Joe Jackson Warns BoG’s 10% NPL Target Could Squeeze SME Lending

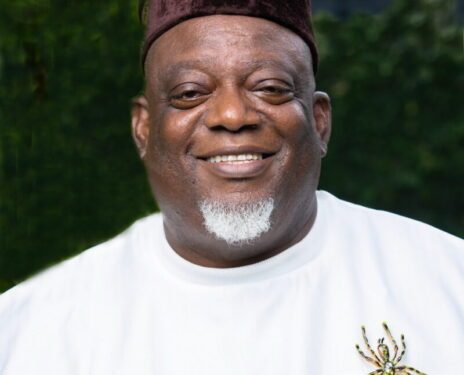

Chief Executive Officer of Dalex Finance, Joe Jackson, has cautioned that the Bank of Ghana’s (BoG) new directive requiring regulated financial institutions to maintain a maximum Non-Performing Loan (NPL) ratio of 10 percent could significantly constrain access to credit for Small and Medium Enterprises (SMEs).

Speaking during the NorvanReports X Space Discussion on the theme “Ghana’s New Currency Controls & NPL Crackdown: Will BoG’s Tough Rules Fix the Economy or Freeze Growth?” on Sunday, Mr Jackson stated that while the central bank’s policy is positive for financial sector stability, it poses risks to SME financing.

“A net effect of all this, unfortunately, will be a reduction in the riskier loans. And SME loans, by definition, are risky. So, the central bank is moving us in the direction where we are a lot more careful about the loans we give,” he explained.

According to him, the strict enforcement of the rule, backed by sanctions including reputational penalties from the BoG, could discourage banks and non-bank financial institutions from extending credit to the informal SME sector.

“SME lending will fall down by the wayside. It may have an effect on our informal SME sector. But the flip side is that, at the moment, nobody’s really lending to them anyway,” Mr Jackson said.

Advising entrepreneurs under the new regime, the Dalex Finance CEO urged SMEs to reduce their reliance on borrowing and explore alternative financing avenues.

“Be very, very careful about borrowing. Explore supplier credit, explore equity, explore other channels (friends and family), before you borrow from a financial institution,” he stressed.

He also cautioned SMEs against over-optimism in borrowing decisions, warning that the reputational risks under the new BoG sanctions framework will not only affect lenders but also defaulting borrowers.

“Some of the defaulters will come not because you mismanaged your purse, but because you are a risky SME. When things go wrong, not only will the institution that gave you the money be in trouble, but you, the entrepreneur, will also be in trouble,” he noted.

Mr Jackson further disclosed that his institution regularly declines loan requests from SMEs deemed too risky, stressing that excessive eagerness to lend in such cases often indicates “collateral lending,” where the true intent is to seize assets rather than support business growth.

While underscoring the central bank’s goal of lowering NPLs as a necessary step for financial stability, he reiterated that SMEs should take the warning seriously, as credit access will likely tighten further.