US Tariffs Threaten Ghana’s Garment Exports, Bright Simons Says

Bright Simons, Honorary Vice President of IMANI Ghana, has raised concerns over the impact of the recently announced 10% US tariff on Ghanaian garment producer DTRT.

In a post on X, Mr Simons highlighted DTRT’s exposure to US trade policies, noting that the company, which employs approximately 5,600 workers in Ghana and produces 50,000 pieces of apparel daily, exports around 50% of its output to the US. Trade intelligence data, he added, suggests that nearly all of DTRT’s most advanced product lines are bound for the US market.

“A 10% basic tariff could hurt, but it all depends on the tariff rates the US government slaps on competitor countries in Asia, Latin America, and the Caribbean,” Mr Simons wrote.

The implications could be even more severe if the US does not renew the preferential 0% tariff under the African Growth and Opportunity Act (AGOA), a key trade arrangement that has allowed Ghanaian firms to compete in the US market. Without AGOA, companies like DTRT would face significant competitive pressure.

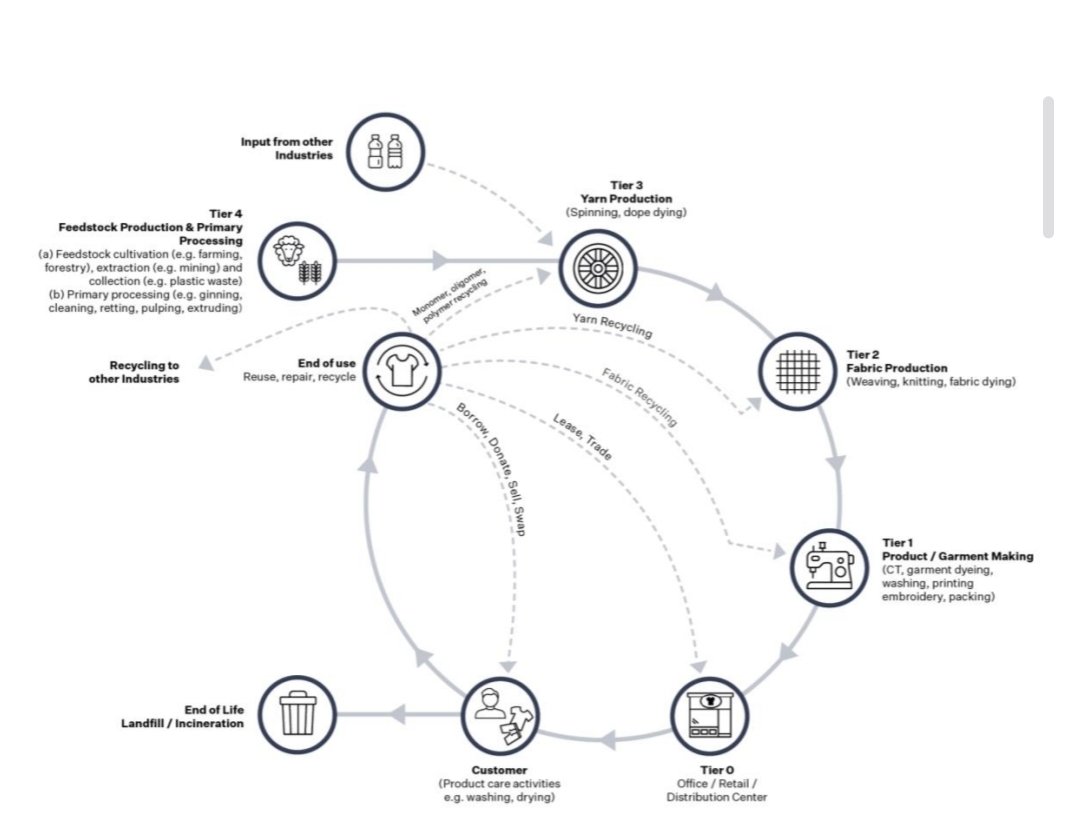

Mr Simons pointed to the broader challenges African garment exporters face, particularly the so-called “shadow Chinese” effect. Many African firms, including DTRT, were founded by industry veterans who previously worked for Hong Kong-based companies sourcing garments from mainland China. As US-China trade tensions escalated, firms like DTRT shifted production to Africa to take advantage of AGOA’s duty-free benefits.

“Ghana was seen as less likely to lose AGOA access due to its democratic stability,” Mr Simons noted, adding that Ghana’s shipping routes to the US, which take between two and three weeks, offer a competitive edge over Asian suppliers, whose transit times can extend up to eight weeks.

DTRT has sought to make AGOA more attractive to US policymakers by increasing intra-African sourcing of production inputs, aligning with the African Continental Free Trade Area (AfCFTA) vision. However, Mr Simons argued that regional sourcing alone is no longer enough to secure AGOA’s future.

“It is quite clear that even sourcing 100% of inputs and intermediates within Africa is no longer enough for the new government in the US,” he said. “These days, one also has to show how certain aspects of production could be shifted to the US or bargain with something else entirely.”

Mr Simons concluded that African policymakers face a growing challenge in navigating US trade policy shifts, particularly as AGOA renewal becomes increasingly uncertain.