Zambian currency and Eurobonds rally on bets of debt revamp deal

Zambia’s currency and dollar bonds traded near multi-month highs, having chalked up double-digit gains so far this month on expectation that the nation is about to clinch a debt restructuring deal with official creditors, possibly as soon as Thursday.

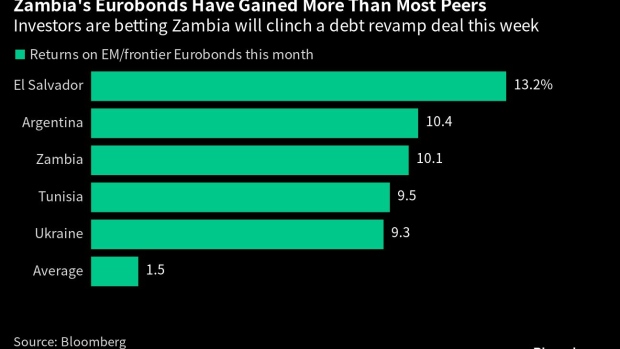

The kwacha has strengthened 11.4% this month, the biggest gain among about 150 currencies tracked by Bloomberg, rising on Thursday to approach a two-month high versus the dollar. Zambia’s eurobonds have returned 10.1%, a performance bested only by El Salvador and Argentina. That compares with the 1.5% average return for emerging and frontier peers in a Bloomberg index.

The bond due 2027 is trading near the highest since September.

A senior US Treasury official said Wednesday they hoped a deal to restructure Zambia’s crippling debt load was “imminent.” President Hakainde Hichilema said, meanwhile, he was confident a deal would be wrapped up, suggesting it could be announced this week in Paris, together with French President Emmanuel Macron and Chinese Premier Li Qiang.

The International Monetary Fund said on Tuesday an agreement could be reached this week.

“The rally will have further legs if the IMF unlocks the delayed disbursement and investors find the conditions of the deal comforting,” said Gergely Urmossy, an emerging market strategist at Societe Generale in London.

Zambia has been struggling to revamp $12.8 billion in external loans since becoming Africa’s first pandemic-era defaulter in November 2020. A restructuring would mark the first major debt relief won by a developing country under the Group of 20 nations’ Common Framework, which brings the traditional Paris Club creditor nations around the same negotiating table with China.

An agreement by official creditors is essential for the IMF to disburse a $188 million loan tranche to Zambia, part of a total $1.3 billion support package. More broadly, it could pave a way for other Common Framework restructurings in countries such as Ghana, Sri Lanka and Ethiopia.

Positive sentiment over a Zambia deal could spill into other distressed credits such as Ghana, “if investors take the view that it makes sense to extrapolate these announcements,” Urmossy added.

READ MORE: Zambia Caps Primary Bond Sales to Foreigners at 5% of Issuance

Zambia’s external public debt, including interest arrears for central government and state-owned companies, amounted to $18.6 billion at the end of last year, from $17.3 billion a year earlier, finance ministry data shows. About $6.6 billion of that is owed to China, Johns Hopkins’s China Africa Research Initiative estimates.

The talks with creditors center around restructuring $12.8 billion of that debt. Zambian authorities are also negotiating to restructure $3 billion in eurobonds.

Further gains in the kwacha could be capped, however, with the central bank probably not in favor of it rising too far.

“I think the currency has already priced most of it in,” Urmossy said. “I think it would be surprising if the Bank of Zambia allowed the kwacha to appreciate further.”