Africa’s private capital deals drop for first time in 7 years

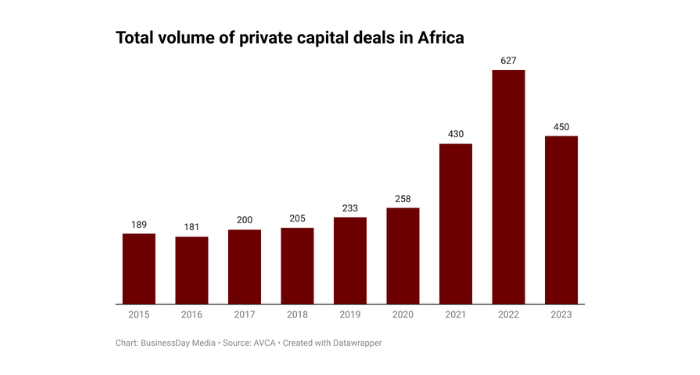

The total private capital deal in Africa dropped for the first time in seven years, according to the latest African Private Capital Activity report.

The report by the African Private Capital Association (AVCA) shows that the volume of deals dropped by 28 percent to 450 deals in 2023 from 627 deals in 2022.

“The decline in venture capital activity (deal volume and value) shook up the entire industry in 2023. With 450 private capital investments recorded, the continent experienced its first decline since 2016,” the report said.

It said despite signs of improvement in the second half of the year, the overall slowdown in private capital investment was largely driven by venture capital’s sharp decline, which plummeted by 34 percent year-over-year.

Abi Mustapha-Maduakor, chief executive officer of AVCA, said despite global economic headwinds, the association is pleased to see Africa-focused investors’ ongoing commitment to the continent, particularly in venture capital – the continent’s leading asset class.

“Whilst there were dips in investment activity across many asset classes, infrastructure proved to be resilient, as the only asset class to receive increased funding during the year,” she said, adding that AVCA’s expectation for the coming year is that investors will remain committed to investment opportunities that leverage disruptive tech on the continent.

The AVCA report noted that despite a reduction in the number of transactions, Africa showed resilience, returning to the steady growth trajectory the region drove until 2022 when investors deployed large reserves of capital that were not allocated during the Covid-19 pandemic.

“Compared with activity throughout the last decade, 2023 was the second-strongest year on record for deal volume in Africa. Notably, deal volume on the continent surpassed the annual average of 264 deals from 2012 to 2022 and the average of 387 deals from 2019 to 2022,” it said.

The report stated that infrastructure drives investor appetite, adding that infrastructure had an impressive year for capital raising and deployment as the only asset class to benefit from increased funding in 2023, with deal values surging to $1.8 billion – a remarkable threefold year-on-year increase.

AVCA said investments in renewable energy largely fueled this trend, indicating a growing interest in leveraging Africa’s abundant solar, hydro, biomass, and wind potential to accelerate the clean energy transition.

The report said in a departure from previous years, Southern Africa reclaimed its dominance as one of Africa’s top investment destinations. The sub-region attracted 119 capital investments at $2.6 billion, the highest volume (together with West Africa) and the value of deals across the continent.

“South Africa accounted for the majority of investments in Southern Africa, with 81 percent of deals in the sub-region, due to growth across the IT and industrials sector and a rise in VC investments in software and services, logistics and transportation,” AVCA said.

“Southern Africa, demonstrating its position as a mature exit market, was the most popular sub-region for exits, increasing its overall share of exits to 36 percent year-on-year,” it said.

AVCA stated that all sub-regions in Africa experienced a year-on-year decline. Economic challenges were exacerbated in 2023, ending the exit rush in Africa of 2022 led by fund managers dealing with a backlog of mature portfolio companies from the Covid-19 pandemic.