China Mulls Record $411 Billion Special Bonds, Reuters Says

China’s policymakers plan to sell a record 3 trillion yuan ($411 billion) of special treasury bonds in 2025, Reuters reported on Tuesday, a move aimed at bolstering the slowing economy.

The plan would be a sharp increase from this year’s 1 trillion yuan and be used to support consumption and investments as well as recapitalizing large state banks, according to Reuters, citing two unnamed sources.

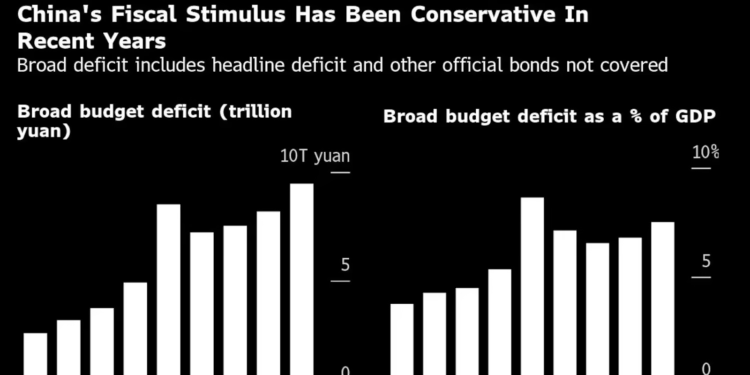

The reported fiscal measures come as China is mapping out its economic plans for next year, with top leaders hinting at bolder stimulus as Beijing faces tariff threats from the incoming Trump administration. Policymakers have pledged to expand the headline deficit and boost bond sales amid efforts to strengthen fiscal policy and boost consumption.

China’s CSI 300 equity benchmark gained 1.3%. Chinese government bonds extended losses, with the 10-year yield rising four basis points to 1.72% from a record-low close in the previous session. The one-year rate surged 23 basis points.

“It’s bigger than our expectations and shows the government’s willingness to shore up growth through a more sizable fiscal stimulus,” said Michelle Lam, Greater China economist at Societe Generale SA.

She added, however, that part of the reported sum is intended for bank recapitalization and should not be viewed as additional demand measures. Bloomberg previously reported China was considering injecting as much as 1 trillion yuan of capital into its biggest state banks to increase their capacity to support the struggling economy.

The State Council Information Office didn’t immediately respond to a faxed request for comment.

Beijing has signaled more forceful economic support next year as it braces for Donald Trump’s return to the White House and a new trade war. President Xi Jinping’s decision-making Politburo this month elevated the importance of boosting consumption as the US and other trade partners increasingly push back against Chinese exports, which have been a key growth driver for the economy this year.

China’s finance ministry this week vowed to increase public spending and accelerate the pace of spending next year in a two-day national conference on fiscal work in 2025. It also pledged to step up support for a consumer product trade-in program and to expand investment, according to a statement Tuesday.

According to Reuters, about 1.3 trillion yuan of the funds to be raised will be used to support that subsidy initiative as well as major construction projects.

Separately, more than 1 trillion yuan will be used to invest in “new productive forces,” which stand for advanced manufacturing sectors such as electric vehicles, the Reuters report cited an unnamed source as saying. The rest of the funds will be used to recapitalize large state banks, according to the report.

Previously, Reuters reported that China plans to set the headline budget deficit as 4% of GDP, increasing from 3% this year. That would be the widest since a major tax reform in 1994.

Taken together, the reported expansion in fiscal stimulus next year from this year would be equivalent to 2.6% of China’s 2023 GDP, according to Bloomberg calculations.

That compares to forecasts ranging from 1.8% to 2% of GDP in additional fiscal stimulus by UBS Group AG, BNP Paribas SA and Goldman Sachs Group Inc., although some estimates exclude bank recapitalization in their tally of stimulus.

China’s special sovereign bonds are issued for specific purposes — such as financing pandemic-related spending — and are therefore not counted toward the headline budget deficit.

In addition to issuing special treasury bonds, Chinese leaders also pledged to increase the sales of local government special bonds next year, which are also excluded from the deficit figure.