenson said. “This is a bad spike to invest into. Mid-term fundamentals are still bearish.”