Finance Ministry announces resumption of coupons and principals payment of old bonds

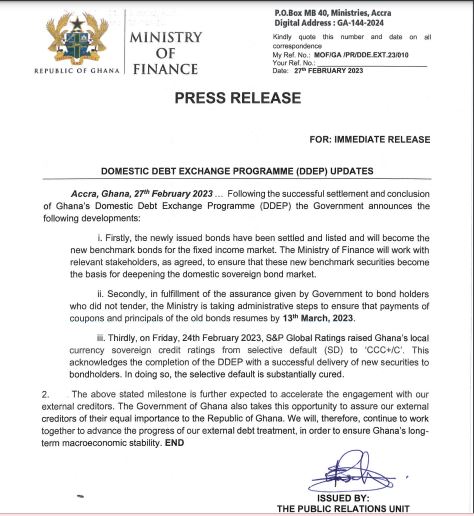

The Finance Ministry of Ghana has announced that payments for coupons and principals under the Domestic Debt Exchange Programme (DDEP) will resume on March 13, 2023. This applies solely to old bondholders who did not sign up for the DDEP.

The move comes after three bondholder groups, the Pensioner Bondholders Forum, Individual Bondholders Association of Ghana, and Individual Bondholders Forum, gathered at the Finance Ministry on Monday, February 27, to demand immediate payments for coupons and principals that matured on February 6th and February 20th, 2023.

The Coalition of Individual Bondholders Groups marched to the Finance Ministry to check on the payment of coupons and principals for bondholders whose bonds had matured but whose payment had not been honoured despite government’s promise. In response, the Finance Minister, Ken Ofori-Atta, assured the pensioner individual bondholders that outstanding bonds which matured on February 6th, for which government defaulted, would be honoured after February 21st.

“Settlements will be made after Tuesday, February 21st, and then we can begin to look at processing everybody’s [bonds],” the Finance Minister said during a meeting with the pensioner individual bondholders to thank him for exempting them from the Debt Exchange Programme. However, the convener of the Pensioner Bondholders Forum, Dr. Adu Anane Antwi, expressed concern that the group had not heard any information from the Ministry regarding the delay in payment.

The newly issued bonds have been settled and listed and will become the new benchmark bonds for the fixed-income market. The Ministry of Finance stated that it would work with “relevant stakeholders, as agreed, to ensure that these new benchmark securities become the basis for deepening the domestic sovereign bond market.”

The move to resume payments for coupons and principals for old bonds will likely be seen as a positive development by bondholders who have been eagerly waiting for payments. The delay in payments has caused concern among individual bondholders, who have been pressuring the government to honour its commitment.

The Ghanaian government’s commitment to meeting its financial obligations is important, not only for individual bondholders but for the wider financial system. Failure to honour commitments could lead to a loss of investor confidence, which could have severe consequences for the country’s financial stability.

The resumption of payments for coupons and principals could also boost investor confidence in the Ghanaian market, which has been somewhat turbulent in recent years. This could, in turn, lead to increased investment in the country, which could have positive implications for the broader economy.

It is worth noting, however, that there is still uncertainty surrounding the impact of the ongoing COVID-19 pandemic on the Ghanaian economy. The pandemic has had a significant impact on global markets, and the Ghanaian economy is no exception. It remains to be seen whether the Ghanaian economy can weather the storm and emerge stronger on the other side.

As always, investors are advised to exercise caution and conduct thorough research before making any investment decisions. While the resumption of payments for coupons and principals for old bonds is a positive development, there are still risks associated with investing in the Ghanaian market.

I do not even know how I ended up here, but I thought this post was great. I don’t know who you are but definitely you’re going to a famous blogger if you aren’t already 😉 Cheers!